MONTREAL — Quebec’s public pension management fund says it is considering mounting a bid to develop the High Frequency Rail project for Transport Canada.

The Montreal Gazette reports that Charles Emond, CEO of Caisse de dépôt et placement du Québec, told reports Thursday that his organization is “looking at this actively, with a lot of interest. It’s the government’s prerogative to select the technology. After that, we will look at alternatives within what they have decided.”

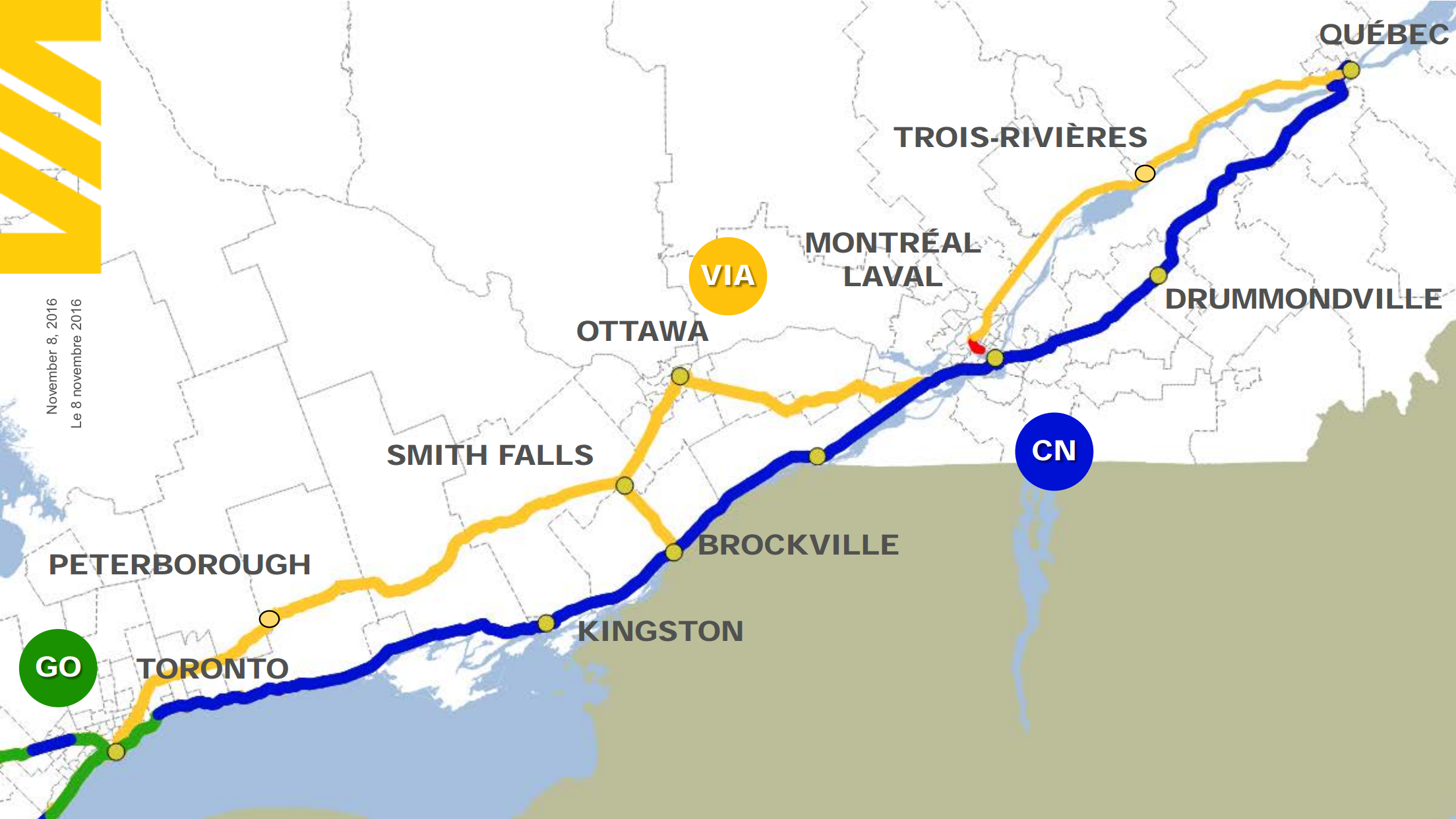

Transport Canada announced last week that it was developing the Request For Qualifications for the High Frequency Rail project, with the goal of narrowing to three the field of prospective private developers for a passenger-only rail route between Toronto, Otttawa, Montreal, and Quebec City [see “Transport Canada defining process …,” Trains News Wire, Feb. 20, 2023].

The Caisse’s infrastructure unit, CDPQ Infra, runs a global portfolio of almost $55 billion in assets, the Gazette reports. Most familiar in the rail industry is Montreal’s Réseau express métropolitain light rail project, a 41.6-mile system which is running well behind schedule and is currently projected to cost at least C$7 billion. That project has created problems for the High Frequency Rail plan by taking over the Mount Royal tunnel, the former commuter rail route which would have been the most direct HFR option for a route from Montreal’s Central Station to Quebec City. CDPQ Infra also announced, then withdrew from, a second portion of REM plans, the REM de l’Est, in the face of criticism of that project [see “Major changes planned for Montreal light rail project,” News Wire, May 3, 2022].

CDPQ is also a 19% owner in one of Europe’s largest high speed operators, Eurostar Group, having bought shares once owned by the British government.

Emond’s expression of interest came on the same day that the pension manager announced suffered a net investment loss of C$24.6 billion in 2022, its worst since 2008, the Gazette reports.

— Updated at 9:55 a.m. CDT to note CDPQ ownership of Eurostar.

The Quebec Pension Fund is this kind of domestic hedge fund that takes the funds from the people and invests it in projects that have direct benefit of the Quebecois.

Recent examples include Bombardier Aircraft. The fund underwrote the C-Series project and stood by until part of its interests were bought by Airbus. The plane is now sold as the Airbus A220 and is selling like hotcakes. The Fund recently announced they are funding the expansion of the production of the A220 and the engineering center expansion in Mirabel.

Recently they have been taking their excess cash and investing in other transporation forms like rail. Transit operations was a recent acquisition and now this HSR effort.

One of the benefits of this pension fund is the fact it does stabilize employment opportunities in the fields they get involved in. So while some see it as strictly a government jobs engine, the Bombardier example shows they they can be incredibly shrewd as well.

Can’t be any worse an investment choice than Brightline.

It’s bad enough when politicians raid a pension fund because they can’t raise capital anywhere else. Here’s a case where a pension fund volunteers to be raided.

I don’t know Canadian law. In America, we have the legal concept of fiduciary responsibility. The first obligation of a fund manager is to grow the capital. The second obligation of a fund manager is to grow the capital. Etc. etc. etc. Supporting a feel-good project guaranteed to bleed countless billions is somewhat lower on the list.

High Speed Rail can operate profitably once its built, but the “private-public partnerships” of the Taiwan Shinkansen, Channel Tunnel, and High Speed One show that relying on private financing for construction is unwise, all three cases above required public intervention when revenues failed to cover debt payments in the first decade.

Brightline hopefully will be the exception, as its construction while incredibly impressive by North American standards, is not at the same level as building an entirely new High Speed Rail line. Japan and France show how new HSR projects can be successfully funded by a combination of funds from the central government, local authorities, and private partners; with the government recouping the costs of construction over several decades from payments by the rail operators.

The NYS Thruway took 50 years to pay off its bonds, but it was planned that way, so no financial crisis, the money was borrowed, and then paid back with interest over time through bonding.