The following is a series of edited excerpts from an interview conducted by David Popp with Jason Shron, owner of Rapido Trains on March 25, 2025. You can find the complete interview on Trains.com Video by clicking here. – Ed.

David: The word on everybody’s minds in the hobby as of late is tariffs. Jason Shron, the owner of Rapido Trains, agreed to talk with Model Railroader about the current tariff situation and what it means for hobbyists and manufacturers alike. Jason has been producing model trains for more than 20 years, and he is always candid about what it means to be a manufacturer of hobby products and all of the challenges that go with it.

So, Jason, let’s start off with tariffs. Tariffs are put in place in order to raise the prices on imported products to make them more expensive to bring it into your country.

Jason: Let me start off with a primer.

David: Yes, let’s start with a little Economics 101.

Jason: A tariff is a tax designed to protect domestic industry. For example, Canada still has a big clothing manufacturing industry. Canada applies an 18% tariff on clothes brought into Canada, except for clothing from Mexico and United States, because we’re all part of the North American Free Trade Agreement. However, if you were to import clothes from China or India or Bangladesh, there is an 18% tariff on the products.

The reason for the tariff is that you don’t want clothes in your marketplace coming from a country where the cost of production is much lower. Lower wages mean lower costs, so you don’t want those lower priced imported items flooding your domestic market and competing with your domestic manufacturers. Most countries have tariffs in some form to protect their domestic industries.

The North American Free Trade Agreement, which started in the mid-90s, is a pact between the United States, Canada, and Mexico to eliminate or reduce barriers to trade. Since then, the industry of all three countries has become heavily integrated.

For example, some parts in auto manufacturing cross the border four or more times in the process of being made into automobiles because you have to go and get circuit boards from here, and you have to get stamped metal from there, and so on. As a result, for the last 30-plus years, there have not been much in the way of tariffs between the US, Canada, and Mexico.

There’re still arguments here and there within various industries, such as softwood lumber and dairy. There haven’t been any blanket tariffs applied throughout North America since we entered into the free trade agreement over a generation ago.

David: So, how does this apply to the model train industry?

Jason: There’s very little domestic model train manufacturing in North America. There are a small number of manufacturers who’ve never left the US. But if you look at the models that most manufacturers are bringing out today in terms of the super level of detail found in locomotives, freight cars, and passenger cars, that industry was built in China. The global model railroad industry of super detailed, museum quality, prototype-specific models all came from China.

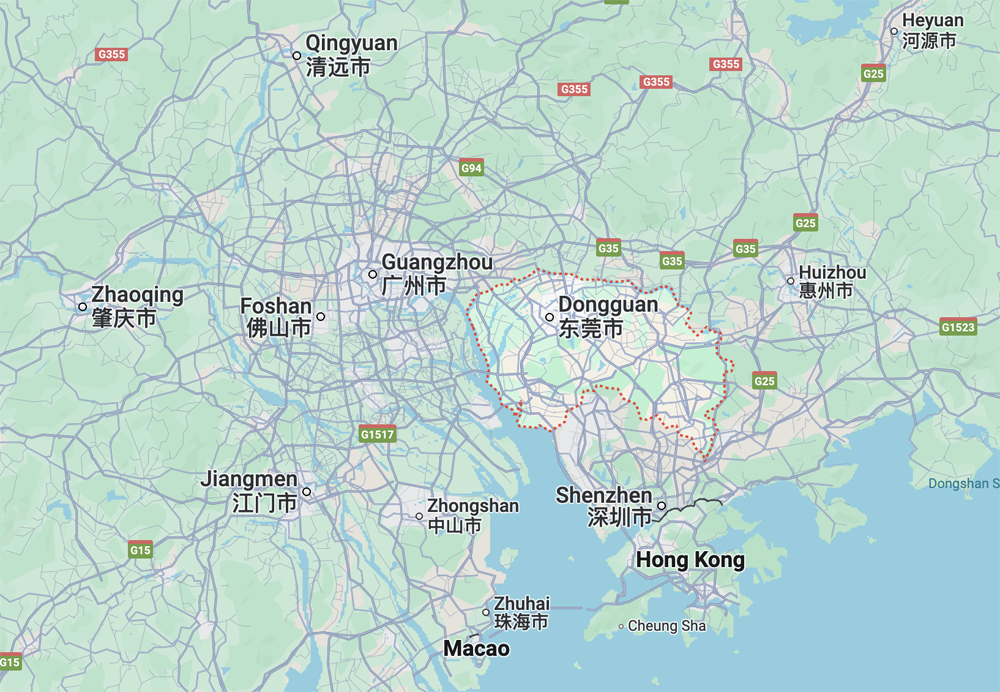

In fact, it came from one city in China, which is the city of Dongguan, just outside of Hong Kong. There was one guy, W. S. Ting, who owned a factory called Sanda Kan, and it was very active from the 1960s to the 2000s. Sanda Kan went to its North American partners and said that with the developments in technology, it could make far more detailed models than they’d been making in North America. And because of the low cost of labor in China, it [Sanda Kan] could install all the grab irons, the handrails, the separate piping, etc. As a result, the modern model train industry we know today was built in China.

The problem now is you’ve got tariffs that are blanket tariffs designed to protect domestic industry. But there isn’t much of a domestic model train industry to speak of in the US. You can get Accurail kits, Kadee couplers, and Micro-Trains models, but I’ve just named the vast majority of the North American injection-molded model train market in those three companies.

The rest of the manufacturers, whether it’s Rapido, Scale Trains, Atlas, or Walthers, we get our stuff from China, which now has a tariff on it.

David: Where do the tariffs stand at the moment?

Jason: The tariffs were initially 10% and then they were quickly doubled to 20%, which means that if we bring in a model, we’ve got to now pay an additional 20%.

As I said before, a tariff is a tax. So, we’re paying another 20% in taxes, which is actually huge when you think about the fact that normally your sales tax is 4 to 8%. Canada has the HST (Harmonized Sales Tax), which is around 13%, but that’s a consumer tax. If a manufacturer pays it, they get it back. But the 20% tariff, we can’t absorb that cost.

Different manufacturers have different business models. Most manufacturers, and Rapido is one of them, sell to stores and give them a discount, which is between 30% and 40%. We also sell to distributors, and that discount is between 45% and 55%. So, if a model retails for $100, the manufacturer may only be getting $55 or $45 for it from the distributor.

From that perspective, our margins are already small on most models. After you pay for tooling, it’s making less than a 10% profit. Once you add the 20% tariff, you can see why we can’t absorb it all. At least some of it has to pass on to our customers.

David: That’s a tough spot to be in.

Jason: Some manufacturers are choosing to raise their prices, which is a business decision.

For now, we’re putting a line on the invoice that separates out the tariff. So, you know when you buy the product what the tariff is and this is what you’re paying. If the tariffs don’t go away after a year or more, we may decide we have to just increase the price. We’ll see.

David: It’s a very fluid situation.

Jason: Yes. The tariff was doubled with five days’ notice. It means that everyone who’s got products enroute from China that budgeted in a 10% tariff, by the time it lands in California, it’s now a 20% tariff. Costs have gone up by a huge amount.

David: So, how is Rapido dealing with this?

Jason: We’ve had a U.S. company for a while that just employed all our U.S. designers. But now we’ve bought a building in Buffalo, New York, so our U.S. company will be based in Buffalo.

The reason we did this is the tariff is calculated on the invoice amount entering the United States. So, if I’m based in Buffalo and I import a model from China and say it cost me $50, then my tariff is ten bucks. If I’m selling it in the United States, my tariff is still $10. If I sell the model for $100, remember all those other discounts and costs involved, the tariff is still $10. However, if I’m selling that $100 model from Canada, the tariff cost is $20. That’s because the tariff is applied to the invoice amount, which would be the retail price coming from Canada to the U.S., and not the manufacturing cost used when coming from China.

This is all very new. I went to Buffalo in February, and I went around with the real estate agent to look at four properties. I then said we’re going to buy property number three. We then sat down, shook hands, and at the end of the week, we had a contract in place. We’re taking possession of the building in early April.

David: Congratulations.

Jason: We’ve done this because we needed to protect our US customers. We have to charge the tariff. We’ve calculated that we can give a 52% discount on the tariff if we’re based in the US because we’re paying the manufacturing cost and not the invoice amount. So, for every 10% of tariff we’re adding a 4.8% tariff charge on to our bills to customers, stores, and distributors.

David: Since you’re going to have this place in Buffalo, what does that mean for your warranty repair? I know from personal experience that shipping models to Canada is very expensive.

Jason: When somebody in the U.S. needs to send a model back, it’s all going to go to Buffalo now. We’ll pick up those models every week from Buffalo and ship them to Toronto in bulk to do the repairs before returning them to Buffalo, and eventually back to the customer. It should speed things up and keep the shipping costs down for everyone. It makes sense because more than 70% of all of our business in the United States.

David: It sounds like having the space in Buffalo will really help Rapido.

Jason: Yes. As soon as the tariffs were applied, we stopped shipping from China to wait and see how it would play out. So, we haven’t shipped anything from China since January. Now that things have settled a bit, we’re starting to ship again, and if you look at our newsletters, everything is arriving “in April.”

When the tariffs were at 10%, we shipped a ton of stuff from Toronto down to Buffalo to a third-party warehouse to hold it there. This week, we’re shipping the next batch of stuff from Toronto, but unfortunately this is at the new 20% tariff. But even without our building yet, we’ve got to get the products into the U.S. in case the tariffs suddenly go up more.

Because of that, we’re being totally transparent with our customers. Even though stuff from the two different batches is shipping at the same time, we are using separate invoices. The items at 10% will say 4.8% tariff [Rapido’s 52% discount on the tariff – Ed.] and those at 20% will say 9.6% tariff. It all depends on when it entered the United States. And that’s why I like having the tariff as a separate line item because you can see that. If we just raised all of our prices, then you have no idea why it cost so much.

David: Speaking of manufacturing and China, during Covid, manufacturing in China became pretty fraught with turmoil. Have things smoothed out since then?

Jason: Oh, absolutely. It seems to be very smooth and we’ve had no major issues.

Our biggest challenge, and anyone who’s experienced growth like we have will agree, is just getting the goods out of the factories. As we give them more and more orders, they have to hire more people. Those people have to be trained, and that takes time.

As an example, we just closed the order book on our Super Continental passenger cars. We haven’t run those in ten-plus years, and the numbers [for orders] were double what we expected. The plan was to get them all here before our fiscal year ends, October 31st.

But when I sent the numbers to the factory, they said they we’re going to need more time.

David: Did you update the models or are they pretty much the same model as before?

Jason: No, we’ve updated them. We’ve changed how they go together. The body now has an inner roof below the upper roof to keep the body square and straight. And the new lighting is made using tiny surface-mounted LEDs powered with track power. We’ve also included a run of them as Rapido anniversary cars because the company turned 20 last year, but they’ll be here in time for our 21st anniversary.

David: Congratulations on the anniversary. It’s a big milestone, and I think it’s wonderful. In addition to the Super Continentals, we’ve noticed that you’ve made announcements for rerunning some of Rapido’s previous locomotives.

Jason: Yes, we’re rerunning some models, but it’s not just a straight rerun. We have some new schemes, and the thing about our locomotive line is that it’s deep and there’s such a variety. Even when we announce a new run, there’s more tooling to do.

We’ve got the new run of [Alco] PAs, which is leaving our factory shortly. In this batch we’ve included the three that the Santa Fe rebuilt with EMD Prime movers. The railroad completely rebuilt the roof [on those units], so that was all new tooling for us.

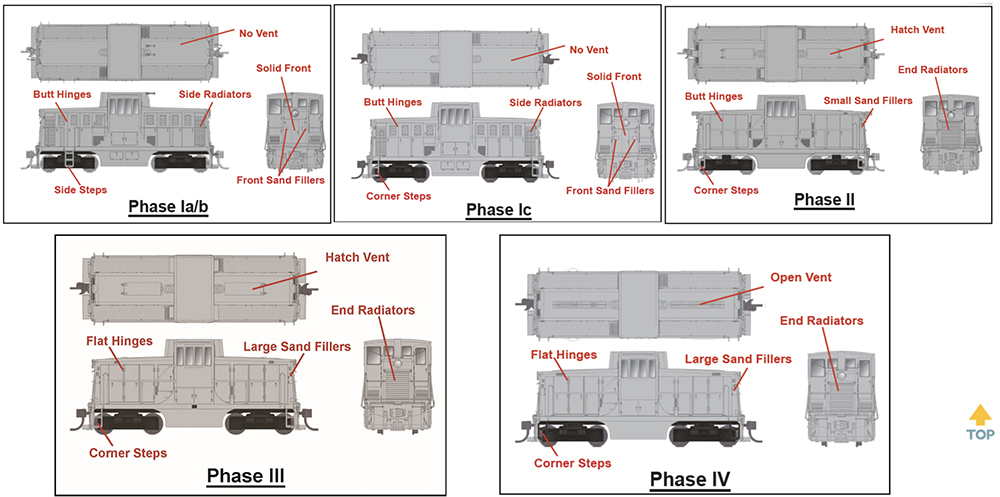

On our new run of GP38s, to get all the variations, we’ve done some new tooling and sometimes even new bodies. We’ve also got a new run of GE 44-tonners coming. We’re doing a whole new phase of 44 tonner, so it’s all new tooling to do that too.

So, while they’re new runs of locomotives we’ve done before, they’re not just reruns of old stuff.

David: Thank you, Jason, for taking time out of your busy schedule to educate us on tariffs and all the other fun things Rapido is working on. Is there anything else you want to share before we go?

Jason: Absolutely, and I’m going to ask this not just of Rapido’s customers, but of all customers buying model trains. Please preorder.

A lot of people are uncertain about preordering because they’re not sure how much the item is going to cost once it finally comes, especially if the tariffs go up further.

If you don’t preorder, we don’t know what to make.

As a manufacturer, it’s possible by the time the stuff’s arrived there’ll be no tariffs or they’ll be back down to 10%. Who knows? And if there is a crazy trade war with China and tariffs hit 50%, you can still cancel your order.

If that happens, we’ll sit on this stuff until the tariffs go down again. But definitely preorder because we need to know what to make. Preordering is usually free. In the worst-case scenario, if the tariffs are through the roof, no one’s going to say, “well, you still have to take it.” No, you can cancel the order or you can put it on hold. I understand that and am good with it. But please preorder.

David: Thank you again, Jason, and best wishes to you and Rapido Trains.

I was just on another model form and a guy was complaining because it was to expensive to import a flashing LED from Germany. I pointed him towards Evans Design who is a US manufacture of this kind of equipment.

There are many cottage indutries in the US and Canada. 3D printing has come a long way in a short amount of time. PFC and other US manufactures still exsist for detail parts. Hey look if you want to spend 300.00 or 500.00 on a superdetailed locomotive thats fine. I would rather take on the challenge of buying a working used Atheren Bluebox for 50.00 and detail it myself.

Nothing good will come of this. The only way you can make competitively priced model railroad equipment in the U.S.A is to depress wages and squash worker benefits.

So yes, I think within 10years, we will see model trains made in the USA again, along with Chinese levels of safety and pay rates.

Fun times ahead I am sure.

Tariffs should be the least of our concerns. Where is our conscience in dealing with a country with vast numbers of political prisoners, which might be harvesting organs from these people. which disregards patents and copyrights, is militarily aggressive against it’s neighboring countries, and has as a stated objective the “reunification” of Taiwan by military force which will bring war with the United States! Where will our hobby be then? Every manufacturer I spoke to at Worlds Greatest Hobby show in Indianapolis a few years ago said the same thing: bankruptcy and closing their business! This would push our hobby back to the 1930″s. And remember how Lionel and other model manufacturers supported the war effort during World War 2? How can our companies support a war when they are in enemy territory?

One of the stated goals of the new tariffs (that went unmentioned in the interview) is the goal of “bringing back jobs” to the U.S. There was a time from the late 1940’s into the 1970’s when the U.S. had quite a domestic model railroad industry. Particularly in H0. Yes, the models were crude compared to what we take for granted today. And, adjusting prices for inflation, today’s models are a better deal than those of the 1960’s. Yes, there’s “sticker shock” when paying $200.00 for a locomotive today. Yet, few scream at paying $4.99 for a Big Mac which cost $0.65 in 1974. So, the question becomes one of, “Will there be a ‘new boom’ of domestic model railroad manufacturers?” Remember that a major cost of models is the tooling. Expert mold makers are paid much less in China than in the U.S. (Even less than in Mexico!) Will a new generation of entrepreneurs, like Gordon Varney, Irv Athearn, and Gordon English of days gone by come forth? Will the banks be willing to loan them the money to get started? Only time will tell.

For a super detailed model locomotive made in the United States, assuming a $20 USD wage for factory workers, you could be paying north of $1000 for a single, small diesel locomotive. This doesn’t even include shipping costs or, if you live outside the United States, the incoming duties, tariffs, and exchange rate.

Athearn was able to keep it’s prices of it’s Blue Box kits low, because of the relatively low amount of detail, and the need for some assembly. Same with Accurail today (At least in terms of need for assembly, detail on those is pretty good). For a low cost RTR made in USA, you can forget about things like fine detail plastic parts, grab irons, and etched metal.

Mr. Marquardt brings up an interesting point. How much detail is really necessary in model railroading? There’s also the fundamental question of Engineering Ethics to consider. That is, “Just because something can be done, does it have to be done?” As an N scaler since the 1960’s, today’s locomotives and rolling stock have what would’ve likely been considered an absurd amount of detail back then. Perhaps, even “over detailed”?

Michael’s point is completely valid, but what seems to always get lost in the wage equivalent conversations is just how much it would cost to pay a good wage. Your assumption of $20 per hour equates to $41,600 annual salary. A livable wage needs to be north of $32 per hour, or about $67K.

It’s not a question of detail, but assembly, and not just grab irons and such. There are lots of internals and subassemblies that go into a quality locomotive these days, and that’s somebody’s time and money.