MONTREAL — Canadian National will be ready to take advantage of economic changes that have been accelerated by the coronavirus pandemic, CEO JJ Ruest told an investor conference today.

“Where the puck will be next is going to be increasingly toward the consumer economy,” Ruest says.

“At the same time, when we look three, five, 10 years out, other historical segments of the rail industry in North America — like thermal coal for export, like thermal coal for making domestic electricity, crude by rail — they … are likely to shrink and likely to be less important to our future in the rail industry,” Ruest says.

The COVID-19 pandemic is accelerating trends that were already under way, Ruest says, including a shift of manufacturing out of China and into lower-cost countries in Southeast Asia, the rise of e-commerce, and more automation in many industries.

CN wants to become a bigger player in moving goods to consumers in the U.S. Midwest, Ontario, and Quebec. To do so, CN will use its unique three-coast network — with ports on the Pacific, Atlantic, and Gulf coasts — to take advantage of shifting global trade patterns.

Ruest says CN’s partnerships with ports in Eastern Canada, including Halifax, Nova Scotia, Quebec City, and Montreal, will help the railway handle more international intermodal business that comes to North America from Southeast Asia via the Suez Canal.

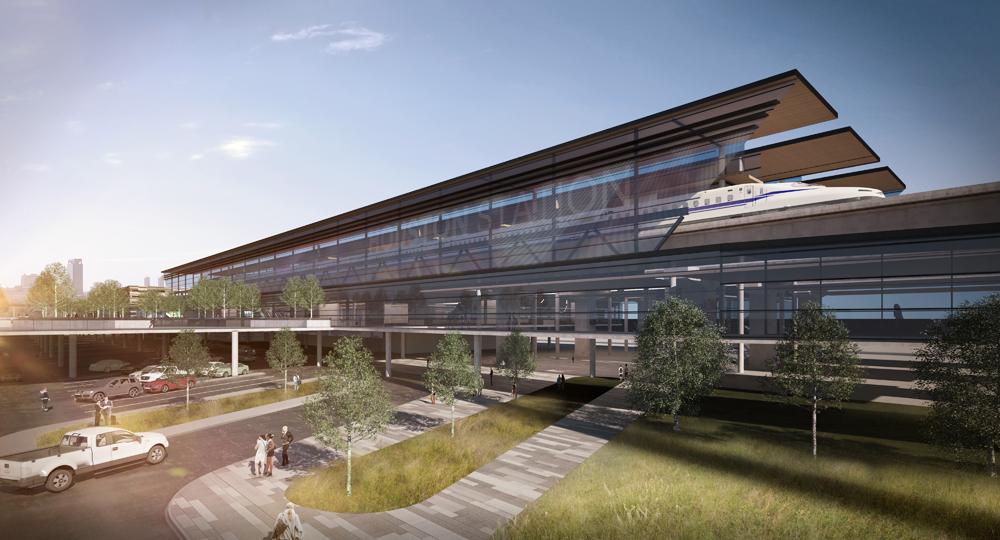

Container terminal expansions and modernization projects are under way at Halifax and Montreal, and CN is among the partners building a new automated container port at Quebec City due to open in 2024. CN hopes the ports can snare some of the container traffic currently handled at the Port of New York and New Jersey, Ruest says.

An intermodal terminal expansion also is under way at the Port of New Orleans, allowing CN to capture more container traffic moving from Asia to the Gulf Coast via the Panama Canal. And container terminal expansions are under way at the British Columbia ports of Vancouver and Prince Rupert, which in recent years have won market share from U.S. West Coast ports, a trend Ruest expects to continue.

CN also aims continued expansion of its domestic intermodal service, like it did with the acquisition of two Canadian trucking companies that specialize in temperature-controlled food shipments. CN also last year joined the EMP container pool, extending its intermodal reach to more locations in the U.S. And it launched short-haul interline service with CSX Transportation linking Philadelphia and New Jersey with Toronto and Montreal.

Ruest participated in a webcast with TD Securities analyst Cherilyn Radbourne.