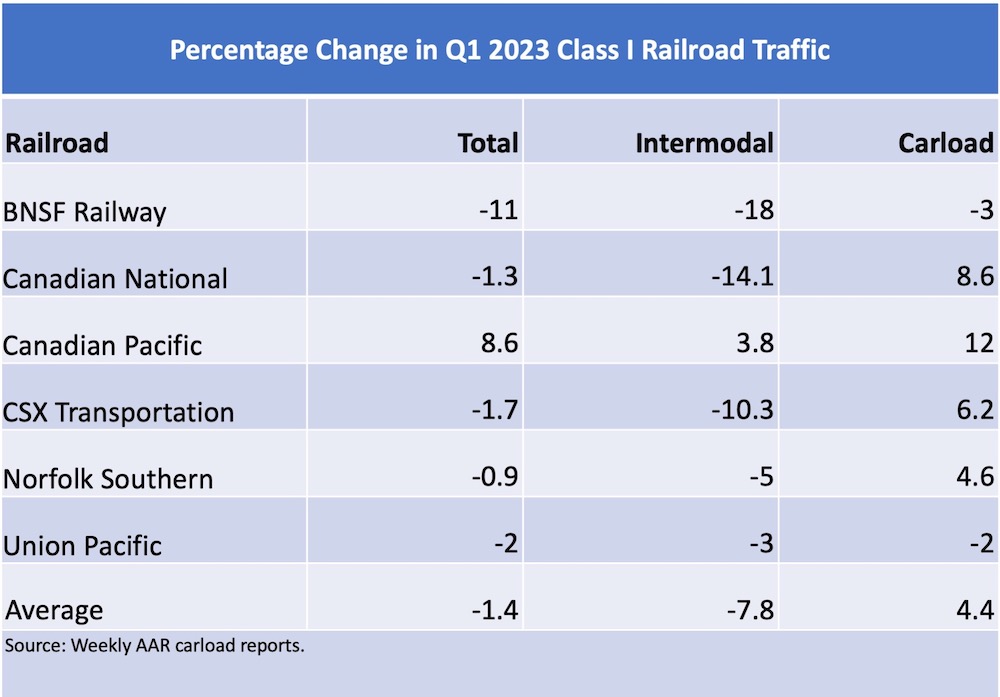

Of the big six Class I railroads, only Canadian Pacific’s traffic volume was in positive territory for the first quarter. But that was due to favorable comparisons with last year’s first quarter, when a March labor dispute in Canada shut down CP’s operations for two days.

The best the other railroads could do during the quarter was a nearly 1% decline in traffic at Norfolk Southern, according to a review of the railroads’ weekly carload reports.

Canadian National’s volume was down 1.3%, CSX Transportation was off by 1.7%, and Union Pacific saw a 2% volume decline.

BNSF Railway was in the basement: Its volume dropped 11%, propelled by an 18% decline in intermodal volume. BNSF’s intermodal slump was deepened by the impact of the Jan. 1 loss of Schneider domestic intermodal business to rival UP, whose intermodal traffic was down just 3%.

CP’s volume was up 8.6%, a reflection of the two-day lockout itself and the impact of shippers preemptively shifting traffic away from CP in anticipation of a strike last year.

All of the railroads benefited from a rise in auto parts and finished vehicle traffic. Auto production has risen as the pandemic-related computer chip shortage has eased.

CN and CP both saw their Canadian grain traffic surge due to a combination of a good crop and comparisons with the prior year’s lackluster harvest.

In the East, CSX and NS both saw carload growth driven by shipments of coal, grain, and stone and sand. Carload traffic was down in the West, as both BNSF and UP saw declines.

Total U.S. carload traffic for the first three months of 2023 was down 0.3%, while intermodal was down 10.3%, according to the Association of American Railroads. Overall volume was down 5.6%.

North American rail volume fell 3.6% for the quarter, according to the AAR.

I’ve been telling my friends for years and I’ll continue to say it:

Railroads are an amazing indicator of the financial future. The trend is clear, sadly. We are headed for a recession.

CPKC will be Running Intermodal Containers Starting April 14th from Mexico to Chicago and Points Beyond along with Auto Racks and Grain and Oil Cans

UP will just piss them off as well, the way they treat trains is just keep the cars until they build a train big enough to meet PSR. So as long as you don’t mind your goods sitting for no reason sure come to UP….lol

Its like I sued to say… They got tired of being treated like the red headed little brother to J B Hunt at BNSF.

Driving away business! Love it.

Well good.

For how many years have we heard about “right-sizing” the network? We’ll haul it, IF it fits OUR network? Maybe the railroads can run off some more business & soak the remaining customers with rate increases & fuel surcharges? None of this matters so long as the shareholders are rewarded with record profits every quarter.

Rinse & repeat.

[1] Is KCS not a Class I?

[2] Why does AAR stats not show Mexico?

Thank you very much Mr. STEPHENS! I am eagerly anticipating your coming article. I enjoy Trains magazine and the website/newswire.

With traffic declining, logic would suggest the derail events will as well.

Look for a presser from the AAR sometime just before the harvest rush in the fall about how their recent safety measures post East Palestine has reduced derails.

Hate to get cynical about these things but these damage control PR outfits try to twist the facts in their favor.

Mr Bill Stevens, I really love and enjoy your articles on the state of the rail industry and current happenings. They are greatly appreciated please keep them coming. Why would BNSF let Schneider go? What was the real reason they moved to UP? Was it really pricing or were there other issues?

David, it’s funny you should ask. I am working on a feature on how the domestic intermodal landscape has shifted in the West. Schneider has said that BNSF’s preferential partnership with J.B. Hunt essentially put a limit on the market share and profitability of the service Schneider offered on BNSF. In other words, J.B. Hunt is No. 1 and there can be only one top dog. The BNSF-Hunt revenue-sharing agreement is unique in railroading, which made it harder for Schneider to compete via BNSF over the long term.