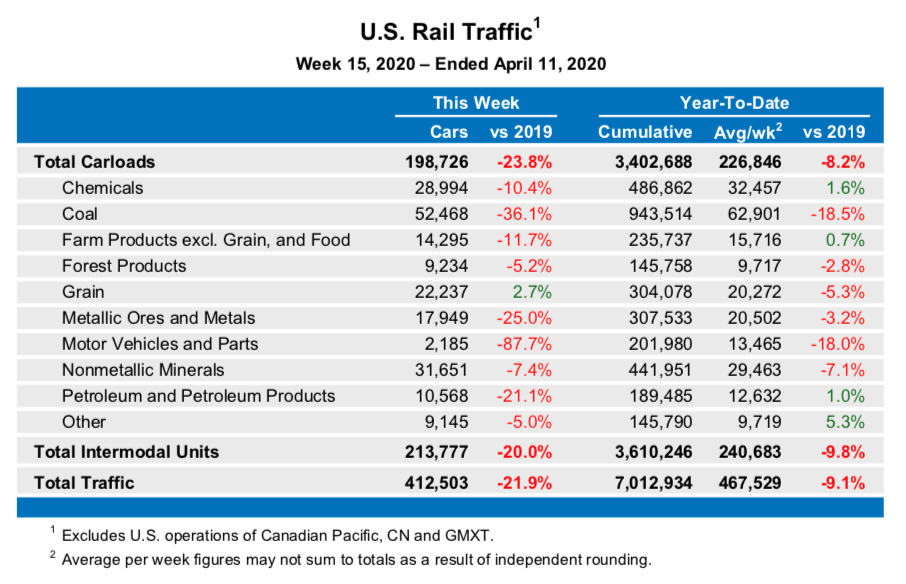

For this week, total U.S. weekly rail traffic was 412,503 carloads and intermodal units, down 21.9% compared with the same week last year.

Total carloads for the week ending April 11 were 198,726 carloads, down 23.8% compared with the same week in 2019, while U.S. weekly intermodal volume was 213,777 containers and trailers, down 20% compared to 2019.

One of the 10 carload commodity groups posted an increase compared with the same week in 2019. It was grain, up 595 carloads, to 22,237. Commodity groups that posted decreases compared with the same week in 2019 included coal, down 29,609 carloads, to 52,468; motor vehicles and parts, down 15,521 carloads, to 2,185; and metallic ores and metals, down 5,982 carloads, to 17,949.

“The pandemic is affecting firms in every industry, and railroads are no exception,” said AAR Senior Vice President John T. Gray. “When rail customers suffer a drop in demand for their products, their need for transportation services declines as well, and that negatively impacts rail volumes. That said, railroads are continuing to move massive amounts of freight, including countless essential chemicals, food products and manufactured goods that we need in good times and bad. It’s still too early to say when the current crisis will end, but when it does — and it will — railroads will be ready to ramp up their service to safely, reliably and cost-effectively meet the freight transportation needs of our nation.”

For the first 15 weeks of 2020, U.S. railroads reported cumulative volume of 3,402,688 carloads, down 8.2% from the same point last year; and 3,610,246 intermodal units, down 9.8% from last year. Total combined U.S. traffic for the first 15 weeks of 2020 was 7,012,934 carloads and intermodal units, a decrease of 9.1% compared to last year.

North American rail volume for the week ending April 11, 2020, on 12 reporting U.S., Canadian and Mexican railroads totaled 288,715 carloads, down 21.6% compared with the same week last year, and 291,347 intermodal units, down 18.6% compared with last year. Total combined weekly rail traffic in North America was 580,062 carloads and intermodal units, down 20.1%. North American rail volume for the first 15 weeks of 2020 was 9,666,804 carloads and intermodal units, down 7.7% compared with 2019.

Canadian railroads reported 73,556 carloads for the week, down 13.6%, and 66,088 intermodal units, down 10.6% compared with the same week in 2019. For the first 15 weeks of 2020, Canadian railroads reported cumulative rail traffic volume of 2,116,131 carloads, containers and trailers, down 4.3%.

Mexican railroads reported 16,433 carloads for the week, down 26% compared with the same week last year, and 11,482 intermodal units, down 31.7%. Cumulative volume on Mexican railroads for the first 15 weeks of 2020 was 537,739 carloads and intermodal containers and trailers, down 1.7% from the same point last year.

— From an Association of American Railroads news release. April 15, 2020.

I’ve been railroading for 25 years and even now the class ones are bending over backwards to get rid of profitable business. to be more truck like, they now serve customers maybe once a week if your lucky. not sure how that’s truck like but the CEOs seem to think so.

Unfortunately the railroad industry has “precision scheduled” its way to being irrelevant.

Fujifilm is pharmaceutical manufacturer.

When volumes return the railroads will be ready to ramp up service? I highly doubt it. The class ones have cut so deep that even now they have trains waiting on crews. And they still want to cut more using the waivers and the pandemic as an excuse.