JACKSONVILLE, Fla. — CSX Transportation’s earnings dropped sharply in a yo-yo second quarter that included unprecedented declines in traffic volume and revenue, followed by a strong rebound.

[CSX Transportation]

The railroad’s traffic volume fell 20%, the largest quarterly decline in CSX history and almost twice as severe as the declines during the Great Recession, Foote says. All of CSX’s business segments were affected by the pandemic: Coal volume fell 44%, merchandise traffic was down 22%, and intermodal sank 11%.

That translated into deep declines in key financial measures. For the quarter CSX’s operating income fell 37%, to $828 million, as revenue slumped 26%, to $2.25 billion. Earnings per share fell 40%, to 65 cents.

CSX’s operating ratio rose 5.9 points, to 63.3%, despite a 19% reduction in expenses.

Now traffic is up about 25% compared to the low point of May, when North American auto assembly plants were shut and finished vehicle traffic all but dried up. “Boy are we happy to see the volumes recover from the May trough as the economy strengthens,” Foote says.

The trends are encouraging, he says, but it’s still too early to accurately predict the ultimate shape of the recovery, due to lingering uncertainty over the durability of the economic rebound and the potential impact of the COVID-19 pandemic’s spread.

The railroad’s key operating metrics generally improved during the quarter. Train velocity was up year-over-year, yard productivity rose, and fuel efficiency improved. Terminal dwell rose slightly.

Carload trip plan performance was 80.5%, down slightly from the first quarter but 6.1 points above the second quarter a year ago. Intermodal trip plan performance was 94%, down 2.2 points from the first quarter but up from 89.9% a year ago. The bulk of the deterioration came in June as volume ramped back up quickly and there was a delay in recalling furloughed employees.

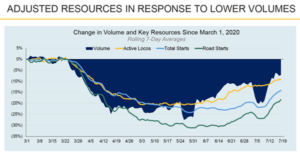

CSX dropped road train starts in line with the steep volume declines that began in March. But in April the railroad began moving its tonnage on fewer but longer trains, which cut train starts more deeply than the volume decline.

Even as volume has rebounded to within 7% of pre-pandemic levels, road train starts remain 17% lower than they were in March.

Jamie Boychuk, executive vice president of operations, says CSX has fundamentally changed its network.

“Our auto network, which practically disappeared throughout the COVID period, has come back strong, and we are moving it in a different way than we ever have,” Boychuk says. “We are mixing the auto network with our manifest and in some areas with our intermodal network. And reducing those train starts … is going to be a good lasting effect as we move forward.”

CSX has recalled hundreds of train and engine employees from furlough amid the volume recovery. “We’ve got a good number of employees still on furlough and we want to find work for them,” Boychuk says.

The railroad’s employee count in the second quarter was 12% lower than a year ago.

“In difficult times, strong companies adapt — and that’s exactly what we have done,” Foote says.

Mark Wallace, executive vice president of sales and marketing, says he’s encouraged by the rebound in domestic intermodal volume in June, which was driven by retailers restocking store shelves and ongoing strong e-commerce sales. International intermodal is looking up, too, he says, thanks to shipping lines restoring cancelled sailings from Asia and elsewhere.

Carload traffic tied to the industrial economy is coming back more slowly, Wallace says, and coal volumes will remain challenged.