CP carried 6% more carloads in the quarter, led by double-digit gains in its potash, forest products, and energy, chemicals and plastics business segments.

The only CP traffic segments not to grow were coal, which was flat, and metals, minerals and consumer products, which was down 3.5%, according to a review of Association of American Railroads weekly carload data.

Canadian National was the other big system to gain traffic in the quarter. Its carloads were up 1%.

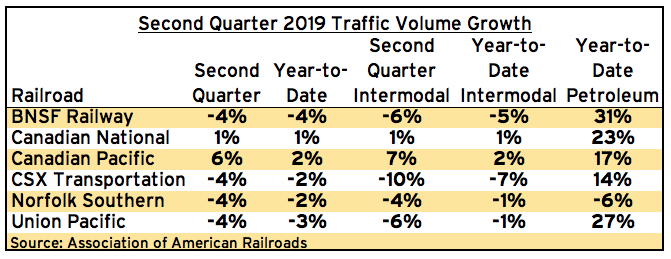

The second quarter traffic figures continued a trend of Canadian volumes outpacing rail traffic in the U.S.

The four big U.S. railroads — BNSF Railway, CSX Transportation, Norfolk Southern, and Union Pacific — all saw their traffic dip by 4% in the second quarter, according to AAR carload reports for the week ending June 29.

Intermodal traffic, which accounts for about half of all rail shipments in North America, was up in Canada and down in the U.S. during the second quarter.

CP’s volumes grew 7%, while CN was up 1%.

In the West, BNSF and UP’s intermodal volumes were down 6%. In the East, NS intermodal volume was down 4% for the quarter, while CSX intermodal traffic was down 10% due in part to the pruning of lower-density intermodal lanes.

A bright spot for five of the six systems this year has been the rise in shipments of petroleum products, the AAR category that includes crude oil.

For the first half of the year, petroleum products volume was up 31% on BNSF, 27% on UP, 23% on CN, 17% on CP, and 14% on CSX.

Petroleum products traffic on NS is down 6%.

The publicly traded Class I systems will release final second quarter traffic tallies during their earnings calls this month. BNSF, a unit of Berkshire Hathaway, is expected to release its quarterly results alongside its corporate parent early next month.

CP has lost so much business to CN over the last 20 years that it is easy to say that they are now seeing an increase due to them attempting to become more competitive.