WASHINGTON — U.S. weekly rail traffic continues to run ahead of 2023 levels, thanks to intermodal volume, according to statistics from the Association of American Railroads.

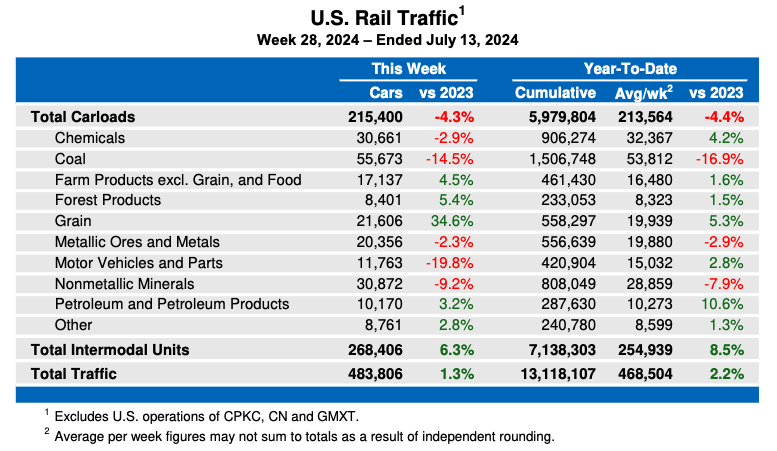

For the week ending July 13, total U.S. volume was 483,806 carloads and intermodal units, an increase of 1.3% over the same week in a year ago. That includes 215,400 carloads, down 4.3% from last year, and 268,406 containers and trailers, up 6.3%.

Through 28 weeks, U.S. traffic in 2024 is up 2.2% compared to the same period in 2023, with carload volume down 4.4% and intermodal traffic up 8.5%.

North American volume for the week, from 10 reporting U.S., Canadian, and Mexican railroads, included 318,065 carloads, down 3.8% from the same week a year ago, and 349,079 intermodal units, an increase of 10.9%. The total volume of 667,144 carloads and intermodal units represents a 3.3% increase. Through 28 weeks, this year’s North American volume is up 2.4% compared to the same period a year ago. In Canada, cumulative volume through 28 weeks is up 2%, while in Mexico, overall volume is up 6.3%.

I can find fault with a lot of what the RRs are doing about traffic. Coal is a big factor for the barely increase in traffic. However, let us discount coal which dropped about ~~8000 carloads. Add in another ~~6000 other traffic then the RRs are evidently increasing their other traffic more than enough to off set coal’s decline.

Coal is a single commodity that really takes no effort by the RRs other than to steal that traffic from another RR. So, I think we do need to give the RRs some credit for getting other traffic to more than off set the decline in coal which overall the RRs cannot really change. the weather is going to effect coal traffic much more.

Yes, the PSR business focus is a big issue driving the stagnation, if not the actual loss of rail traffic to trucks. However, it would seem that flat, if not actual dropping industrial production is also a factor in declining rail volumes, esp. coal and the carload businesses.

Just read a fascinating article in a (not-to-be named) rail magazine about the “Silicon Valley” freight rail network (The San Jose / S. Peninsula area of the Bay Area, former SP & WP, now all UP). Though there are some local “haulers” that operate out of the Warm Springs yard (ex SP/WP?), the once substantial local industries and business in Silicon Valley are but a mere fraction of what they were.

To be sure, Silicon Valley has undergone a seismic transformation from heavy industries (and a lot of agricultural production) to the high-technology industry, but one stat in the article really stuck out: Where there were once over 1,000 different industries and businesses being served by freight rail in the Silicon Valley area (pre-UP), by 2012 that number had shrunk to 40 industries. Ten years later (2022), that number had shrunk even further to about 20 local industries/businesses. And the article ends by noting that the Union Pacific seems to have a “Ho-Hum” attitude every time a business there stops shipping by rail.

Silicon Valley, to be sure, is a unique case study, but there are probably a number of other major urban metropolitan regions that have similarly lost much of their freight-generating rail traffic over the last 40-50 years.

The losses are self inflicted, with PSR driving former rail shippers to trucks – and they’re not going back. You reap what you sow.