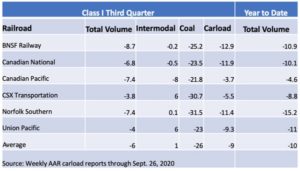

Overall volume at the big six Class I railroads declined an average of 6% during the third quarter, as coal continued to plummet and carload struggled to recover compared to pre-pandemic levels.

Overall volume at the big six Class I railroads declined an average of 6% during the third quarter, as coal continued to plummet and carload struggled to recover compared to pre-pandemic levels.

Intermodal, however, returned to positive territory in the third quarter, notching 1% growth, on average, at the big systems, according to a review of the railroads’ Week 39 Association of American Railroads carload reports.

CSX Transportation saw the smallest overall quarterly traffic decline, at minus-3.8%. The railroad was buoyed by a 6% gain in intermodal traffic for the quarter.

BNSF Railway was the third quarter’s cellar dweller, with volume off 8.7% compared to a year ago. The carload decline of nearly 13% was largely due to sharp drops in BNSF’s metallic ores, petroleum, and sand and gravel business segments. BNSF, the largest intermodal carrier, saw its container and trailer volume fall slightly, by 0.2% in the quarter.

Coal numbers were bleak across the board, with the big systems losing a quarter of their coal volume, on average.

Carload traffic, down 9% on average, remained in the doldrums as industrial production was slower to recover than the consumer-related sectors of the economy that drive intermodal volumes.

Wall Street analysts expect earnings to decline an average of 8% for the third quarter at the six publicly traded Class I systems, according to the Institutional Broker’s Estimate System.

Kansas City Southern, the smallest of the Class I carriers, will kick off third quarter earnings when it releases its results on Friday morning. Analysts expect its earnings to fall by 2.5%, the smallest drop for the railroad group.

Canadian Pacific and Canadian National are scheduled to report their quarterly results on Oct. 20. CP’s earnings are expected to decline 7.5%, while CN’s are expected to sag 13% compared to a year ago.

CSX reports its financial results on Oct. 21. Analysts expect the railroad’s earnings to dip 14.8%.

Union Pacific will report its results on Oct. 22, with Wall Street expecting an earnings decline of 7.6%.

Norfolk Southern will bring up the markers for the publicly traded railroads when it reports its results on Oct. 28. Analysts expect NS earnings to slump 4.8%.

BNSF, which is a unit of Berkshire Hathaway, is expected to report its third quarter results alongside its corporate parent on Oct. 31.