The refinery, which suffered damage in a massive fire last week, is the largest on the East Coast. The refinery’s owners announced this week that the 153-year-old complex along the Schuylkill River would be shut down.

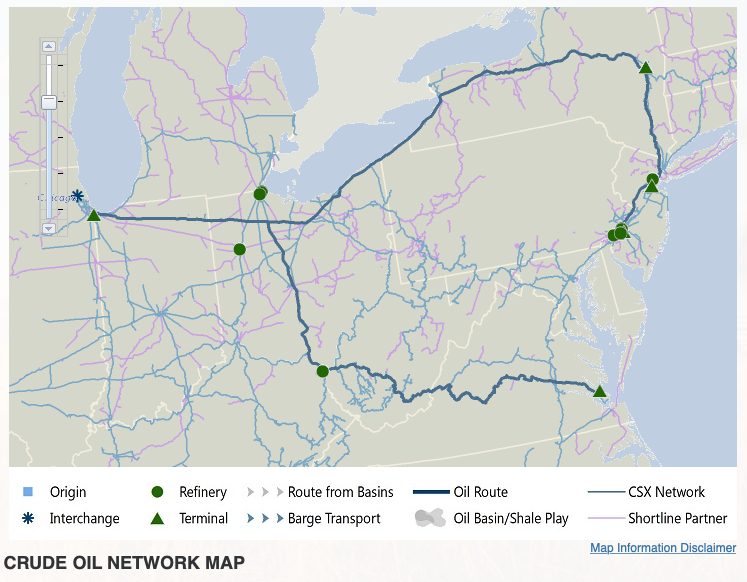

The Philadelphia refinery received unit trains of crude oil that originated on BNSF in the Bakken oil field of North Dakota and were interchanged with CSX in Chicago.

Petroleum and petroleum products traffic on CSX, the category that includes crude oil, was up nearly 14% this year through June 22, according to Association of American Railroads data. BNSF is the largest hauler of crude in the U.S.

The refinery, which dates to 1870 on a site that has been used to store refined products since 1866, was capable of receiving two 120-car unit trains per day. The 140,000 barrel capacity of two trains represented 40% of the refinery’s capacity of 335,000 barrels per day.

In 2013, Philadelphia Energy Solutions spent $186 million to build a rail terminal that includes 5.6 miles of track and a high-speed unloader. Pennsylvania contributed $25 million to the project.

At the time of the first crude-by-rail boom, the refinery was the largest single destination for oil produced in North Dakota.

The rail unloading terminal was built just a year after the refinery complex emerged from bankruptcy under new ownership, a partnership between The Carlyle Group and Sunoco.

Last August, Philadelphia Energy Solutions emerged from a financial restructuring after which Credit Suisse Asset Management and Bardin Hill became majority owners and took control of the business. The Carlyle Group, Energy Transfer Partners and other investors own a minority stake.

“The recent fire at the refinery complex has made it impossible for us to continue operations. We are grateful that the fire resulted in only a few minor injuries,” Philadelphia Energy Solutions CEO Mark Smith said in a statement. “We are committed to an orderly process to safely wind down our operations.”

Energy analysts were not surprised by the decision to close the refinery, which had slim profit margins and was not particularly sophisticated.

When it comes to geo-political oil I think everything is a conspiracy. I would guess the problem with Philadelphia was that it was too productive and therefore was beating the price of the Gulf Coast finished product. Once Keystone Pipeline is operable that North Dakota oil will go straight southwardly and be mixed with WTI at Cushing OK. The North Dakota/ Albany NY to Philadelphia connection had become a rogue producer competing with Cushing. It had to be eliminated. Somebody lit a match and solved that problem.

Chris Duprey, you really ought to get out more often. We’ve been upgrading and adding refinery capacity along the Gulf Coast for the past 15 years now. Fuel prices are down and have been for the past 10 years.

The former Union Oil refinery (originally Globe Oil, then Pure Oil) was rebuilt in the 1980’s after a devastating fire and explosions which destroyed much of the industrial complex and killed nearly 20 people. It continues to operate today by owner, Citgo.

Marginally profitable? Watch gas prices skyrocket now. I don’t think we’ve added any new refining capacity in the past 40 years. They just keep closing refineries & raising fuel prices to make more money.

With oil prices hanging low, it was like clockwork that some refinery would either blow up, catch fire, or shut down for some unannounced long term maintenance.

Just like the decrepit Clark Refinery (Premcor) that blew its top in Blue Island, Illinois in 1995, just like the Union Oil refinery explosion in 1985 in Romeoville, Illinois. These old refineries just get sold, over and over until it finally blows its top from lack of maintenance.

Same as the “knuckle-heads” that run their Amtrak trains off the tracks but somehow are not to blame. The perceived blame lines with the employment equivalent of “their upbringing”.

All due to some knuckle-head “accidently” releasing hydrocarbon vapors inside the plant. After seeing some video of the fire, it is a real shame that one little mishap caused so much destruction at the plant and for other employees.

No surprise here. Cheaper to close it and move operations elsewhere than to rebuild.

I do feel sorry for those 1,000 or so employees at the refinery that are going to lose their jobs.

The present owners and other responsible parties are obligate to clean it up by environmental law. A superfund site is one where responsible parties can’t be found, or are bankrupt..

Joe Birts, it will become an EPA Superfund site, just like all toxic land areas become…that’s just how it works.

So who will pay for the cleanup of the site? It’s bound to be highly polluted and will take years & multi-millions to clean up. Gas & diesel prices have gone up and I’ll bet the taxpayers get stuck with the clean cost. Maybe CSX & BNSF will get some additional carloads, carrying off the polluted soil and parts.

Another thing. This is off topic, but what are the chances of CSX abandoning the Sand Patch? I’d say it’s about 50/50 at the moment…

Oil’s right behind coal anyway. Might as well start the slow phase out now…