WASHINGTON — The Surface Transportation Board has approved Canadian National’s acquisition of 218-mile regional Iowa Northern Railway.

The board’s decision today (Jan. 15, 2025) also imposed several conditions to offset potential anticompetitive aspects of the $230 million deal. Among them: The development of a scheduled local service plan, keeping gateways open on commercially reasonable terms, and maintaining competitive access to locations with voluntary reciprocal switching agreements.

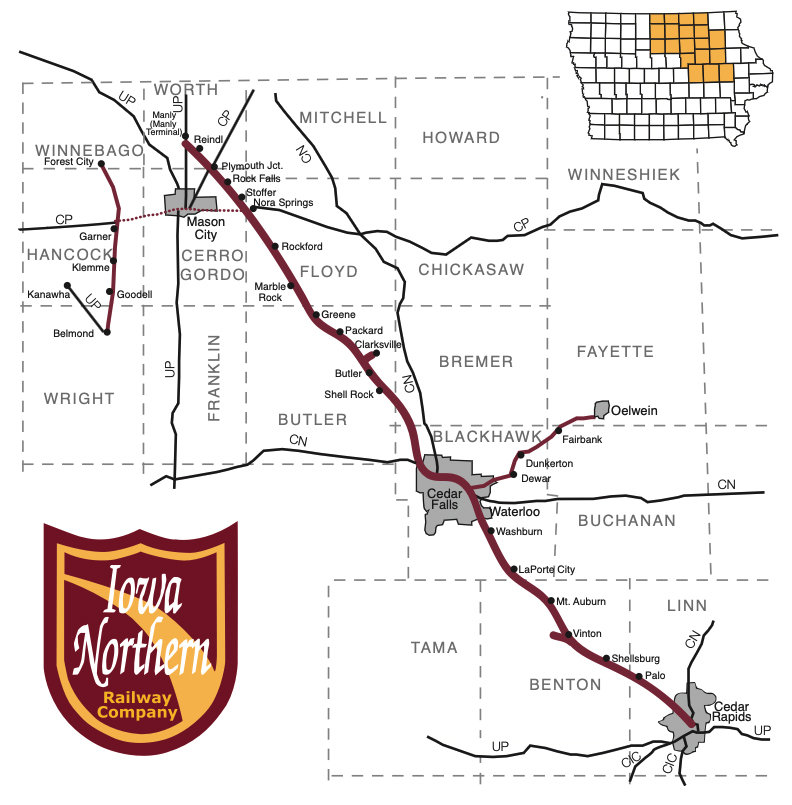

The merger will become effective on Feb. 13. The board also approved a pair of related trackage-rights deals. CN gains trackage rights between Cedar Falls and Manly, Iowa; Iowa Northern gains rights from CN’s Chicago, Central & Pacific on routes out of Waterloo, Iowa.

“We recognize and thank the STB for its commitment to a rigorous process that has yielded the right outcome,” CN CEO Tracy Robinson said in a statement. “We look forward to welcoming the team at Iowa Northern Railway into our CN family of railroaders, and we are carefully preparing for a successful integration. We are excited to grow our network, offering customers, farmers and our supply chain partners with single-line access to new markets. This is an important step in our growth plan, reinforcing our commitment to providing customers with exceptional rail service and powering the economy.”

Dan Sabin, chairman of the Iowa Northern, said the combination was a milestone is his 55-year railroading career. “I am proud of what Iowa Northern’s employees and customers have built and their important role in Iowa’s economy. I am also excited about the benefits of our combination for customers, employees, and the communities we serve,” he said in a statement.

The 3-1 vote reflected a split on the board, which failed to meet its own July deadline to reach a decision in the case. Chairman Robert E. Primus cast the lone vote against the deal, while board members Patrick Fuchs, Karen Hedlund, and Michelle Schultz issued their own separate concurring statements.

The board members made it clear that in reaching the decision they wrestled with the statutory requirement to approve the deal unless its anticompetitive effects would be outweighed by the public interest.

“After considering the application and the full record in this proceeding, the Board finds that, without conditions, CNR and GTC’s acquisition of Iowa Northern’s rail lines would likely cause a substantial lessening of competition,” the decision says.

CN has argued that its acquisition of Iowa Northern would boost rail competition, divert freight off the highway, and give Iowa shippers broader access to single-line service.

Primus did not see it that way.

“While I disagree with today’s decision, as I believe this transaction will cause a substantial lessening of competition that is not outweighed by the transaction’s modest public benefits, I recognize the views of the other Board members in favor of approving this transaction,” Primus said in a statement. “As Chairman, I will not stand in the way of a majority and bringing a conclusion to a matter before the Board.”

Hedlund said she fully supported the decision, “but not without certain misgivings. I remain concerned about whether the conditions imposed on Applicants will in fact preserve the ‘dedicated service’ to almost 20 small- and medium-sized grain elevators historically provided by Iowa Northern (IANR).”

Fuchs said the decision was an acceptable compromise. “Though some of the Decision’s analysis and conditions do not reflect my first preferences, it includes justifiable competition-related protections for shippers while, in effect, increasing the IANR system’s financial stability, offering modest operational benefits in some circumstances, and reducing uncertainty for parties,” he wrote. “More broadly, considering recent proceedings in which the Board has missed statutory deadlines, I write separately to offer four interrelated suggestions for focusing, expediting, and improving the Board’s review of non-major transactions to further the purpose of the governing statute.”

Schultz wrote that, ideally, the approval would not have included every condition that the board imposed. She also agreed with Fuchs’ suggestions to streamline the review process.

Primus’s dissent explained his opposition to the merger.

“We all have heard the timeless adage: Never judge a book by its cover. Sage advice that, unheeded, can leave the reader disillusioned and disappointed. Such advice should be applied to the Proposed Transaction, for on the surface this appears to be a minor transaction with promises of greater access and growth for shippers along the freight rail network in east-central Iowa. And yet, just a few pages in, the small and medium-sized shippers who have come to rely on IANR for superior performance, rates, and customer service will discover that this transaction turns from a budding, feel-good romance into something resembling an Edgar Allan Poe novel,” he wrote.

“While I have great respect for CN and its recent network and service accomplishments, I regrettably believe this transaction will do very little to build upon the local success established and enjoyed by IANR,” Primus wrote. “Instead, it will foster a lessening of competition and create haves and have-nots based on carload amounts, ultimately reducing the number of small and medium-sized shippers accessing the network. And, because its potentially adverse impact upon the network is of regional or national transportation significance, I maintain that this transaction should have been classified as significant.”

The CN-IANR merger was reviewed as a minor transaction. A significant merger involves a more thorough review.

Note: This story was updated at 11:40 a.m. Central with comment from CN and IANR.

Now that the sale is approved, look for CN to abandon it’s current line into Cedar Rapids from Manchester IA. Also, how many current Iowa Northern employees will be required to move somewhere else on the CN system to keep a job.

for all you shippers, you may as well start getting trucks lined up, I can tell you from experience that the CN has no time any of you

Much of the text in the lengthy STB decision document exhibits a lot of hand-wringing about the non-competitive possible outcomes of approving this deal. Conditions were stipulated primarily to maintain the competitive status quo but one doesn’t get the sense that STB board is really confident IANR’s proven ability to grow its business is likely to be sustained.

I don’t see how the STB could NOT see this as harming competition. CN & IANR are parallel for nearly all of the length of the IANR. Also, CN and IANR are the only RRs to serve the Waterloo/Cedar Falls area, although IANR has some contractual obligations to UP to interchange traffic from UP’s ex-CGW line to UP or pay a fee. I think this includes John Deere. I assume this obligation will be binding on CN also.

This article makes no sense. If CN is buying Iowa northern, why are there trackage rights at all?

Why not let IANR continue as an independent company to provide local service with access to the mainline and let CN buy only that?

Another once-great shortline that will be ruined by CN’s legendary service quality.

CN probably bought IANR so CPKC could not.

You could take it one step further and note that timing is everything as I can see CN actively seeking as many buys and regulatory approvals not coming off the recently approved CPKC merger. Would tough for the board to not allow these rather small requests, buyouts and mergers but gives the other Class I the opportunities secure assets.

This deal still doesn’t make sense and it seems Mr. Primus felt the same way. IANR gets rights on CCP, all that means is CN can set up a dedicated train for IANR customers at Waterloo and take it to Chicago on the old IC route instead of taking it down to Cedar Rapids for UP to bring it in.

I guess that is the new term for “competition”.

My take is UP couldnt care less, and only CPKC probably had even the slightest interest. IANR is basically a tiny freckle on the massive skin of CN’s largesse.