WASHINGTON — A slump in rail traffic continued in November, with lagging intermodal traffic leading to a 4.5% drop in overall volume, compared to the same month in 2020.

WASHINGTON — A slump in rail traffic continued in November, with lagging intermodal traffic leading to a 4.5% drop in overall volume, compared to the same month in 2020.

The latest statistics from the Association of American railroads show that U.S. railroads originated 1,028,039 containers and trailers in November, a 9.6% decrease from November 2020. The month’s 917,787 carloads represented a 2% increase.

The November figures mark the fourth straight month of overall declines compared to 2020, with the rate of decline increasing each month. October volume was down 2.8%, after September saw a 1.9% decline. In August, the decline was just 788 carloads and intermodal units, officially a 0% decrease.

AAR Senior Vice President John T. Gray focused on the rise in carload traffic.

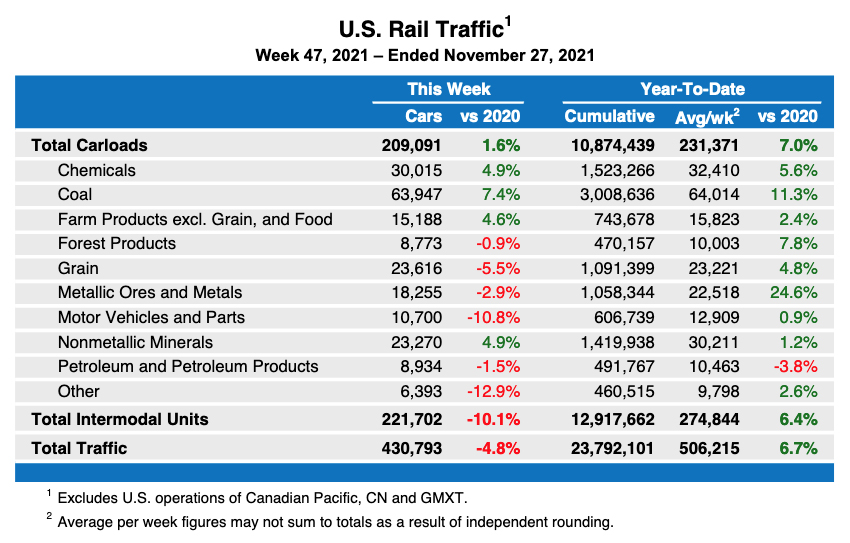

“Fifteen of the 20 carload categories we track have seen year-to-date carload increases on U.S. railroads through November,” Gray said. “Coal leads the way, with carloads up more than 11%, or nearly 306,000 carloads, mainly because the price of natural gas to electricity generators has doubled since the beginning of the year. Chemicals, grain and commodities related to steelmaking have also all showed solid carload growth this year.”

Year-to-date totals for the first 11 months show carload traffic up 7%, intermodal traffic up 6.4%, and overall traffic up 6.7%. The year-to-date traffic averages 506,215 carloads and intermodal units.

Weekly traffic also down

For the week ending Nov. 27, the total U.S. traffic of 430,793 carloads and intermodal units represented a 4.8% decrease from the same week in 2020. That included 209,091 carloads, up 1.6%, and 221,702 intermodal units, down 10.1%.

North American totals, for 12 U.S., Canadian, and Mexican railroads, include 295,807 carloads, down 4.4% from the corresponding week in 2020, and 281,953 intermodal units, down 16.1%. The total traffic, 577,750 carloads and intermodal units, is a 10.5% decrease.

interesting to note the two big downers of relevancy is the Auto and Intermodal. You can’t blame railroads on supply shortages impacting Autos but give them a pat on the back for not only finding ways on not expanding intermodal lanes but their slow reaction of opening closed terminals and laying too many people off when every economy indicator that demand for imported goods was trending up either in purchases or companies trying to restock inventories….

If railroads like to place an asterisk next to coal when carloads were on the way down, they should do it when it is on the way up as well. Several Class 1s have said there will be good years and bad years in coal, but the general direction is down.