Like most railroads, CP saw a flood of intermodal traffic arrive at its terminals Wednesday through Friday, with much lower volumes the rest of the week. Day of the week pricing, which offered lower rates on slow days and higher rates on peak days, did little to smooth volume.

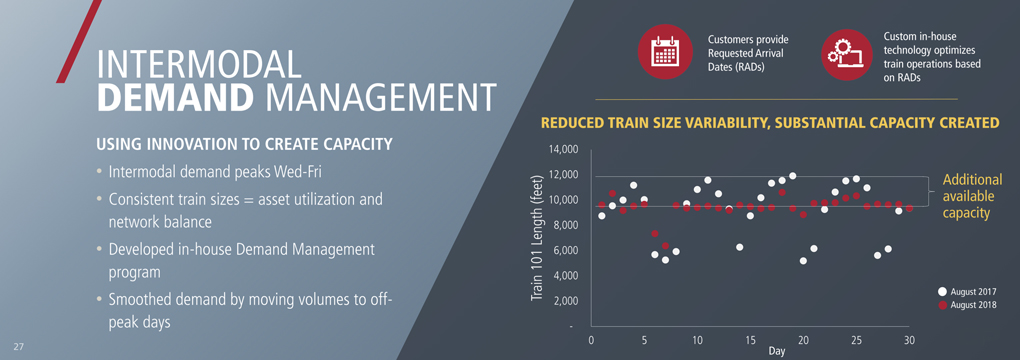

CP’s premier domestic intermodal train, Toronto-Vancouver hotshot 101, would swell to 12,000 feet on heavy-volume days, but shrink to 5,000 or 6,000 feet on low-volume days.

It’s the sort of thing that drives a Precision Scheduled Railroad nuts. The operating model strives to keep crews, locomotives, and cars in balance. And when you’ve got a long consist some days, and a short train on others, efficiency and capacity are lost.

Jonathan Wahba, CP’s vice president of intermodal sales and marketing, and Mike Foran, the railway’s vice president of market strategy and asset management, set out to solve the problem. Last year they created a small “skunk works” team that was so secret that top management didn’t know about it.

As a first step, CP went out and talked to its intermodal customers.

“We were surprised. Two-thirds of all the traffic we delivered in western Canada on any particular day didn’t need to be there that day. Didn’t need to be there the next day. Or the day after. We were hurrying up to wait,” Wahba said during CP’s Oct. 4 investor day.

So CP came up with a concept called the requested arrival date. The shipper would tell CP when its container needed to arrive, and CP would manage when the box moves to ensure on-time delivery.

A few large shippers signed up for a low-tech pilot project. Using pen and paper, CP tracked about 200 boxes a week. The pilot and subsequent larger-scale testing went well enough that Wahba and Foran asked the executive team for about $1.2 million for a full-blown information technology program.

CP now uses a homegrown algorithm that automatically monitors and schedules shipments based on the customer’s requested arrival date. This allows CP to shift boxes to lower-volume days.

The result? Train 101 now routinely runs at 10,000 feet every day, with length varying only by about 500 feet over the week.

“Every aspect of our business is now perfectly planned and balanced,” Wahba says.

CP gained $50 million-worth of capacity without adding train starts, pulling locomotives out of storage, or hiring more crews.

It also did away with day of the week pricing. In its place, CP now offers several tiers of pricing, much like how FedEx charges based on varying levels of speed and service.

“This is obviously a win-win and a great plan,” says intermodal analyst Larry Gross. “A key requirement is that the parties must trust one another, and at the risk of stating the obvious, if the shipper is going to tell the railroad when they really need the box, then it is incumbent for the railroad to reliably get the box there when it is needed.”

It would be more difficult for a U.S. railroad to develop a similar program because the Canadian railroads retail their intermodal service and therefore have direct connections to each customer, Gross points out.

CP expects to see continued intermodal growth over the next few years, Wahba says.

Domestic growth will be driven by e-commerce parcel service, big-box retail shipments, reefer service, and retailers who co-locate at CP intermodal terminals, Wahba says.

Next year, CP hopes to win back some of the five steamship line contracts that come up for bid and are currently moving via Canadian National. Collectively, the contracts are worth more than $600 million, he says.

“We have zero desire to win all that business,” Wahba says. “It would be wildly irresponsible to our current customers to try and swallow that much freight because we don’t have that much capacity.”

Funnily enough , one of our local truck delivery firms rang me , as I was first reading this . “We have a consignment for you,its missed your run , If its urgent , we send a truck over with it this afternoon , otherwise , can we deliver on the normal run tomorrow”. I was busy , didn’t need the parts , so said I was more than happy for them to deliver it tomorrow. Probably saved them a couple of hundred bucks on a $ 80 delivery job.

Terminal box storage has been a big deal for a long, long time. Some ocean carriers have to arrange off-site storage for their loads. There was (and probably still is) some tension between IM marketing/sales and IM operations over collecting the storage fees for boxes held in the terminal.

That space isn’t free, but is likely easier to manage than “lumpy” train sizes.

John Sutherland: yup. And storage (or

“storage in transit” has a cost too.

Yet some freight cars (need to) roll slower or can occupy “near terminal” trackage (if not all ripped out). Not every Intermodal load needs “premium” “Z train” terminal to terminal fast schedules. And those cost money too (big money in HP/ton and line haul track capacity).

But you still have to deliver when you said you would. Every time.

As if confirming my conjecture that there are more flex points in the manufacture-to-end-use supply chain than just the overland transport segment.

The key would seem to be transparency and ditching the adversarial relationships and talking like partners. Which among other things requires more sales and marketing expertise at the railroad than they currently spend on. And while I mention supply chain transparency: Blockchain?

I can see one potential hurdle that isn’t mentioned. If the box is not urgent and can wait a couple of days before getting on a train, it will need to be stored somewhere. That occupies space, which has to be found somewhere. I don’t think the shipper cares where, as long as it is not at the original loading dock. So presumably the railway will have to make room at the intermodal yard, if it can, or arrange for double drays to and from a separate storage area. That has a cost, but is it offset by the additional efficiencies from smoothing the flow?

Since deregulation in 1980, it took them 40 years to figure this out?

Interesting the “trust” issue is mentioned. I can understand that, in that I will tell a mechanic shop I don’t need the equipment until 4 days from now. When I do that I worry if they will wait until the last minute to start, so that if something goes wrong we’re stuck.

On the other hand, I have jumped through hoops before to get something done right away, because it simply can’t wait, only to come back a week later and see nothing has progressed since I finished…

The heart of this problem is that the railroads really don’t know who the beneficial owner of the freight is most times. The shipper is the freight forwarder, trucking company, steamship line, or LTL carrier and the RR has no idea where the box or when it’s really been promised…and they ain’t telling you! (you might get ideas about stealing their customers…)

So, it’s no trivial thing to find out that the box of widgets that came in your gate in that HUB or EMP box on Friday afternoon aren’t really needed by Amalgamated Widget Assemblers until a week from today – and you really don’t need to put them on a train until Sunday night.

I noticed that the data was gathered by hand. I’d bet those guys camped out in the out gate and wheedled the needed info from the drivers. Only after they had enough to make their case could the go back to the forwarder/truck line and make their proposal to do “pull scheduling”

Hats off to them! Most of the solutions bandied about over the years that I’ve heard involved trying to use fixed capacity and yield pricing (like airlines sell seats on planes) to smooth out the flow. One of the big hurdles was always that billing and operating systems were all geared to “push scheduling” and fixed pricing.

Sounds like CP has something it can sell to the other roads…

This is a really good idea that should spread. I would think yield pricing could do the same thing. Really hard to implement on the IT side, though.

RR intemodal capacity management has been talked about for a long time. Nice to see someone finally tackle it.

Like Mr Harrod, I’m a bit underwhelmed with this revelation. Sounds like it’s being presented as no one has ever thought of this before? Compared to the many experts here who often fill in the gaps of a news story and provide needed context, I don’t have any particular knowledge or experience with Intermodal and all its fine details. I’m also not an expert on PSR but wouldn’t solving the problem of widely varying demand day-by-day be a part of PSR?

As for hotshot train 101 (BTW, how many intermodals run in Canada on CP, total?), are they trying to say that their solution, which has reduced the train’s length on some days from 12,000 feet to 10,000 feet, leaves them running a train that fits in all their sidings, or most of them, and thereby drastically improves the fluidity of the railroad? If so, then yes, I can see how this change is significant.

I can only speak for US CP Intermodal 199 ops circa 15 years ago which also routinely ran around 10,000 feet, which West of the Twin Cities it didn’t fit in any siding, but since it was the only hotshot and everything was going to go into the siding for it anyway, it didn’t matter if it was 10k or 12k or 20k, it was the only train that long on the railroad and since it was hot, it didn’t need to be parked anywhere. (Its counterpart, 198, was somehow much less hot and not as long and even had “junk” added to it routinely) I should also not fail to mention that one should notice how hot 199 was actually intended to be by knowing 95% of the time the power was only 2 GE’s (8800HP), regardless of tonnage or length.

Can this be a railroad … asking customers what they want, instead of stumbling along in the dark and focusing on the bottom line? My perspective is that what they have developed could have been done with project management software that I used way back in the 1980s, if they had just stopped thinking like traditional railroaders. I commend the managers at CP that cared enough and dared enough to think a problem though to a solution!!!

A: They started this without the top managers involved. B: They talked to the Customers. C: They used pencil and paper to start up the concept. They should be commended. Next step talk to the crews like this.

I’m not a big fan of PSR, but this time, they ASKED the customer WHAT DID THEY WANT? And then figured out a way to provide what the customer wanted. BRAVO. This is exactly what the railroad world needs more. The, “take it or leave it” customer service model is a dead end.