Amtrak’s formulaic approach to restoration has several significant flaws: It fails to account for current booking trends during the COVID-19 pandemic, does not factor in business that will be lost because of connections that are no longer possible under the reduced schedule, and assumes passengers who happen to use trains that travel long distances are inherently different from passengers who ride shorter state-supported runs and trains on Amtrak’s Northeast Corridor.

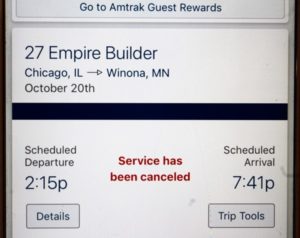

As Amtrak learned in a previous attempt to save money through triweekly operation, passengers who find a service is not available on the days they wish to travel — or suddenly involves a mid-trip layover — are as likely to not take the train as they are to rearrange their plans to fit the limited schedule.

An incomplete financial picture

Amtrak depicts its long-distance plan as a financial necessity because of reduced ridership and revenue during the pandemic [see “Amtrak leadership defends value of triweekly service as short-term move,” Trains News Wire, Aug. 17, 2020]. The company cites $500 million in long-distance train operating losses the previous fiscal year in justifying cuts that, including workforce reductions, would help save $150 million in fiscal 2021 [see “Amtrak plans triweekly service for almost all long distance trains as of Oct.1,” News Wire, June 15, 2020].

Trains News Wire has asked several times, without a response, for a detailed list of expenses for the Empire Builder, Southwest Chief, and Silver Meteor. It is therefore impossible to ascertain the proportion of costs attributed to those trains that are direct and avoidable expenses that would disappear if trains did not run, as opposed to allocated overhead and equipment-usage charges that remain on days no revenue is earned. Without that information, or the scheduling information released last week, it would not be possible to accurately assess the amount of revenue triweekly service would retain compared to daily operation.

Nevertheless, even before the triweekly schedules were revealed, Amtrak released what a spokesman called a “final” blueprint of performance benchmarks to determine service restoration [see “Amtrak releases criteria for restoring long-distance service,” Trains News Wire, Aug. 11, 2020].

Like earlier proposals that met with resistance on Capitol Hill, this plan says consideration of restoring long-distance trains will not begin until Feb. 15, 2021. At that time, each service must show, for June 2021, at least 90% of the advance bookings they had for June 2020. They must also have attained the percentage of October-December ridership set in a triweekly operating plan; those percentages will be based on figures for the same months in 2019, when the trains ran daily. Service will not be restored until May 2021 at the earliest.

Current booking trends

The “Restoring Long Distance Service” white paper which sets the performance benchmarks states that “at times,” systemwide ridership has dropped by more than 95% from fiscal 2019 levels. But that occurred only in April, and was fueled in large part by lockdowns that have since been lifted.

In July, only Acela revenue was off 95%; management brought back three weekday Boston-Washington round-trips on June 1 without a formula dictating their return. Ridership has increased since April in all service categories — corridor, state-supported, and long-distance — as Amtrak and state sponsors have restored some frequencies. But the long-distance routes — which maintained their full daily schedule thanks to Congressional funding to support the national network —generated $38.6 million, or 56%, of the company’s $68.4 million in ticket revenue in June and July combined. The network has also supplemented and connected with corridors that have had significant decreases in frequencies.

In reports obtained by Trains News Wire during the past month, systemwide bookings have plateaued at about 23% of last year’s monthly revenue, but long-distance train weekly averages have stayed relatively constant in the 45% to 50% range from late July through August 17, 2020.

The strongest revenue generators have been in Amtrak’s sleeping cars, as patrons continue to shun air travel. With business and commuting trips expected to remain depressed, there is no reason to believe these trends are likely to suddenly turn against long-distance trains from October through the November and December holidays.

Missed connections

The long-distance trains’ numbers have, however, been been dragged down by the elimination that began June 6 of four weekly Silver Star and three Silver Meteor departures. Because it is triweekly and loses four days of intra-Florida service, Silver Star bookings for the period were off 76% to 83% from last year’s totals on days when the average for all long-distance trains was down between 49% to 62%.

The change in the two Silver trains also illustrates the loss of connecting service that occurs with the elimination of daily service. Only the northbound Silver Meteor currently connects with either the westbound Lake Shore Limited at New York and Capitol Limited at Washington (plus the triweekly Cardinal only on Wednesday); there are no northbound connections on days only the northbound Silver Star runs. Starting in October, the connections will be even more limited; trains to and from southern destinations will not connect on the following days:

[Bob Johnston]

Silver Meteor: Monday, Tuesday, Thursday

Crescent: Monday

Eastbound to Southbound at Washington (only)

Silver Star: Saturday

Silver Meteor: Monday, Wednesday, Thursday

At Chicago, Amtrak attempted to coordinate triweekly arrivals and departures to preserve connections between the Cardinal, Lake Shore, and Capitol Limited and the western long-hauls. Tuesday’s Cardinal departure will now only get passengers from state-supported services, and connections will not be possible on the following days with these trains:

Westbound:

Texas Eagle: Tuesday, Friday, Sunday (every day)

California Zephyr: Wednesday

Eastbound:

Texas Eagle: Wednesday

The Eagle’s days are determined by the rendezvous at San Antonio with the New Orleans-Los Angeles Sunset Limited’s existing triweekly schedules. But the business it derives as an integral part of the Chicago-St. Louis corridor, and at Arkansas and Texas destinations, accounts for the majority of bookings. Now its only westbound connection from the east will be three Michigan trains.

In the west, the popular Sunset and California Zephyr connections to the northbound Coast Starlight are preserved all three operating days, but can only be made from the Southwest Chief on Monday and Friday.

At Portland, Ore., the Starlight’s connection to the Empire Builder works in both directions. Saturday’s southbound train from Seattle misses the eastbound California Zephyr, but is the only weekly departure connecting with the eastbound Sunset.

The connection considerations matter because, if a passenger’s preferred dates of travel don’t mesh with the more limited schedules, they simply may not make the trip. The inability of customers to make connections for trips like Orlando-Toledo, New York-Dallas, or Cleveland-Little Rock, will negatively impact ridership and revenue for all trains involved.

The interconnected system that filled seats and rooms in October through December 2019, and enticed passengers to book summer trips in January and February 2020 for June, is materially different from the more limited triweekly offerings travelers now face. A mathematical formula that incorporates reduced available seating capacity, but not the decreased travel-date options, can’t possibly take this significant factor into account.