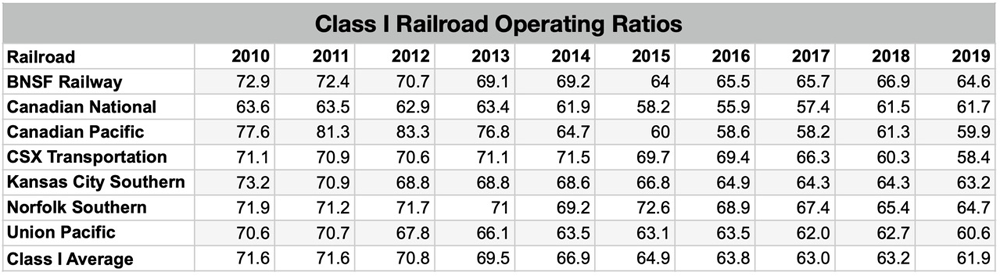

The operating ratio at every Class I railroad fell below 65% for the first time in 2019 as the industry average improved to an all-time low of 61.9%.

The increased profitability came as overall industry revenue was down 2.3% and four of the seven Class I systems reported lower revenue. This means the operating ratio improvement was due to the industry making productivity gains and cutting costs by more than the decline in revenue.

CSX Transportation, at 58.4%, won the operating ratio crown for the second year in a row and became the first U.S. railroad to post an operating ratio below 60%.

The operating ratio measures the percentage of revenue that’s consumed by operating expenses. The industry average operating ratio improved 3 points in the past five years and 9.7 points over the past decade, according to a Trains News Wire analysis.

Independent railroad analyst Anthony B. Hatch, who coined the term “Cult of the Operating Ratio” for Wall Street’s hyperfocus on the efficiency metric, says Precision Scheduled Railroading has made the industry far more productive.

The six railroads using the late E. Hunter Harrison’s Precision Scheduled Railroading operating model are moving tonnage in fewer but longer trains, meaning they don’t need as many crews, locomotives, and freight cars — or as many mechanical forces to maintain smaller equipment fleets.

Class I railroad employment in the U.S. reached record low levels in 2019 due to the combination of a traffic slump and PSR operational changes. Overall, Class I rail employment fell 11% last year, according to railroads’ regulatory filings with the U.S. Surface Transportation Board.

The continued decline of coal traffic, along with a freight recession tied to trade and political uncertainty, posed a “confidence check” in the industry last year, Hatch says. “And yet the railroads are in really good financial condition,” he says.

The lower operating ratios put railroads in a better position to make investments in technology in an effort to catch up to the trucking industry, Hatch says. And the increased profitability also means railroads should be able to make investments that can help make continued service improvements, he says.

But there is a danger in pushing operating ratios too low.

“We’re beginning to think that an operating ratio of 60 or slightly below might be optimal,” Hatch says.

Go much lower, Hatch says, and a railroad may become so efficient that it does not have capacity for growth and could wind up chasing away business — all while raising the risk of regulatory intervention from an increasingly active Surface Transportation Board.

Canadian Pacific’s operating ratio was 59.9% last year, and Union Pacific is on track to join the sub-60% operating ratio club this year. Its operating ratio was below 60% for the final nine months of 2019 and stood at 60.6% for the year. UP has a long-term operating ratio goal of 55%.

A better measure of a railroad’s financial success, Hatch contends, is return on invested capital, or ROIC. UP and Canadian National reported ROIC in the 15% range last year, while CP’s was nearly 17% while growing its intermodal business in Canada, Hatch notes.

Intermodal has a relatively low profit margin compared to carload and bulk freight — which can be a drag on the operating ratio. But it makes a positive contribution to ROIC, Hatch says.

Quick Question people wasn’t PSR suppose to be the answer to the class one railroads right , well the answer is no its a BOMB its a farce . Ok fine longer trains not as many crews , but it takes more man power to put these 200-300 car trains together also these longer freights don’t fit in the yards in their final destinations ,so more man power to break them apart . You are also pushing the limits of the Engines , I have seen 5-7 engines in a constent smoking cranking to make power to get to speed , this will lead to more brake downs you will see . Go back to the old ways shorter trains ,make faster trains and the workers will be happier , and maybe the stock price of CSX might go back to where it was before PSR was put into place not TANK to where it is now !

Revenue is directly generated by business. With no more business and in fact less business the only overhead left to cut to lower the operating ratio is upper level management pay. Nah that will never happen.

All of you are correct. If PSR is so good, where is all the business they should be capturing? Most new technology to be employed will eliminate more railroaders.

CSX record OR meanwhile the day to day operations go to he—! case in point this week in Tampa FL CSX closed six(6) crossings in downtown Tampa, with next to no warning to the city. Closing for “emergency ” maintenance all at the same time. It created a monumental traffic jam for days!!!!! Photos of the crossings, shown on local media showed crossings in deplorable condition! But who cares about the customers and traveling public ,when the OR is at a new low and the stockholders are happy.

Why aren’t some of the savings being passed on to the customers in the form of lower rates?

We are witnessing the death of an industry, all by its own stupid actions. Now we understand why railroads got regulated in the first place.

I wonder when the CEO will start talking about maximizing long term profits instead of minimizing operating ratio.

Chase away all your customers and scrap every piece of metal you can find. Sound like a good long term plan. Why exactly do railroad need customers anymore. They’re just a drag on the stock price. No problems there. Just borrow billions to buy back shares.

Nothing against Anthony Hatch but would it be too much of a burden to reach out to other analysts for the opinion? Oh, and for the record, PSR blows chunks too.

I totally agree with Gregg it is amazing that they are all hoping to hit Zero.Then maybe we can all enjoy driving with nothing on the interstates with nothing but semis.

Hooray for the race to the bottom!!!

The Class 1 with the operating ratio of ZERO wins the game! Bonuses for all the executives! No customers, no problem!

The Class 1’s are trying hard to become Sears and KMart. Cost cut their way to oblivion. So far only BNSF hasn’t joined the religion whole hog, but even Warren is taking heat for it.

I have yet to see a Class 1 partner with a master commercial developer, (for example: Hillwood) to offer a “service”. Or least I haven’t heard of any recently.

All of these new large scale industrial parks are being built domestically with no rail service. Some not even close.