Harrison’s efficiency-driven operating model has since spread to Union Pacific, Norfolk Southern, and Kansas City Southern, making additional workforce reductions likely through the end of 2020.

Overall railroad employment tends to ebb and flow with traffic volumes. But now the Class I systems are moving more traffic with fewer people: U.S. rail traffic was 24% higher in May 2019 than it was in February 2017, according to Association of American Railroads data.

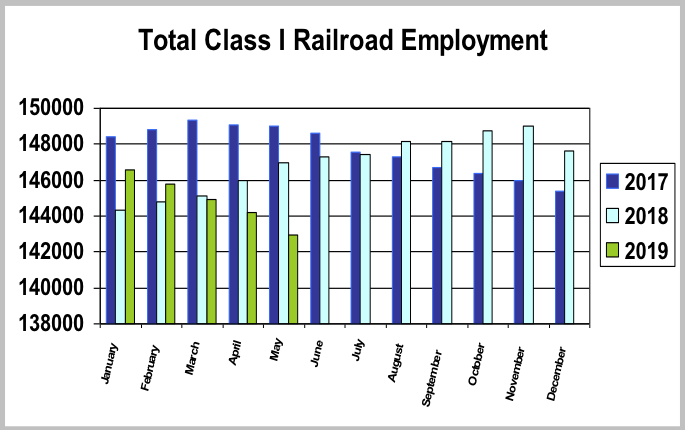

A review of railroad employment figures compiled by the U.S. Surface Transportation Board through May 2019 shows the impact of PSR.

CSX’s total employee headcount is down 18% since it adopted Precision Scheduled Railroading in March 2017. In contrast, overall employment at eastern rival Norfolk Southern is down 8% over the same period.

At CSX, the biggest hit was to executives, officials, and staff assistants, whose numbers fell by a third. Not far behind: A 29% reduction in professional and administrative staff. Some of those cutbacks, however, were launched by CEO Michael Ward just before Harrison arrived at the railroad’s headquarters in Jacksonville, Fla.

The number of maintenance-of-equipment workers at CSX fell 22% as the railroad reduced the number of its car and locomotive shops and scaled back operations at some of its remaining shops.

The number of train and engine crews at CSX fell 16% as the railroad operates fewer but longer trains.

The CSX maintenance-of-way headcount is down 11%.

Last fall, NS announced it would gradually adopt a PSR-based operating plan. Since September 2018, overall headcount at NS is down 5%.

The biggest drop since September has been an 11% decline in executives, officials, and staff assistants. The number of professional and administrative staff fell 7%.

Transportation department employment other than train and engine crews is down 9%, while the number of train crews has declined by 6%.

Maintenance-of-way and mechanical employment both have held relatively steady.

NS expects its headcount to drop by 3,000 positions, nearly all of it through attrition, by the end of 2020 as its locomotive fleet shrinks by 500 units and it, too, moves tonnage on fewer but longer trains beginning in July.

A loss of 3,000 positions would be a decline of 12% from current levels.

Union Pacific’s total headcount is down 7% since September, the month before it began shifting to an operating plan based on principles of Precision Scheduled Railroading.

The biggest reduction — a drop of 17% — has been to the mechanical forces that maintain freight cars and locomotives. UP has closed several car and locomotive shops and scaled back the operations of others across the system as it operates with fewer locomotives and freight cars. At the end of April, UP had more than 2,100 locomotives in storage.

The number of executives, staff, and assistants is down 11%, while professional and administrative staff has been reduced 12%.

UP’s train and engine crew headcount is down 3%, which is roughly in line with the decline in carloads so far this year.

Maintenance-of-way staffing is down 2%.

And what of BNSF Railway, the lone Class I railroad not adopting PSR?

BNSF’s employment levels have held relatively steady since UP shifted to Precision Scheduled Railroading.

BNSF had 43,335 employees in mid-May compared to 43,711 in mid-September.

The number of BNSF train crews has fallen 3%, roughly in line with the 4% drop in traffic volume this year.

Since February 2017, employment has risen on the U.S. operations of longtime PSR railroads Canadian National and Canadian Pacific. Employment on CN’s American subsidiaries is up 14%, while headcount on CP’s Soo Line subsidiary is up 6%.

Employment is up slightly on the smallest Class I railroad, Kansas City Southern, since 2017. KCS also is in the early stages of adopting an operating model based on the principles of Precision Scheduled Railroading.

John and Brett.. Let the Shortlines market and handle the carload network. To me that seems about the right path since the Class 1’s don’t want to handle the expense of operating it. Shortlines can grow the traffic the Class 1’s don’t bother with. Class 1’s give the Shortlines open access let them operate locals and the entire carload network, switching, humps, marketing.. Progressive Rail, WATCO, etc plenty out there to do it.

Curt: Good question. I did not drill down for the traffic figures for the individual Class I’s pre- and post-PSR.

But in 2018 they were all pretty much right around 4% traffic growth, with the exception of 1.5%-ish growth for CSX.

In 2017 CN was up 10%; BNSF, KCS, and NS were up 5%; CP was up 4%; UP was up 2%; and CSX was flat.

Rich, according to AAR data U.S. railroads originated 2.1 million carloads and intermodal units in February 2017 compared to 2.6 million carloads and intermodal units in May 2019. Some seasonality in those numbers, for sure, along with the impact of the weird “freight recession” that was going on in 2017.

The railroads are a shrinking industry regardless how they make money. The are not interested in market share or how to make money on shorter hauls.

American railroads are trying to put themselves out of business as they drive away customers. Well done hunter!!!!!

@Jim Norton: Changes in tariffs and US trade patterns have more to do with traffic demand for US Class 1’s.

By spinning off so much local business over the years because it wasn’t strategic, they have tied their business closer to the what the international trade markets are demanding.

Less trade, less traffic.

Why do you continue to show this unflattering photo of Mr. Harrison?

Yet, the Class Ones continue to fail in surpassing 2018 traffic levels.

Bill; just curious but, how much of the 24% increase in volume from February 2017 to May 2019 is on BNSF, CP and CN in the U.S.?

Hunter Harrison started PSR? Wow I never would have known.

Braden, I think you’ve nailed it, contract out all the peripheral work leaving the class 1’s to operate trains only.

My initial thought was since they have cut costs & employees along with being more efficient, maybe it’s time to expand gaining more customers and hiring agents like the old days to find those customers & keep the ones they already have.

But in this day of cut, cut, cut, that wouldn’t make sense. Look for RR’s to implement your idea Braden. Your name will be said right next to Hunter Harrison. Better copyright your plan now.

Please someone show me the 24% increase between Spring 2017 and Spring 2019, that this article is citing?

https://www.aar.org/data-center/rail-traffic-data/

Youre right, Braden, contracting don’t have to pay RR Retirement, So less RR Retirement on Class I the more $$$ Class I’z make, Its comin, just like it came to US Govt. Govt contracts increased HUGE since the early 90z. I know that PERSONALLY!

Didn’t finish my statement.. As railroads transition into intermodal. Expect to see more line spinoffs. One goal of PSR looks to move more or most of whats left of carload traffic onto the shortlines.. Yet if they don’t care for the expense of operating the carload network. Why not just contract shortlines to operate all hump yards and flat switching? Class 1’s can just handle the linehaul. While we are at it. Let them build trains at your intermodal ramps as well?

PSR runs what’s left of the carload business as efficiently as possible.