CALGARY, Alberta — Strong traffic growth propelled Canadian Pacific to record revenue and its lowest first-quarter operating ratio ever.

But CP lowered its outlook for the year due to the economic impact of the coronavirus pandemic. It now expects earnings to be flat and revenue ton-miles to be down by mid-single digits compared to last year.

Previously CP projected volume growth of around 5%, with earnings per share growth of around 10%.

Traffic is expected to bottom out in the second quarter, followed by a slow rebound in the third and fourth quarters, executives said.

Amid the economic downturn, CP emphasized its strong balance sheet and said it would proceed with this year’s planned capital expense budget of $1.6 billion. But CP has paused its share buyback program and will hold its dividend at current levels for now.

“Not only can we weather the storm … we will come out on the other side a stronger, more resilient company,” CEO Keith Creel says.

Creel acknowledged the unprecedented nature of the pandemic and its impact on the economy and rail traffic. “There’s certainly no playbook for times like this,” Creel says, noting there will be challenging times ahead.

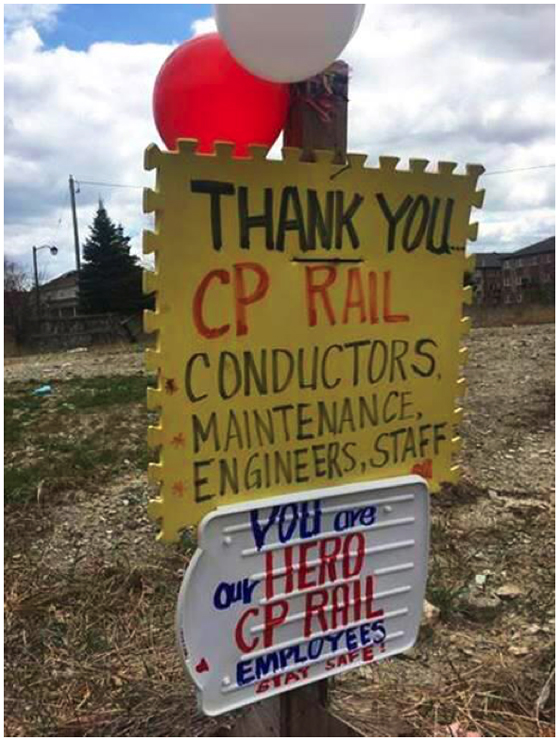

He also thanked CP’s 13,000 employees for keeping the railway moving and supporting the “health and well-being of society.”

So far, April’s traffic volume is down 10% based on revenue ton-miles. CP has responded by reducing train starts by 15% and yard assignments by 18%, Creel says.

The railway has furloughed 800 employees, mostly in train and engine service. To ensure that it can handle growth when volume returns, CP has reached deals with rail labor that will allow furloughed train crews to return to work sooner, Creel says.

In exchange for CP paying certain benefits beyond unemployment, crews have agreed to return to work within 72 hours of a callback rather than the standard 15 days, Creel says.

CP remains confident about its long-term future, executives said, due to growth opportunities across its system, including the pending acquisition of the Central Maine & Quebec, which will give it access to the Port of Saint John, New Brunswick. Within three years, CP expects the line’s annual revenue to grow to $100 million from the current $40 million.

In the first quarter, CP’s volume was up an industry-leading 9% when measured by carloads and revenue ton-miles, the preferred metric of the Canadian railways. The only traffic segments to decline on a carload basis were coal and potash.

CP set an all-time first-quarter record for Canadian grain tonnage, which Chief Marketing Officer John Brooks attributed to better cooperation across the supply chain; moving grain in longer, 8,500-foot trains; and the arrival of the railway’s new fleet of hopper cars.

The new hoppers enabled CP to carry 100,000 more metric tons of grain in the quarter than the cars they replaced, he says.

CP is optimistic about volumes in its bulk network, including grain, potash, and fertilizers.

In its merchandise segment, CP expects crude, ethanol, frac sand, and automotive volumes to decline [see “Crash in oil prices could mean Canadian Pacific crude-by-rail traffic falls to zero,” Trains News Wire, April 21, 2020]. But CP expects slowing auto production and sales to be offset by a new contract with Fiat Chrysler America, which signed on to use CP’s new auto terminal in Vancouver, and new business from Glovis, the logistics arm of Hyundai and Kia.

Although domestic intermodal had a record quarter, CP expects volumes to decline in the short term amid the economic impact of the pandemic. It also expects international intermodal volumes to deteriorate in the second quarter despite the addition of new customer Yang Ming.

The railway’s key operating metrics — including average train speed, terminal dwell, and safety statistics — all improved.

CP’s operating income was up 54%, to $834 million, as revenue grew 16%, to a first quarter record of $2.04 billion. Earnings per share, adjusted for the impact of one-time items, increased 58%, to $4.42.

The railway’s operating ratio improved 1.1 points, to 59.2%. It was the first time CP produced a sub-60% operating ratio in the first quarter.

CN may have had most of the protesters, but CP did get some. For example, around the Montreal area.

John Rice, the CP didn’t have any protesters on their lines, that was CN.

CHINA and JAPAN import SAND.

Recyclables are paving roads.

That picture is quite the contrast to the mobs of protesters just a few short months ago.

I think CP is in the bootlegging business, most of the trains on their old D&H mainline run in the wee hours of the morning from what I can hear from my house — one rocketed pass me in Ballston Lake at 2am last night when I was stargazing down by the lake.