OMAHA, Neb. – Union Pacific sees Precision Scheduled Railroading as a way out of the operational and service rut in which it’s been stuck for the past year.

“By a number of measures it’s evident that we have not made the kind of progress I expect in improving our service and productivity performance in recent months,” CEO Lance Fritz told investors and Wall Street analysts on a Wednesday morning conference call. “We’re not meeting the expectations of our customers, and we know we can be better.”

UP announced on Monday that it would adopt a Precision Scheduled Railroading operating model, dubbed Unified Plan 2020, to boost profitability, cut costs, and improve service. [See “UP aims to boost profits, service with Precision Scheduled Railroading,” Trains News Wire, Sept. 18, 2018.]

“I believe a large part of the problem is attributed to the complexity in our network transportation plan … compounded by significant changes in business mix,” Fritz said. “Unified Plan 2020 is a way of addressing that network complexity. In a nutshell, it’s Precision Scheduled Railroading principles implemented on the Union Pacific network, taking into consideration the unique characteristics of our franchise and our base customers.”

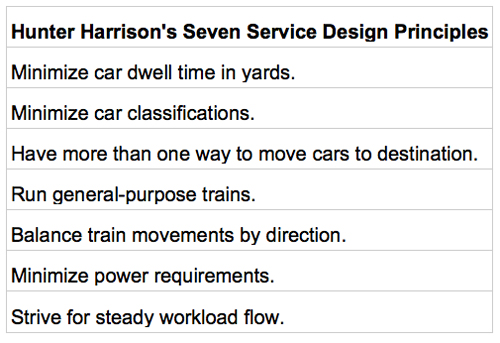

UP will depart significantly from the Precision Scheduled Railroading operating model the late E. Hunter Harrison developed at Illinois Central and later deployed at Canadian National, Canadian Pacific, and CSX Transportation.

UP will roll out operational changes in phases, plans to retain its current lineup of classification and regional yards, and will not rationalize its 32,000-mile network of main lines and secondary routes.

A key question: Can Union Pacific “Hunterize” its operations without having Harrison or a team of Precision Scheduled Railroading veterans?

Yes, Fritz says, noting that UP has closely watched operations at CN, CP, and CSX. “We’ve learned a great deal from those interline relationships: Exactly what PSR is, how it works, how it impacts us and how it impacts them,” Fritz says.

UP does have some people who are familiar with Precision Scheduled Railroading, including Cindy Sanborn, who was chief operating officer at CSX and now serves as vice president of UP’s Western Region.

“We have the right talent to be able to implement those seven core tenets and do it effectively on the Union Pacific franchise,” Fritz says.

UP decided to implement the new operating plan in three or four phases to minimize the potential for disruption. Service suffered at CN, CP, and CSX as Harrison rapidly rolled out systemwide operational changes while leading those railroads.

Implementation will start around Oct. 1 with more than 250 changes to the operating plan on the Mid-America Corridor, UP’s routes linking Wisconsin, Chicago, and Texas. The corridor handles half of UP’s merchandise traffic.

“It’s not a small toe in the water,” Fritz says. “It’s a pretty substantial move right out of the chute.”

The next phase is likely to begin early in 2019, with the final phase complete late in the year.

UP does not anticipate idling any of its 14 hump yards or converting them to flat-switching facilities. UP also will complete its 15th classification yard, Brazos Yard in Texas, by 2020 as planned.

Brazos is necessary to handle manifest traffic growth on the Gulf Coast and to streamline operations in the Mid-America Corridor, says Tom Lischer, executive vice president of operations.

But UP will use yards differently as the new operating plan unfolds, Fritz says, partly by having road trains swap blocks at hump yards – something the current operating plan avoids. Cars also will bypass yards en route to their final destinations.

The railroad is not considering line sales as a part of its shift to Precision Scheduled Railroading. And UP’s operating ratio targets don’t hinge on asset sales, Chief Financial Officer Rob Knight says.

UP still aims to reduce its operating ratio to 60 percent by 2020 and eventually reach its long-term target of 55 percent.

This prompted a question from an analyst: If the financial targets are the same, what’s the big deal about the new operating plan?

“What’s transformational about this is how we’re going to design the transportation plan itself, how we are going to execute the service product for our customers,” Fritz says. “We’re going from a focus on trains to a focus on cars and car movement.”

As a result, UP expects to see its costs dramatically improve due to much better utilization of crews, cars, and locomotives. It will need fewer of each as cars are handled fewer times en route and transit times improve.

UP also will run more general purpose trains that include bulk, merchandise, and intermodal traffic, executives say. But UP will leave its premium intermodal trains untouched.

Implementation of Precision Scheduled Railroading at other railroads led to 20 percent to 30 percent reduction in the number of employees. UP would not provide details on potential changes to the employee headcount. But officials say they expect substantial productivity gains and cost reductions.

UP learned from the “Blend and Balance” pilot program it launched last October in the corridor linking the Pacific Northwest and Chicago, Fritz says. The program was reminiscent of the Harrison philosophy of running general purpose trains and balancing the network by operating equal numbers of trains in each direction every day. The idea is to keep crews and power in balance with the added efficiency of increasing train length.

But Blend and Balance was a kind of light version of Precision Scheduled Railroading. It focused on trains, not individual cars, and did not fully embrace wholesale operational changes.

“We learned a lot from that pilot and now believe that a more unconstrained implementation of those concepts, and other PSR principles, is warranted across our entire rail network,” Fritz says.

Ultimately, the operational changes should make UP’s service more consistent and reliable, Fritz says.

Kenny Rocker, executive vice president of marketing and sales, said UP will talk extensively with customers about operational changes. “We are doing this to grow volume,” Rocker says, although he acknowledged that the needs of some shippers may no longer fit the UP network.

This is hilarious! Who knew that the folks at UP had such a sense of humor?!

“We’re going to implement PSR. But it’s not going to have most of the characteristics of the thing that Hunter Harrison implemented at CSX, CN and CP. And the person who will implement it is the old-guard operating chief who left CSX at the beginning of its transformation and had nothing to do with it.”

What this is is a major US carrier cowtowing to Wall Street analysts who are demanding to know why this wildly-successful thing that every railroad pundit and executive said would fail — other than those who remained at CSX — isn’t being implemented at the railroad in which they own stock.

Don’t think for a second that they weren’t out there behind the scenes encouraging the witch hunt at the STB which attempted to kill PSR as it was being implemented. Now that it has succeeded, and the owners of other railroads want the same kind of asset and employee efficiency that CSX has, ruh-roh!! Nightmare!

So it boils down to this: “We’re implementing something, and calling it Precision Scheduled Railroading over and over to appease the analysts, but we’re not going to do any of the hard things that are at core of PSR.”

This just made my morning. Long live the spirit of E. Hunter Harrison!!!!

They are making a mistake if they are going to try and do this without rationalizing their system. Hump yards are 1950’s technology and flat switching yards are what slow shipments down. I used to work for a paper company in northern Maine. We had a distribution warehouse in northern Massachusetts. It was amazing the difference in time between trucking and rail. A trucker could pick up a shipment in the morning and deliver it to the warehouse that afternoon whereas it might take the railroad two to three days or more to make the delivery with all the yard delays. First the yard in town then in Bangor and again in Portland and again in Massachusetts before it was finally assigned to a local for the final movement to the warehouse. A big amount of time was spent just sitting out on the line. UP needs to look at their system and get rid of excess capacity and streamline where ever they can. They won’t succeed in cutting costs unless they reduce overhead. In addition they need to shed problem shippers that don’t provide enough profit to make serving them worthwhile. Only thing is do it more slowly than CSX. Take the time to do it right.

The best laid plans of mice and men……… Lotsa luck there sir, CSX could hardly be called a success, at least

not in most shipper’s eyes. Running a railroad without shippers does simplify things though.

The last sentence says it all. PSR is growth by elimination. PSR is its own oxy-moron.