KANSAS CITY — Canadian Pacific Kansas City executives today dramatically increased the revenue growth anticipated from the CP-KCS merger, saying they’ll be able to capture more freight from other railroads and divert more trucks off the highway than originally envisioned.

CPKC now expects $5 billion in revenue growth through 2028, a five-fold increase over the pre-merger outlook period that covered the next three years. “The pipeline is big,” Chief Marketing Officer John Brooks said at the railway’s investor day held in Kansas City Union Station.

The railway expects industry-leading growth through 2028 by gaining $925 million worth of traffic from other railroads; $1.4 billion in truck-to-rail conversions; $1.5 billion from industrial development and near-shoring projects; and $1.1 billion in other new business, including from transloads and partnerships with short lines.

The more upbeat outlook is due to CPKC’s ongoing conversations with customers and CP gaining control of KCS once the $31 billion merger became effective on April 14. In the 60 days since the merger, CPKC’s sales team has combed over every commodity group and customer looking for opportunities that could arise from the new combined network, Brooks explains.

CPKC’s unique ability to provide single-line service in Canada, the U.S., and Mexico also will allow the merged system to take advantage of the near-shoring of manufacturing from Asia to locations in Mexico as companies look to diversify their supply chains, executives say. They cited plant expansions by toymaker Mattel, new electric vehicle plant announcements from BMW and Tesla, and a new John Deere production facility as examples.

The railway also will extend its reach through a deal with CSX Transportation and Genesee & Wyoming that will create a new corridor linking the Southeast with Texas and Mexico.

CPKC also will work to develop large land holdings around its terminals in key metropolitan areas in Canada, the U.S., and Mexico for transload centers, cold storage warehouses, and auto ramps.

Intermodal Growth

CPKC sees itself as a solution to highway congestion problems at the Laredo gateway, the busiest U.S.-Mexico freight border crossing. The railway could convert up to 1.8 million truckloads to rail, most of which are cross-border moves.

CPKC believes that by 2028 it can capture two to three times the 64,000 truckloads that it originally estimated it could convert to intermodal service.

“The opportunity for truck conversion is almost limitless as long as we establish the products and routes that compete in the marketplace,” Brooks says. “I think that’s where the industry, particularly in the U.S., has fallen short. I think we’ve had a lot of success in Canada, when you think about our 100-series trains from Calgary to Toronto. Once you put the discipline in place, you can convert truck to rail. We’ve done it, and I’m confident in that north-south corridor.”

The railway’s new Mexico Midwest Express intermodal service, which links Chicago and Kansas City with Texas and points in Mexico, aims to exploit what CPKC says is rail’s advantage at the border.

The highway border crossing is open just 16 hours a day, trucks are required to change drivers at the border, and only about 10% of trucks are inspected at the border. CPKC’s International Railway Bridge is open 24 hours per day, and customs officials inspect all trains that cross the Rio Grande. CPKC also is doubling its cross-border capacity by building a second single-track span across the river. The $100 million bridge is scheduled to open by the end of 2024.

CPKC says it also wins on transit time: The MMX service that began last month has been averaging 3.9 days from San Luis Potosi, Mexico, and Chicago, compared to four days for truck, the five-day schedule that CPKC advertises, and 6.8 days via other rail options that require an interchange.

Every train has either been on time or early, says Jonathan Wahba, senior vice president of sales and marketing for intermodal, automotive, and bulk. The service thus far has impressed Schneider, which along with Knight-Swift is an anchor customer on trains 180/181. “You should rename your MMX service the bullet train,” Schneider CEO Mark Rouke told Wahba.

The MMX trains also provide the first cross-border intermodal refrigerated container moves of Mexican produce northbound and U.S. meat southbound. More than 100 trucks per day of produce cross the border per day at Laredo northbound, and an equal number move southbound with beef and pork produced in the Midwest — and all are ripe for conversion to intermodal, Wahba says.

CPKC already has placed in service 250 of the 53-foot reefer containers that are part of its order of 1,000 boxes. The remainder are scheduled to be delivered by the end of the year, and next year cold storage warehouse partner Americold will open a facility at the CPKC intermodal terminal in Kansas City.

KCS was never able to develop the Port of Lazaro Cardenas, on Mexico’s West Coast, as a backdoor entrance to the U.S., partly because Western railroads preferred the longer hauls from Los Angeles and Long Beach to inland markets in Texas and the Midwest.

But with congestion and labor troubles at the San Pedro Bay ports, CPKC says shippers want alternatives to North America’s busiest port complex. The advantage of Lazaro, Wahba says, is that boxes bound for the Gulf Coast from Shanghai, China, can arrive 10 to 14 days faster via Lazaro than the all-water route through the Panama Canal to Houston. CPKC intermodal partner Hapag-Lloyd has just begun marketing Lazaro as a shortcut to Texas.

CPKC also expects container traffic through the Port of Saint John, New Brunswick, to continue to grow rapidly. The containerport has become the fastest-growing in North America since CP acquired the Central Maine & Quebec in 2020, re-establishing its link to Atlantic Canada via shortline partner Irving railways.

Auto Network

Separately, CP and KCS served clusters of auto assembly plants in Ontario and Mexico. But they shared the same problem: Short hauls from the plants to interchanges with other railroads. The interchanges slowed service and could crimp the supply of auto racks if not all railroads were operating smoothly.

Now CPKC can link assembly plants in southern Ontario with consumers in Texas — and Mexican assembly plants to consumers in Chicago, the Upper Midwest, and Canada. “We have the ability to create a bespoke closed loop network for automotive shippers that has never existed before, in essence allowing them to guarantee their own capacity,” Wahba says.

CPKC will build a new auto ramp in Dallas that will open next year. An unnamed automaker has inked a contract to use the facility, Wahba says.

Carload and Bulk

CPKC’s carload network will benefit from a diverse range of new projects coming online across the system in the next few years, from steel and lumber to chemicals and energy products. The railway projects $600 million worth of new business from industrial development projects, $275 million from new single-line service connecting points on the former CP and KCS systems, and $250 million from emerging markets such as renewable fuels.

Through new single-line service, CPKC will be able to connect shippers and receivers on the former CP and KCS networks, says Coby Bullard, senior vice president of sales and marketing for CPKC’s merchandise commodities. The railway will haul aluminum ingots from Quebec to a smelter in San Luis Potosi, and then carry the aluminum to a new finishing plant being built in Mississippi, for example.

CPKC will build a transload center on land it already owns in Dallas to handle Canadian lumber destined for the housing market in fast-growing Texas.

With single-line access from Canada and the Upper Midwest to the Gulf Coast, CPKC will be able to offer new export options for U.S. and Canadian grain farmers as well as Canadian potash producers. A new potash export facility at Port Arthur, Texas, is scheduled to open in 2025 and handle Canpotex exports to Brazil.

Capital Spending Boost

Through 2028 CPKC will raise capital spending to between $2.6 billion and $2.8 billion per year – up from the $2.2 billion CP and KCS spent last year – as it adds terminals, passing sidings, centralized traffic control, and other projects to handle traffic growth. Capacity expansions over the next three years on the north-south corridor between St. Paul, Minn., and Texas will cost $275 million, while the $300 million ongoing expansion of CPKC’s Chicago-area intermodal and auto terminal at Bensenville Yard will be completed in 2026.

Financial Targets

CPKC’s financial targets for 2024 through 2028 include:

- Revenue growth at a compound annual growth rate in the high single-digit percentage range

- Double-digit earnings per share growth

- Continued profit margin growth

- A return to double-digit return on invested capital.

This year CPKC expects earnings per share to grow in the mid-single digit range.

CPKC’s presentation slides are available online.

Sounds impressive, but right now main trunk of this railroad is only seeing 6.8 trains per day north of Ottumwa, and probably only 5.8 per day south of Ottumwa.

The growth is unbelievable. I don’t want to say what a turn around it is for this railroad to be making since the capabilities weren’t there before but wow! What a brilliant move for these two companies to combine. The opportunities keep coming and will only grow further. Good things to come! I’ll be reaching out to my advisor to be buying more CPKC!! Impressive

Remember, this isn’t a presentation of facts. It’s only a TRAINS magazine article about a CPKC presentation where “Everything’s Coming Up Roses” despite their circuitous, slow, steep and competition-dependent route from Chicago to the Mexican border.

They are going to have to answer to someone. When you go around telling the press you are going to increase revenue by $5B USD, it will get asked in the investor conference calls with the CFO.

And if they fall short either something will be to blame or their pronouncements were merely sales talk.

Beating their own times by a full day? Now that’s impressive! Hopefully they’re smart enough not to restring the schedule to remove that buffer. Five days advertised looks like it’s still better than the competition’s 6.8 days, although the Ferromex-UPRR-CN partnership may be able to shave some time off that too.

Watch for mysterious slowdowns on the UP line north of Houston. And it won’t be from congestion. UFO’s will suddenly land on the tracks and cause delays.

It is refreshing to see a RR talk about GROWTH and actively moving trucks traffic to rail. Unlike BNSF & UP needing to be reminded of their Common Carrier obligations to handle the traffic offered. I can only hope that CPKC is successful.

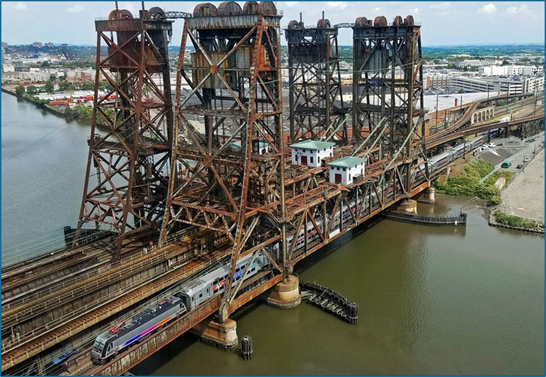

The star of the above photo is the stylish and imposing 6-axle 4300 hp diesel-electric locomotive EMD SD70ACU!

Dr. Güntürk Üstün

Does this take into account the number of derailments they seem to be having?