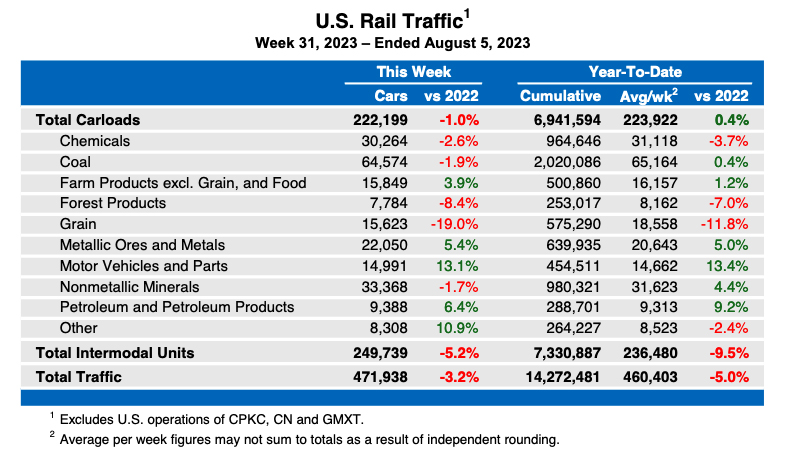

WASHINGTON — Weekly U.S. rail traffic remained at similar levels to those established in recent weeks, with volume for the week ending Aug. 5 down 3.2% from the same week in 2022.

It was the sixth time in the last seven weeks that the weekly figure has shown a decline of between 2.4 and 3.2% compared to the corresponding week a year earlier.

Overall traffic for the week was 471,938 carloads and intermodal units. That included 222,199 carloads, down 1% from the same week in 2022, and 249,739 containers and trailers, down 5.2%.

Through 31 weeks of 2023, U.S. carload traffic is up 0.4% while intermodal traffic is off by 9.5% for an overall decline of 5%.

North American volume for the week, from 12 reporting U.S., Canadian, and Mexican railroads, includes 328,156 carloads, up 0.7% from the same week in 2022; 331,701 intermodal units, down 6.4%, and 659,857 total carloads and intermodal units, down 3%. North American volume through 31 weeks is down 4.1% compared to the same period in 2022.

How do you spell “recession”?

Or could it be that the class 1’s are finally reaping what they’ve sown with PSR. If trucking tonnage has slowed considerably then I can’t see it. Maybe a lot of trucks on the highways running around empty. All signs now are pointing to a slowing of the economy but hopefully not a recession. But if the fed continues to jack up interest rates who knows. Regardless poor service will always drive off customers in good times or bad.

Perhaps not a “recession” yet, but quite possibly it’s on the way (this fall/winter). From what I’ve seen/been reading, it seems that overall freight volumes are down across the board (trucking/rail/international imports) this year, much of which is due to reduced industrial activity/production and a slowdown in consumer consumption (less goods/more services) after the pandemic.

Yes, the Class I’s focus on “efficiency” in their operations and PSR-related actions do not suggest they’re serious about regaining “mom & pop” carload business as it’s not perceived as being financially remunerative, at least in the eyes of Wall Street. The Class I’s freight market share for will not grow and likely will decline further, if modestly. Hopefully the short-line/regional carriers will continue to try and grow their business volume / market share (though they are of course at the mercy of their Class I connections …)