The world increasingly expects transportation that’s fast, reliable, and easy. Railroads are slow, unreliable, and complicated.

As a result, they’ve lost market share to trucks and often aren’t even on shippers’ radar.

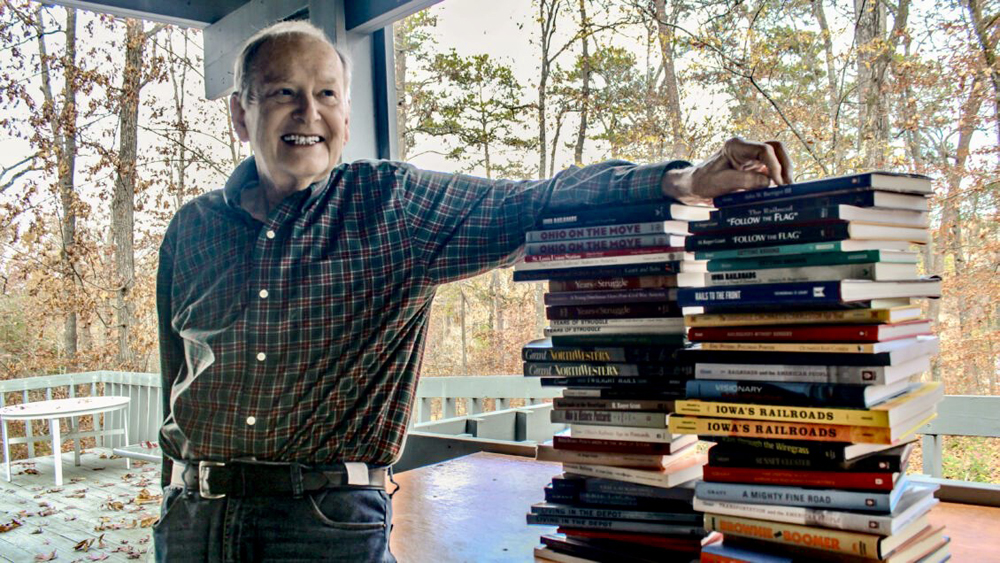

Mike Smith, a Class I railroad veteran who is president of the Finger Lakes Railway in upstate New York, summed up the situation while accepting the North East Association of Rail Shippers Person of the Year Award on Wednesday.

Smith lamented the lack of rail service to three new Ohio facilities, warehouses for Heinz and Campbell’s Soup and a Pratt Industries paper mill.

“We were not even considered. We weren’t in the equation. Nobody thought about rail as an option, even though these are the perfect commodities for us to be handling,” Smith says.

And that’s a major problem.

“If we’re not considered to be relevant … we really have no future,” Smith says. “That’s what I’m paid to worry about. I worry about it. I hope you worry about it. Because as railroads, what we need is the support of customers, many of you here in attendance today.”

John O’Bryan, senior vice president of business development and integration at railcar manufacturer The Greenbrier Cos., says it’s “disturbing” when railroads are not considered to move commodities like canned goods and paper. Boxcars are a much more cost-effective way to move heavy products, he says.

Michael Miller, president of Genesee & Wyoming’s North American operations, says the company’s shortlines regularly conduct sales blitzes that involve making cold calls on potential customers within a 50-mile radius of their tracks.

“The vast majority of those people don’t have a clue what a railroad is,” Miller says.

The biggest challenge, he says, is getting potential shippers to even try rail.

Shippers who rely entirely on trucks often don’t know the difference between a boxcar and a domestic container, according to a sales rep for a Class I railroad.

Arthur Adams Jr., vice president of sales and customer engagement at CSX Transportation, pointed to rail’s declining market share. In World War II, railroads hauled 85% of all freight. Now market share has dwindled to just 8%. And over the last decade, rail’s share has declined every year.

“Other modes are eating our lunch,” Adams says.

“The challenge is what are we going to do about it? I think the key is customer engagement and customer experience,” Adams says.

If you need a truck, you simply call the trucker, who will show up on time and deliver on time, Adams notes.

“If a customer wants to do business with a railroad today, I would argue it’s probably a painful exercise,” Adams says.

If you need rail service, you have to apply for credit; find out who to speak with at the railroad; decide whether to own, lease, or use railroad-owned cars; learn how to properly block and load a railcar; and understand demurrage policies.

CSX is focused on making the railroad easier to do business with, Adams says. It’s providing better data for customers, simplifying customer touchpoints, developing a sales force that can educate customers, and is aiming to become more of a supply chain partner.

Companies spend $1 trillion on transportation in North America every year.

“If we could peel off just 1%, think about the impact,” Adams says.

Peter Swan, an associate professor of logistics and operations management at Penn State Harrisburg, says the industry trend toward Precision Scheduled Railroading operating models won’t help.

Minimizing assets like crews, locomotives, and freight cars limits railroads’ ability to maintain current traffic levels, much less grow, Swan contends.

“It’s clear railroads don’t want all the traffic they have,” Swan says. “Just the most profitable business.”

But independent analyst Anthony B. Hatch pointed out that the fastest-growing big systems are Canadian National and Canadian Pacific, both of which are further ahead on Precision Scheduled Railroading than their American counterparts.

I’m going to go out on a limb here and guess that the shippers who don’t know about railroads, etc., are the younger generation. Whether the railroads like it or not, there will be more and more of these people in decision-making positions among shippers. The railroads need to learn how to use social media, yes, social media, as part of their outreach programs. And create shipper-friendly apps that run on phones, similar to what the airlines have done.

AND, it means training their salesforces to use these apps. And it means hiring social media-savvy people in marketing and sales. As a rough model to follow, look at how the airlines have evolved from using travel agents issuing paper tickets 20-30 years ago. A good counter-example is the recent failure of the UK company Thomas Cook, which failed to evolve.

I like the idea of the independent companies and would/could be a part of open access. In either case, it is not going to happen given the current political environment and Class 1’s resistance I am sure . The railroad industry in the U.S., is a closed business and shrinking vs the freight market in general. The industry needs a shake up and PSR is not the answer.

Open access: This is sheer fantasy, but what if independent switching companies were able to contract with a Class I railroad to provide way freight service over defined territories of the Class I’s line? With sufficient coordination and cooperation (that’s the fantasy part) the Class I would get additional cars to haul long distances while the local first/last-mile company provides the small-business-style customer service.

In my years of driving, one thing that management at my company said time and time again, the customer is who decides what is needex. And providing services to the customers is what we did.

I can think of any number of times I did something extra for a customer to make their life easier. And the customer remembers. I read of UP customer who is going to the STB to get service. What does it say that you cutoff customers.

Railroads are kind of sad, so much potential.

As I’ve said before, I ain’t no expert just a worn out truck driver.

It could easily be that railroads have become irrelevant in the 21st Century.

Let’s look at the history. Railroads were developed in order to provide transportation in a time when the alternatives involved either walking, or a horse. The concept of the train, with a large locomotive powering a consist of many cars loaded with goods from multiple shippers, arose from the structure of the steam engine, which at the time was a large affair and the use of which was feasible only for large shipments. With these large shipments, given the technology of the time, a fixed-path guideway makes sense, even given that at the endpoints the goods will have to be transshipped to other means of transportation, for delivery to their ultimate destinations.

Fast forward to 2019.

The great strength of railroads is that it can be cheaper for long-haul shipments. The great weakness is the need for an expensive fixed-path guideway, necessitating transshipment of goods at both ends.

The great strength of trucking is that it is point-to-point. There is no need to transship the load from one means of conveyance to another. The great weakness is that it is manpower intensive, and that it is generally more expensive for long-haul than rail.

In the last sixty years a complete global transport system has been built up on the concept of fast transshipment, using modularized containers. The 20-foot container (or TEU) is the workhorse of the global freight industry.

We have seemingly a problem in North America that the railroads do not want business, or want only select business. I cannot tell you why.

We should look at other economies to see how they are handling railroad freight traffic. What percentage of goods in, for example Europe, moves by rail as opposed to truck? How about South America (although not an integrated market), or Australia (which is). Is this percentage higher or lower than in North America, and if so (and in either direction), what is the reason?

Ideally, a railroad in North America should be happy to ship any TEU which shows up in their yard. My perception is this is not the case. Is this simply my perception or is it true? We need data. If it is true, perhaps we need third-party freight aggregators to intercede between the shipper and the carrier. If it is not true, then what am I seeing?

Rail has use as a backbone technology but it has to be properly applied in order to survive. The days of the “Customer be damned” attitude have gone, and such an attitude is a sure ticket to failure given that there now exist goods transportation alternatives which did not exist a hundred years ago.

The above comments are generic in nature and do not form the basis for an attorney/client relationship. They do not constitute legal advice. I am not your attorney. Find your own damn economic parasite.

For railroading to succeed in the 21st century in my opinion, I believe the system needs more open access, perhaps government ownership of much of the ROW to balance the inherent advantage of the highway system that is funded exclusively with taxpayer money. The railroads, other than perhaps the Canadian railroads and the BNSF are running themselves out of the transportation mainstream. I really don’t think the current management cares as long as the operating rations remain in the low 60’s to upper 50’s. No industry can sustain such bare bones operations in the long run.

Mister Landey:

While the TEU is the workhorse of the global transportation market, there is also a ten foot version, of somewhat less than 640 cubic feet shippable volume. Such a container can take eight standard North American pallets, assuming they are not loaded to higher than three feet three inches.

Let’s talk about a hypothetical canned food manufacturer. They would have a need to ship to grocery wholesalers or supermarket chain receiving warehouses pallets of canned goods. This gives each ten foot container eight different kinds of canned goods. However, there is usually more than one wholesaler in a metropolitan area, and if you include receiving warehouses that gives a four-way split on a 2 TEU container car.

Get enough of that – and a railroad amenable to shipping whatever shows up in a TEU in their yard – and you could put together a business distributing these half-TEU containers. Hell – I might even do it myself, just to get out of the office.

This is a manifestation of the “last mile problem” encountered by telecommunication companies and electrical utilities. It is not the major distribution network which is the problem. Bulk transport has never been the problem. It is getting the good (electricity, com, canned goods) from the end of the bulk transportation network to the end user.

Solve that problem, and then use a tactical thermonuclear device on railroad management (to get their attention) and you might get through to them that there is a profit centre here they are ignoring.

Now, I can see their objection to handling case lots and the like – but a 10 foot container, with a bunch of its friends, becomes something that becomes worth considering.

On the subject of coal in the UK. The British are trying to get away from coal. They don’t want the pollution. So it surprises me not that you did not encounter any coal shipments while visiting in 2012.

The above comments are generic in nature and do not form the basis for an attorney/client relationship. They do not constitute legal advice. I am not your attorney. Find your own damn psycho hose beast.

ANNA – When I went to England in 2012 I was told wagonload cargo is extinct. Unit freight trains carried finished autos, aggregate, COFC and concrete castings for London’s building boom. I assume also coal, though I didn’t see any. Meaning all chemicals, food, animal feed etc etc was carried on what the Brits call “roads”.

All good discussion points. The railroads are losing market share now due to the changing nature of industry and distribution. The railroads have not been prepared for the change because the legacy industry of coal and other bulk commodities propped up a lot of their finances. Too, I do not buy into the theory that railroads cannot make money on short hauls. The FEC has shown the way for many years that a railroad can be flexible and market sensitive with regional intermodal service. The big problem is that the railroads have pocketed the cost savings vs passing on some of those saving to its customers in pricing and or expanding lower marginal freight. It is the choice of the railroads and freedom to an extent that they collectively can do mostly what they wish, but the result is more trucks on the highway. Furthermore, the railroads are a difficult industry to deal with vs calling for a truck. The railroads in all the decades of operation have not figured out how to be customer friendly while being able to track freight shipments down to the minute. The railroads being a legacy industry have a lot of issues to deal with. I am afraid that the current crop of executives are only looking out for themselves and WS. It appears that the industry is content on letting market share slip as long as money is to me made on slow moving non-sensitive freight. This is an industry that one time moved most of the mail and express freight. That is mostly all gone now.

Here we go again with Peter Swan. He seems to be the enemy of railroads. If somehow we could return to competition, we might have some hope. One small step would be to remove property taxes on railroads. While we’re at it, lets remove all property taxes. Users of whatever should pay for whatever they’re using. Don’t tell me about schools. Parents should pay for their children’s education. Right now the public schools are propaganda mills. If the children hear about railroads it is about railroads as museum pieces.

Railroads have by virtue of their history, near monopoly, and privileged legal standing some of the aspects of a public utility. As their main goal has increasingly become 60 and now 50% operating ratio the public and their representatives may well consider those privileges. They will scream like a stuck pig. There is little evidence that RRs are willing to face that future.

Mike Smith said, “[W]hat we need is the support of customers.” That’s entirely backward. Customers need the support of the railroad. Railroading is a service industry, and unless railroads actively seek to support their customers with good service, the customers aren’t going to be interested. Period. That’s not rocket science–short lines and regionals know that philosophy is the only thing that keeps them in business–but it’s far from the consciousness of the Class I boardroom. So frustrating!!

This story would make great study material in any US business school.

Yes, market share has dropped, but ton-mileage is still near all-time highs.

Railroads need not go after every possible traffic source. It all goes back to volume does not equal revenue which does not equal profit.

Just-in-time just doesn’t really work with railroads’ needs to run long trains to keep costs under control, and most volumes are not really suitable for the mass-transit system which railroads really are. Those 30,000 bushels of corn travelling less than 200 miles really belong on trucks, not trains. This quickly eats up most of the market share. Railroads may only hold about 8% right now, but with today’s physical plant, there are probably only one or two percentage points which could even be picked off, and are in the margin for railroads to begin with.

UPS doesn’t haul junk mail and thank-you cards for the same reason the big railroad railroads don’t provide team track or small-customer service anymore. Focus on the profit center.

When I worked for Zenith Electronics I always told people that if you want it cheap but don’t care when it shows up, use a train, if you want it on time, use a truck. They went with train with some critical components and we ended up shutting down productions lines on a regular basis.

Railroads were the backbone of the country. Robert Ash is right, if RR’s were run like they are today during WWII, we would have lost. Read “Trains Go To War” by Classic Trains. It’s amazing the freight & war personnel they handled during all wars. Plus the flexibility they had on the battle field to support troops on the front lines with supplies in a fluid hostile environment. RR execs could learn a lot from the dedication to moving freight during these trying times.

Today it’s about the $$$$$. RR’s purpose is to move freight for their customers in a timely manner. Instead freight cars sit in yards waiting until 200 cars can be assembled into one train and moved by one crew. (At least for now until crews are reduced or eliminated)

If RR’s were truly interested in keeping their customers/shippers happy, they would be moving trains frequently. (I know that means smaller faster trains & more crews. But aren’t trains suppose to be the most efficient form of transport compared to trucks?) In turn customers would be happy and the RR’s reputation as being reliable and easy to use would grow. That in turn would increase their customer base and that in turn would increase $$$$$.

I know I’m simplifying this, but who said success comes easy.

Every single post below (Curt, Robert, Anna, Paul, Michael) is on point, informative, well thought through, and important.

I live west of Milwaukee. For the life of me I can’t think of more than about two customers (ship or receive) in my area on either UPRR or CP Rail. CN has some remaining customers – manufacturers in Waukesha and one or two quarries. Yes there are a handful of remaining rail customers in Waukesha but that city is on the whole a study of rail archaeology of abandoned spurs and sidings.

For example there are three plants in Waukesha (ownership has changed over the years) that manufacture electrical transformers. Not so long ago, all three plants were served by rail. Tank cars brought in dielectric oil, flat cars hauled out finished transformers. Two of the three plants have gone all truck; one continues to use CN.

After a 40 year career as a rail shipper I can state unequivocally the one requirement every rail shipper needs is low to zero expectations. You’ll almost never be disappointed and, on occasion, you might even be delightfully surprised when those low expectations are exceeded.

Really a stunning revelation that the question needs even to be ask however, many commodities have left the railroad for many reasons never to return. When I travel the Interstate highway system, I see many new warehouses being built nowhere near a railroad siding although there could be some intermodal business. Still a bleak picture for the future.

The only customer service the railroads are interested in is pleasing Wall Street. Furthermore, the rr do not have the sales and support staff to expand its once formidable position in the shipping industry. Had the railroads been run in WWII like they have been over the last decade, we would have lost the war. The railroad management is stripping assets and filling its pockets as the industry diminishes. Clearly a sad commentary. As to major companies not looping the railroads in on warehousing and production facilities, when is the last time a railroad executive or sales team contacted these firms? The railroads have been all talk and not go for decades now. Read in November Trains Fred Frailey’s account of railroads executives pursuit of business in the 60’s vs the hands off approach of today. It says it all. Other than the BNSF, the majors rr’s here in the U.S. ought to be bought out with new ownership that has vision and expansion. The highways are clogged with the railroads retreat in the shipping business while the STB has stood around with its hands in its pockets. How is that for the public’s interest.

Also add: it takes time to get a rate quote. Lots of time if you’re not a big shipper.

There are a lot of dynamics to this puzzle though. Energy policy and energy cost isn’t standing still and is shifting – possibly titanically – and will affect the cost v. time tradeoff and could affect next day supply chain logistics profoundly.

Same with manufacturing near-shoring (e.g. Mexico) and even reshoring (which again depends on energy policy).

Same with the ability to sustain a purely consumer driven economy and demographic change.

Stay tuned.

But regardless railroading has to adapt and become simpler to use and more reliable in the service product. So-called PSR (better asset utilization and capacity created with fewer train starts) could be part of the puzzle but not IMHO when profit is solely reallocated to shareholders or maintaining existing plant, but ALSO invested in bottleneck removal.

When I first started this nonsense we were expected to keep a 30 day supply of all components on site, in order to keep production going even with shipping disruptions. But that is a lot of money to tie up in stock. Even for the industry I am in, where if we make 20 of anything in serial production it is a major production run. Of course, at 20 mil a pop, this adds up fast. Just-In-Time manufacturing cuts the inventory cost (on which you have to pay interest, storage charges, and inventory tax, to name a few), but requires absolutely reliable shipping.

Our products are big enough that we would love to ship in and out by rail. But, our customers have the same problem (although they are generally end users). They want our equipment to show up exactly when it should, or they have to idle an expensive workforce. But rail is not reliable and is not convenient and is therefore not an option. We ship by truck, frequently by barge, and have been known to charter 747 cargo aircraft for single-unit pieces that we just can’t ship by truck.

This actually has an impact on how we design. We have to keep the subassemblies within a gauge envelope (involving weight) suitable for shipping by truck. If we could ship by rail (and know it would be picked up on time and delivered on time and without tripping the G-sensors) we would design our subassemblies differently.

Alternate methods of shipping (air, truck) are more damaging to the environment than shipping by rail. They also cost more – in some cases, a lot more. But they are reliable. Rail is not. End of rant.

The above comments are generic in nature and do not form the basis for an attorney/client relationship. They do not constitute legal advice. I am not your attorney. Find your own damn iconoclast.