How would this “reduced” offer (in NS’s terms) benefit NS stockholders? Through the creative use of a voting trust to keep the railroads under separate management while the Surface Transportation Board considers the acquisition, said CP. One railroad cannot buy or exercise control over another without STB authority. However, when the boards of directors of two railroads strike a merger deal, they usually can’t wait for the STB to approve it, since changing conditions could quickly make the financial terms obsolete. The solution is to close the corporate merger, paying off the stockholders of the acquired company, and immediately place one railroad in a voting trust till the STB rules.

Under the STB’s 2001 merger rules, though, a slightly different procedure applies when one Class 1 carrier strikes a deal to acquire another one. The railroads must explain to the Board how the proposed voting trust would insulate the carriers from “an unlawful control violation” and why the trust would be in the public interest. The STB will rule on the proposed trust after a “brief” pause to allow public comment.

The twist CP is suggesting is that, after a three-week due diligence examination, CP would close the merger deal with NS and place CP, the acquiring carrier, and not NS in an STB-approved voting trust. At the same time, CP’s CEO, Hunter Harrison, would resign his CP post, sever all ties with CP and be elevated to a similar position at NS. Then he would attempt to “Hunterize” NS operations, lowering the operating ratio and saving the company billions of dollars.

Meanwhile, CP would operate independently under Harrison’s heir apparent, president Keith Creel. When the STB approves the CP-NS transaction, which Harrison is confident it will, the new holding company could gather in the remaining 30 percent of the $1.8 billion in annual benefits by creating single-line CP-NS routes, diverting traffic from competing carriers and reducing NS’s effective tax rate.

Not surprisingly, NS disagrees with CP’s assertion that the STB would approve the voting trust. It hired former STB members Francis Mulvey and Charles Nottingham to explain that, by installing CP management at NS, “CP essentially would usurp and preempt the STB’s exclusive jurisdiction” to review and approve the proposed combination. Mulvey and Nottingham went on to observe that keeping CP in “limbo” for as long as it takes the STB to rule on the merger could result in “compromised service for shippers, reduced investments in rail infrastructure and network capacity, and disruptions for NS labor interests.” But no one really knows how the STB will react to CP’s voting trust plan — the 2001 merger rules have never been used.

NS formally rejected CP’s revised proposal on Dec. 14. CP volleyed back a second revision on Dec. 16, adding to its compensation package a “contingent value right”—essentially an IOU from CP, whose value depends on the stock price of the CP-NS holding company. However, anticipating NS would reject this iteration as well, CP hinted its next conversations would be directly with significant NS stockholders.

Bill Ackman, whose Pershing Square Capital Management mounted the proxy fight that ousted CP’s board and management in 2012, admitted in the Dec. 8 investors call that most of the merger synergies are “management based, not consolidation based.” In fact, Ackman allowed, NS’s lagging returns create an “ideal activist situation,” and he would be buying NS stock himself except for the legal restrictions he has as a CP director. One certainly gets the impression that this deal is less about creating a visionary transcontinental railroad than cleverly letting Ackman move in on NS before some other activist investor does, and giving the 71-year-old Hunter Harrison a chance to work his financial and operating magic on an underperforming Class 1 one last time.

And did anyone notice the last line in the 6th paragraph above, of "diverting traffic from competing carriers"? Doesn't sound line "enhancing" compettion to me, hopefully the STB and Transport Canada likewise will smell a rat …

Harrison and his men would gut NS of everything they can. Every bit of history, programs, special equipment would be done if he can get away with it. Competition is one thing but trying to get down to two railroads does not benefit either country but only the money men at this point.

The outsized egos of Harrison and Ackman – as well as plain old looking to make a buck – are getting in the way of the fact that all railroads have a much bigger fish to fry … implementation of PTC. If the folks at the STB are smart, they will place a moratorium on mergers, or consideration of them, until after December 31, 2018. They placed such a moratorium after the mergers/consolidations and service disruptions of the late 1990's, they can do so again, and should.

Lawrence makes a good point that KCS would be a logical partner for either railroad. How about a CP-NS-KCS combo?

Regarding traffic between CP and NS, I would think that crude oil from North Dakota would be in the mix as well.

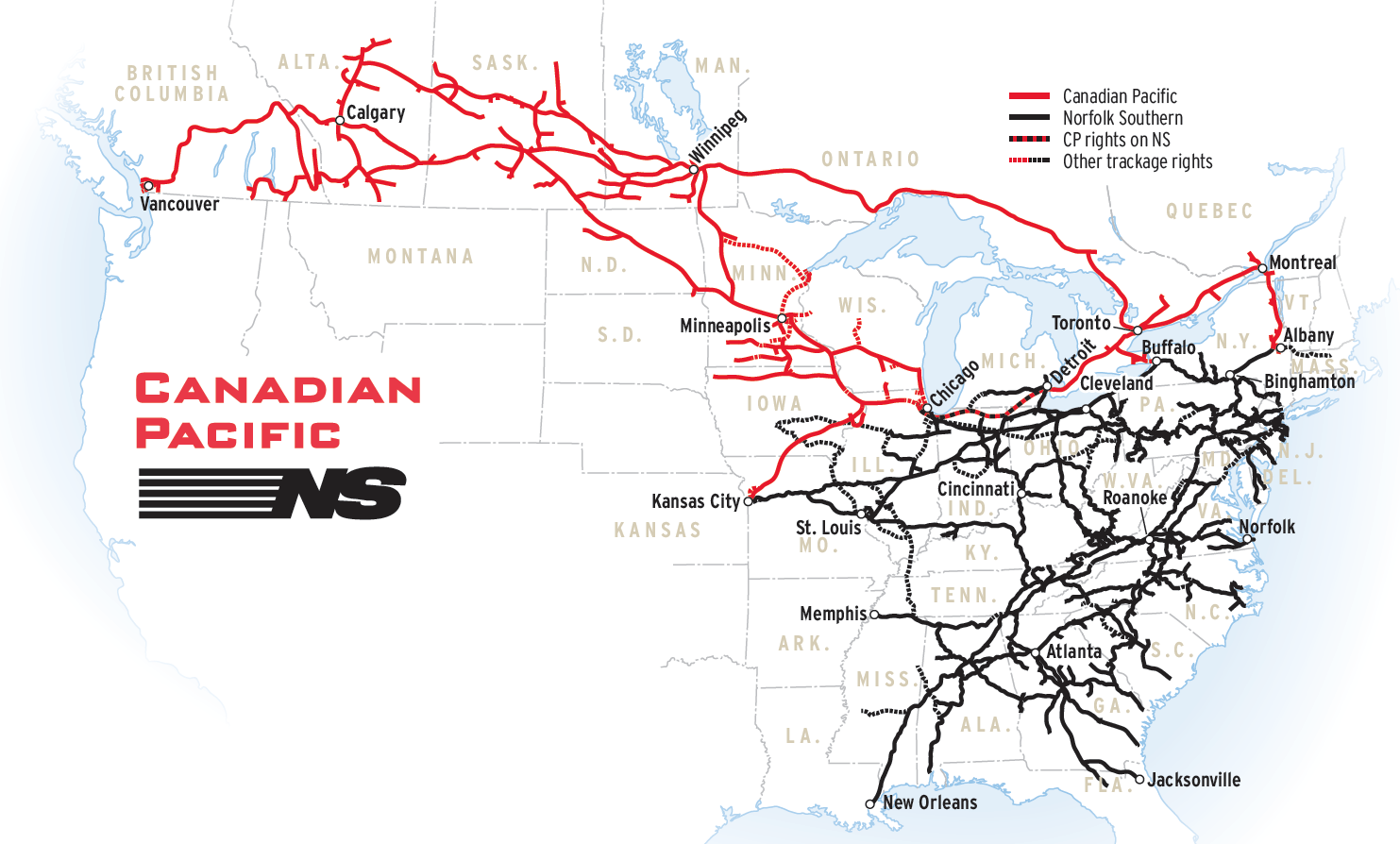

Looking at the map, I do see a possible Chicago bypass as well. NS is using Iowa Interstate to reach Des Moines and at least some of this traffic moves through Peoria rather than Chicago. I see NS trains heading to/from Iowa Interstate in Peoria regularly. Iowa Interstate forms a convenient connection between NS at Peoria and CP at Davenport. Iowa Interstate could also shorten CP's Chicago-Kansas City line, which could be significant if KCS were in the mix.

I would enjoy seeing more traffic though Peoria as NS/CP route traffic on the Iowa Interstate by trackage or haulage rights. I have enjoyed watching Iowa Interstate prosper, having also had to watch The Rock die.

Lawrence is right. Traffic between NS and CP is limited to mainly lumber, grain, fertilizer and potash. If NS merges with any other RR then there has to be a case for Domestic Intermodal benefits as that is where the future of Railroading is.

CP taking KCS north/south line and NS taking KCS east/west line makes complete sense. It gives CP a chance to move grain and oil from Canada to Houston and it gives NS a chance to move Intermodal seamlessly to Dallas.

As an NS employee I truly hope BNSF steps in to rescue us, at least the former Southern Railway lines of the System. A system where BNSF controls the Southern portion with access to Harrisburg, PA coupled with former KCS trackage between Meridian, MS and Dallas would be an incredible transcontinental Railroad!

Really, Lawrence? Vancouver BC to the U.S. East coast is a "limited line haul at the best?" That's about as far as you can go east-west on this continent by rail.

As for the voting trust deal, notice how eager Ackman and EHH are to put CP in trust and move over to NS? Once they are in position to strip the NS of assets and work their short-term stock windfall strategy, they could care less if the merger is EVER approved. They will only be too happy to spin off the debt-heavy CP on some sucker and feast on the fatted calf one more time.

Regardless how this proposed merger plays out, I don't see the advantages of it. Vancouver, BC to the east coast of the US is a limited line haul at the best. And vice versa. While each Railroad needs to find a new and additional source of revenue, combining them isn't the answer. Each railroad would be much better to merge with the KCS. It would have advantages for each railroad all the way with KCS having a route to the Pacific if it could find a partner to utilize it with. My thoughts only.