NEW YORK — Railroads will not regain market share lost to trucks unless they shift to traffic growth mode, transform their operations, and provide service that’s far more reliable than ever.

That’s the view of Oliver Wyman partner Adriene Bailey, who this week outlined four big steps railroads must take in order to deliver the consistent, predictable service that shippers want. “We need to go where the industry has not gone before,” the railroad consultant says.

At the RailTrends conference, Bailey said she was encouraged by recent service and growth comments from Norfolk Southern CEO Alan Shaw, CSX Transportation CEO Joe Hinrichs, and Canadian National CEO Tracy Robinson.

“It’s clear the aspiration for growth is there — and we at Oliver Wyman continue to believe the freight is there to be had by the railroads and there is capacity to serve that freight — but it won’t convert from truck to rail until and unless the service product is there to meet shipper needs,” Bailey says.

As the big four U.S. railroads hire conductors to fill their depleted crew ranks, they’re focusing on improving the velocity of their networks. “Railroads have been clawing their way out of this death spiral for a year now,” she says.

But Bailey says fluidity does not equal reliability — and that a return to pre-pandemic service levels won’t be nearly enough to help railroads divert freight from highways. Railroads, she says, need to aim higher.

Shippers say they would shift freight to rail if the railroads showed that, over the long term, they could meet service requirements that include visibility, reliability, and capacity.

How can railroads get there? Bailey says the railroads need to do four things.

First, CEOs need to admit the need for an operational transformation that would take several years. Railroads will need to publish customer-centric performance metrics, improve interline service, and close other service gaps compared to trucks. An encouraging sign, Bailey says, was CN Chief Operating Officer Rob Reilly declare last month that the railway’s 90% on-time departure rate was not high enough. “That was a moment of a bright, shining light,” Bailey says.

Second, if traffic continues to decline due to an economic downturn next year, it’s a good opportunity to improve service and figure out how to maintain it when volume returns. If railroads resort to furloughs and “blind cost-cutting” to hit short-term financial goals, they’ll jeopardize the long-term future of the industry. “This may be our last chance,” Bailey says. “Let’s not blow it.”

Third, railroad leadership must convince investors — and themselves — that volume growth will provide huge benefits compared to continued loss of market share. To do this, railroads will have to prove that sustained service improvements will lead to growth. Wall Street analysts would have to drop their overemphasis on the operating ratio and instead focus on service, growth, and operating income.

Finally, the industry must convince Washington to level the regulatory playing field, which is currently tilted toward trucks. Regulators are holding back efficiency and technological advancements in rail, while supporting them in trucking. Also part of the solution: Improve the labor-management relationship.

Regain share vs. continued decline

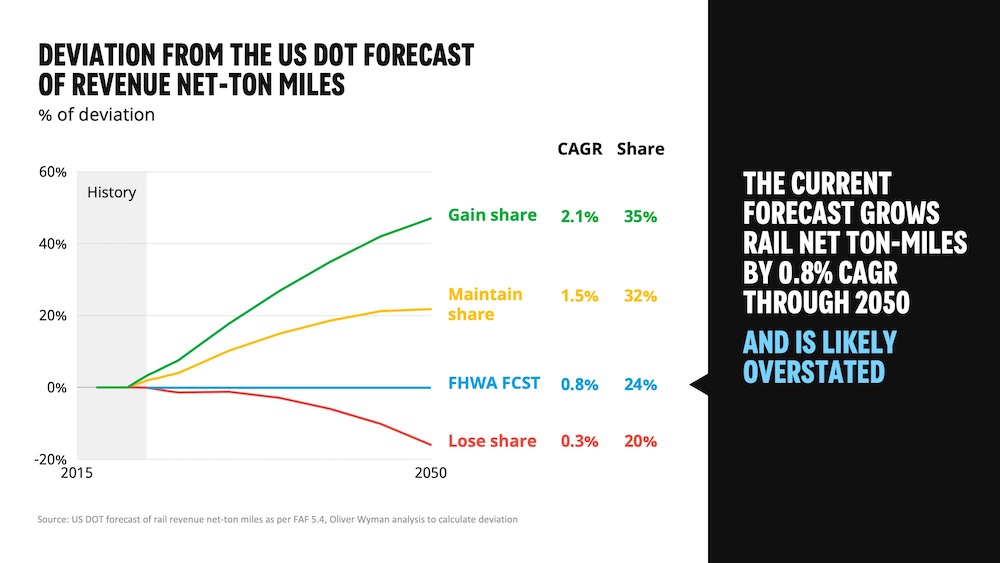

Bailey compared how railroads would fare under various market share growth and share loss scenarios through 2050. They ranged from losing 0.3% of revenue ton-miles per year to gaining 2.1% annually, which would return market share to the 2017 level of 35% of revenue ton-miles.

Continued loss of market share through 2050 would cost railroads — and by extension, their investors — $476 billion in revenue and $128 billion in lost operating income, the Oliver Wyman analysis shows.

A failure to lure freight off the highway also would have consequences that extend well beyond railroads. Because rail is safer than truck, there would be 16,000 additional deaths and 660,000 serious injuries due truck-related accidents. Some $332 billion would be required to add 17,600 lane miles to highways and in added maintenance costs. And energy needs would rise by 230 terawatt hours per year if both truck and rail were to convert to zero-emissions technology.

Broad agreement on need to change

Several speakers at RailTrends echoed Bailey’s views.

“We must be, without a doubt, reliable for our customers,” CN’s Robinson says. “We must do what we say we will do.”

Robinson, who became CN’s CEO in March, said the railway won’t be quick to furlough crews if volume declines. “We’re going to do it a little differently. We don’t yet have enough people, especially in certain areas,” she says.

CN has analyzed how the last several downturns went in the hope of finding clues that will help the railway respond this time.

“The problem with furloughing heavily, is that you can never get them back as quickly as you need them, and then you miss the upswing,” Robinson says. “And that’s what causes a lot of tension with customers and sometimes regulators.”

Unless a slowdown appears to be prolonged, CN will “wrap our arms around our people and do what we can to keep them busy, particularly in those hard to hire locations,” Robinson says.

“This is about building for the long term,” she adds.

Norfolk Southern Chief Marketing Officer Ed Elkins says the company is becoming a customer-centric, operations-driven railroad that’s investing in growth. NS also is trying to understand how to better fit into customer supply chains. “We only make one thing people are willing to buy, and that’s service,” he says.

Rahul Jalali, Union Pacific’s senior vice president of information technologies and chief information officer, says the UP is working to make it easier for customers to do business with the railroad online. UP has embedded some of its tech people at customer locations to learn how they can improve the systems shippers use to interact with the railroad.

Justin Broyles, executive vice president of commercial affairs for shortline holding company R.J. Corman, says he’s seen a change in the Class I railroad mindset recently.

Instead of rejecting potential traffic from short lines — saying they can’t make the rate work, or transit time is too long, or the traffic doesn’t meet their profit targets — Class I railroads have been inquiring about ideas R.J. Corman submitted two or three years ago.

Rick Paterson, a railroader turned analyst at Loop Capital Markets, says railroads have a choice. They can embrace operational reforms, resiliency, and customer focus to become modern, high-performance companies. Or they can go back to business as usual with an eye on the operating ratio, running with as few train crews as possible, and remaining fragile networks susceptible to disruptions.

“The U.S. rails need to change their mindset, institute service reform not just service recovery,” Paterson says.

Transforming operations is easier said than done, Paterson says, but if successful will restore shipper confidence and lead to growth.

Railroads have said that once their crew ranks are back at full strength, service will return to pre-pandemic levels, Surface Transportation Board Chairman Martin J. Oberman notes.

“But why should that be the goal? That is simply a return to mediocrity and rail service that continues to be a damper on the economy and is completely unacceptable,” Oberman says.

RailTrends is sponsored by trade publication Progressive Railroading and independent analyst Anthony B. Hatch.

Ah yes more mindless drivel from the railroad apologists, generally not the brightest people in the galaxy to begin with. Go back and read some of my TRAINS articles from 20 years ago.

Very simple message here, IT’S THE SERVICE STUPID!!! If you want to grow a service business, then try giving better service.

J-I-T still stands for “Just in Truck”.

And in another new item UP is asking customers to limit traffic or face embargoes. It really tough to grow business whey you can’t/won’t accept more business.

It really shouldn’t be a war or competition between the trucking and rail industry. In today’s diverse and market driven economy both form of transportation are needed to transport good and services. Neither trucks or trains can do the entire job by themselves alone. The train is needed to move large amounts of freight across the country in as few trips as possible and the truck is needed to move those goods and merchandise to the local markets and stores once it is unloaded from the train. What is needed is cooperation and cohesion between trains and trucks and that both are part of the supply chain.

Joseph C. Markfelder

Driverless trucks are still a long way ahead. Operator less trains are much closer. If railroads want one man crews they need the trust of their employees. Treating people like dirt is not the way to get trust.

Neither scenario is very practical. Railroads run through some very inaccessible areas. It’s not practical for one man operations. Think about a remote area in the Sierra Nevada and a knuckle fails, causing a break-in-two. How will the roaming conductor reach that location? Sure, the old NYC or B&O across Ohio and Indiana might be feasible. There are too many questions at this time.

And driverless trucks? Imagine a driverless truck going up, over and down the Grapevine. Or how about Lookout Pass in Idaho and Montana. These are difficult roads with a driver! I often see Tier 4 tractor-trailer rigs with the hood up on Lookout Pass. And in the winter, good luck. What happens when the second of 10 trucks stalls out or spins out? Will the driverless trucks work in the desert on easy grades? Maybe. Again, there are too many questions.

Nowhere did I see any mention of change on the shippers/receivers side…and there is flexibility there by getting away from JUST-IN-TIME needs and going to back having some capacity to handle minor disruptions in traffic flow. You don’t need to go back to having months worth of inventory on hand, but you can have 2 or 3 weeks of supplies at all times in case of disruptions…there is no taxes on inventory anymore.

No one seems to have noticed they also mentioned the government is holding back the railroads too…by not letting them implement some of the technological things they could that they’re letting the OTR carriers do. An example is single person crews or crewless trains…the Feds are allowing OTR carriers to go driverless, but not the railroads? That’s creating an unfair advantage…

UP’s comment assumes that customers want to do business with the UP. Doesn’t UP know that customers don’t like the service they’re getting? Making it easier to get poor service doesn’t fix the problem. CSX just hire a retired Ford Motor Corp operations exec to be its new CEO. What happens next will be worth watching.

NS hired Alan Shaw as the new CEO. CSX hired Joseph R. Hinrichs as the new CEO. Shaw is a career railroader. Hinrichs came from the Ford Motor Company.

One was a part of the service problem. The other complained about the service problem. I wish them all the best. Let’s see how they do for their respective companies.

Here’s #5…stop treating customers like it’s there fault that the Operating Ratio isn’t down to the impossible range.

Your one comment says it all.

Everything that was suggested by the consultant to save the railroads from themselves has been said before and by now should be obvious to anyone. Railroad management is definitely aware of what needs to be done. But even if they were willing to make all the changes listed in the article above, which they are not, they would find all new and exciting ways to screw things up. It’s both unfortunate and unnecessary but I suspect railroads will continue to loose market share here in the U.S.

Easy to give advise, when not responsible for the fiancial results of the target of the advice. And thaty dvice is the same as presented in past years.

Ms. Bailey has worked for railroads, and knows of the relentless efforts to reduce costs – which has an immediate effect on net income.

Customers are all from Missouri: “Show me.” Changes in operations tp attract business take longer than a single quarter.

A Google Earthview of all those warehouses and industries that lack a railroad track will show that the won’t be using railroads, except possibly for niche-market long-haul intermodal. All the rest of the traffic rides trucks.

After having been in the industry for 40 years…call me either skeptical or laughing. If they hire to keep people instead of furloughing, if they hire to keep instead of going to a one man crew thing (stupid), if they run more trains that are faster and shorter that actually fit the system, if they repair and put back into service locomotives and rolling stock, if they stop harrasing the employees with candy a$$ ‘rules’ enforcement…..way too many ifs and way too many petty staff managers to do any of this. Ain’t gonna happen.

I have watched the class one come up and out with many many ‘customers first’ programs, banners, flags, rah rah rah that comes to naught when the next slow time comes.

Naaa, ain’t gonna happen.

There’s an old saying that states, “If the dog didn’t stop to take a dump, it could have caught the rabbit.” Many ifs. Time will tell.

Yeah, if they do those four things, their market share will improve. Except for this: they won’t do any of the four. The railroads can’t figure out how to move two opposing 15,000-foot trains where the passing siding is 8,000 feet. They also can’t figure out how to move a train when their work force is quitting in droves.

There aren’t enough trucks, or drivers, or diesel fuel for the truckers to move the market share the railroads are throwing away.