Forces outside the control of shipping firms have caused these companies to move containers from ships to trains around the globe in recent weeks. While drought has spurred the move on the 47-mile Panama Canal Railway [see “Maersk shifts some container traffic …,” Trains News Wire, Jan. 11, 2024], the ongoing conflict in the Middle East, and attacks by Houthi rebels in Yemen on shipping in the Red Sea, have led many container companies to switch to routes avoiding the Red Sea and Suez Canal, leading to additional rail traffic for various routes between Europe and Asia.

Red Sea disruption

Around 20% of all global trade — and 30% of global container traffic — normally transits the Red Sea and the Suez Canal, including goods from Asia for Europe and the eastern seaboard of North America. In an average week, nearly 400,000 TEUs (20-foot container equivalents) travel between Asia and these locations.

Typical journey times for ships between Chinese ports and northern Europe via this route are around 26 days. Via the longer route now being used around Africa, the time rises to 36 days and with time in ports at either end can reach 50 days. Despite multiple nations sending warships, and attacks on the Houthi rebels led by the U.S. and U.K. militaries, most merchant shipping is now avoiding the area.

The disruption caused by the attacks on shipping in the Red Sea has resulted in shipping lines and cargo airlines increasing prices. The cost of sending a container from China to Europe has more than doubled since November, with a 40-foot container from China to southern Europe now reportedly costing around $7,100; in early December it was less than $3,000. Even if shipping lines still take the shorter route via the Red Sea, the cost in insurance premiums for transiting a war zone has increased substantially. For shippers, the disruption to supply chains has led to factories closing temporarily as parts from Asian suppliers have been delayed; in Germany, Tesla has announced its only European factory, near Berlin, has been forced to stop operations from late January to mid-February as parts sourced from Asia will be delivered later than scheduled.

Rail alternative

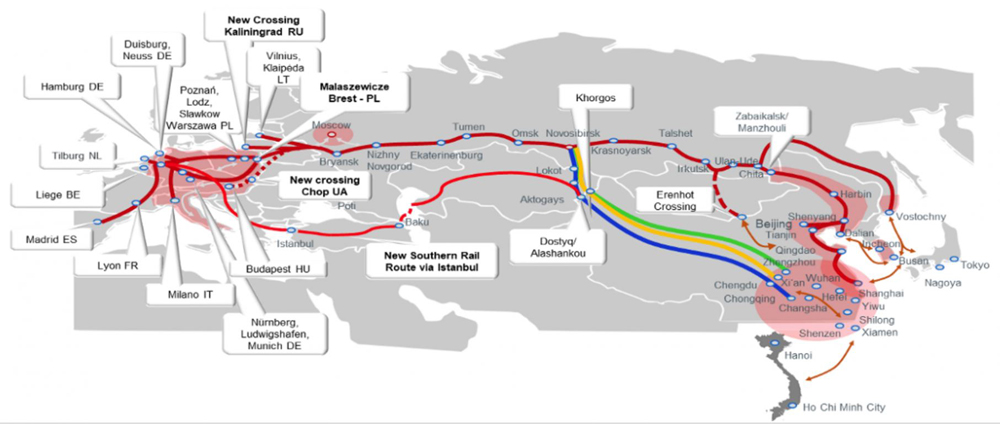

Rail freight between China and European countries – much of it routed via the Trans-Siberian railway in Russia — had seen major growth in the last decade, with a long list of cities connected to China by freight train. These included cities in Germany and central Europe with daily services, and even Madrid in Spain and London, England (although that train only ran once).

Russia’s 2022 invasion of Ukraine led to this traffic decreasing but not ending completely. It also led to the creation or promotion of alternative routes that avoid Russia. Despite less use of the Trans-Siberian route, nearly 20,000 trains were despatched from Chinese cities to Europe by all routes in 2023, carrying around 2 million containers; this includes those destined for Russia itself, but also those using the new routes avoiding Russia.

By rail, a container can reach Poland or Germany from China in as few as 12 days (via Russia) or around double or triple that via the newer, more complex routes. The Trans-Caspian International Transport Route — founded by the governments of China, Kazakhstan, and Azerbaijan — aims to offer an alternative to transiting Russia, but it relies on containers being transshipped from trains to ships to cross the Caspian Sea between Kazakhstan and Azerbaijan. They then either go overland by train via Georgia and Turkey, where they use the rail tunnel under the Bosphoros in Istanbul connecting Asia to Europe, or via another ship across the Black Sea from Georgia to Romania, where trains take over again. Perhaps not surprisingly, all that complexity adds time and harms reliability.

Rail freight rates between China and Europe were averaging around $4,200 per container in late 2023, but with increased demand, the price has also risen with rates of around $6,000 now being offered – if space is available, as many trains are fully reserved well in advance. Before the Red Sea crisis, rail freight could offer a slightly faster transit between China and Europe for around the same price as going by ship; it is now offering potentially a much faster transit for around the same price. However, unlike the largest container ships, which can carry over 23,000 TEU (or around half that number of 40-foot containers) the average international freight train on the China-Europe routes is capable of handling 80 to100 TEU (40 to50 40-foot containers). Even if there were unlimited numbers of suitable freight cars, locomotives, and crews — and there are not — it would take thousands of trains to replace to replace one large container ship.

My understanding is that the short lengths of signaling blocks in Europe also make it difficult to run longer trains. The blocks are optimized for frequent, short passenger trains, not long drag freights.

Soviet, now Russian, bloc draft gear and couplings can handle heavy trailing loads; EU ones cannot. 80 to100 TEU (40 to 50 40-foot containers) can be handled on 20 to 25 US single-level TTX flats.

I believe the Ukranians have learned that their cars, even if regauged, are still too large to meet EU clearances.

Are double stack trains possible on any of these routes? I have never seen a photo of one, and do not recall reading anything about the possibility of double stacks.

I would have to say clearance would be a problem in Europe. Especially with many of the main routes electrified.

I once read somewhere (?) that India was motivated to build and maintain their 5’3′ Indian broad gauge railroad so that they could double stack containers with a high center of gravity, on conventional flat cars.

I would like to see India add two standard gauge inner rails to their existing broad gauge mainline track so they could contribute to a fluid continuous standard gauge Silk Road RR linking Asia to standard gauge Europe.

So far, Kashi, China comes the closest to linking eastern standard gauge China/Asia to Western Europe via the eastern Iranian standard gauge border at Sarakhs. https://i.pinimg.com/originals/9f/da/6d/9fda6d70b1583417bfe7960eb4270c73.jpg

CORRECTION: India’s broadgauge is 5’6″, not 5’3″. I wish we had an editing feature on this forum.

If a ship carries 23,000 TEU (twenty foot equivalents) and a train carries 200 (2×100 forty foot boxes) than only 115 trains would replace a shipload, not ‘thousands.’

Do Euro trains carry a hundred boxes?

The longest European container trains I see on a daily basis are only about 40 cars long.

When I visited Europe I was astonished by how short the freight trains were along with the diminutive wagons. It’s no wonder they’re hardly used for freight as they don’t get much efficiencies of scale.