“This is truly a once-in-a-lifetime opportunity,” Wabtec CEO Raymond Betler told investors and analysts on a conference call on Monday morning. “This is an ideal combination.”

The acquisition will create a more diversified company that combines Wabtec’s strengths in freight and transit components with GE Transportation’s locomotive manufacturing and service business.

“We will be a stronger, more diverse business,” Wabtec Chief Financial Officer Patrick Dugan says.

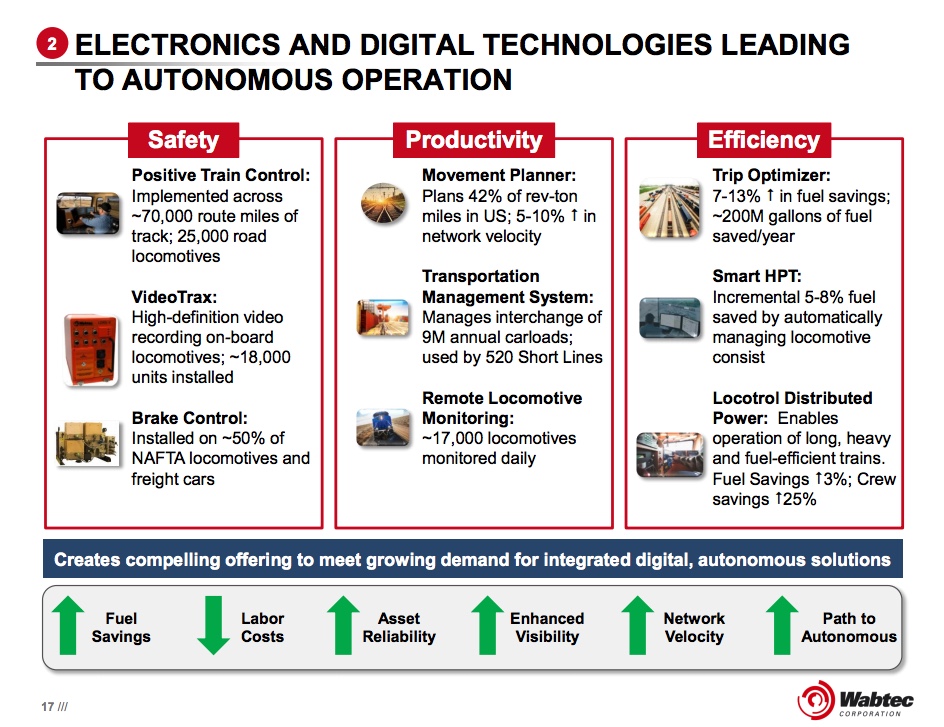

The combination also will accelerate technological advances that can lead to autonomous operations, as well as improve safety, productivity, and efficiency.

Wabtec is a major supplier of positive train control equipment, for example, while GE produces digital systems that can help railroads connect, monitor, and improve performance of locomotives, freight cars, and yards.

“We should be able to move the technology of this entire industry forward,” Wabtec Executive Chairman Albert Neupaver says.

Wabtec officials say the combined company will have $250 million in annual merger synergies. Some of that will come from cost-savings by eliminating duplication, while some will come from revenue gains from things like putting more Wabtec brake, compressor, and electronic components on GE locomotives.

The typical new GE locomotive has about $250,000-worth of Wabtec components, depending on the specifications of the customer, executives say.

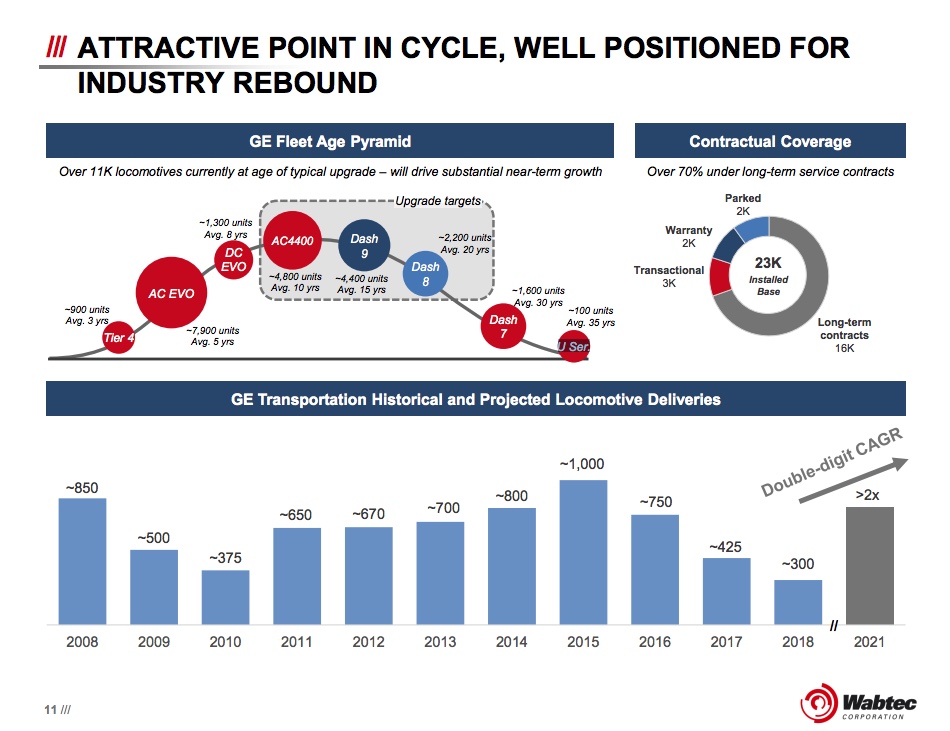

The deal comes as GE Transportation rebounds from a cyclical low in what’s traditionally been a boom-and-bust business. Already GE has an $18-billion-backlog of business, which represents half of its total anticipated revenue through 2020.

“The industry continues to show positive signs of recovery,” says Rafael Santana, the president and CEO of GE Transportation. Revenue is expected to grow at a double-digit clip over the next three years.

In the past six months, GE has received $3.6 billion in orders for new and remanufactured locomotives, including 1,800 new and 1,000 modernized units.

More than 11,000 GE locomotives are currently at ages at which they would typically begin to undergo upgrading and modernization. Candidates for upgrades include 4,800 AC4400s, 4,400 Dash 9s, and 2,200 Dash 8 models currently in service around the globe.

Wabtec’s backlog of business also is at record levels.

The deal is expected to close early in 2019, subject to the approval of Wabtec shareholders. It also will require antitrust review in the U.S. and abroad, as well as approvals of the tax structure of the complicated deal. Executives did not foresee any regulatory hurdles that would alter or stop the deal.

The merger is a complex spinoff of GE Transportation from its beleaguered parent, General Electric. GE slimming down to its fastest-growing and most-profitable business segments.

Under the terms of the deal, GE will receive $2.9 billion from Wabtec. Existing Wabtec shareholders will own 49.9 percent of the company. GE shareholders will own 40.2 percent, with GE Corp. retaining a 9.9-percent stake.

The GE Transportation business will be distributed to GE shareholders through a tax-free spinoff, then immediately merged with Wabtec. GE’s stake will be locked up for 90 days, but it must sell its 9.9-percent share of the company within three years.

The company will operate under the Wabtec name and be based at Wabtec’s headquarters in Wilmerding, Pa., outside Pittsburgh. Betler will be chief executive of the combined company.

The Chicago-based freight segment will be headed by Santana. The transit segment, based in Paris, will be headed by Stephane Rambaud-Measson.

And there go more jobs.

Peter Laws

Did you miss this line right after that one: “Some of that will come from cost-savings by eliminating duplication”, it’s not like they shied away from saying there would be cuts now did they?

“$250 million in annual merger synergies” in execuspeak means “a lot of folks are going to be working somewhere else”.