U.S. railroads originated 1,023,394 carloads in June 2019, down 5.3%, or 57,173 carloads, from June 2018. U.S. railroads also originated 1,075,974 containers and trailers in June 2019, down 7.2%, or 84,002 units, from the same month last year. Combined U.S. carload and intermodal originations in June 2019 were 2,099,368, down 6.3%, or 141,175 carloads and intermodal units from June 2018.

In June 2019, four of the 20 carload commodity categories tracked by the AAR each month saw carload gains compared with June 2018. These included: petroleum and petroleum products, up 8,122 carloads or 18.1%; non-metallic minerals, up 774 carloads or 5.1%; and chemicals, up 613 carloads or 0.5%. Commodities that saw declines in June 2019 from June 2018 included: coal, down 30,144 carloads or 9.0%; crushed stone, sand, and gravel, down 10,764 carloads or 9.9%; and grain, down 6,715 carloads or 7.1%.

“June marked the fifth straight monthly decline for total U.S. rail carloads and for U.S. intermodal traffic,” said AAR Senior Vice President John T. Gray. “Manufacturing is responsible for much of the rail traffic base, but U.S. manufacturing output has been falling for several months. Housing too is in the doldrums, and trade is suffering because of tensions with trading partners overseas. Taken together, demand for rail service just isn’t as strong as it was six months or a year ago. Obviously, railroads hope things turn around, both for their own sake and for the sake of the broader economy.”

Excluding coal, carloads were down 27,029 carloads, or 3.6%, in June 2019 from June 2018. Excluding coal and grain, carloads were down 20,314 carloads, or 3.1%.

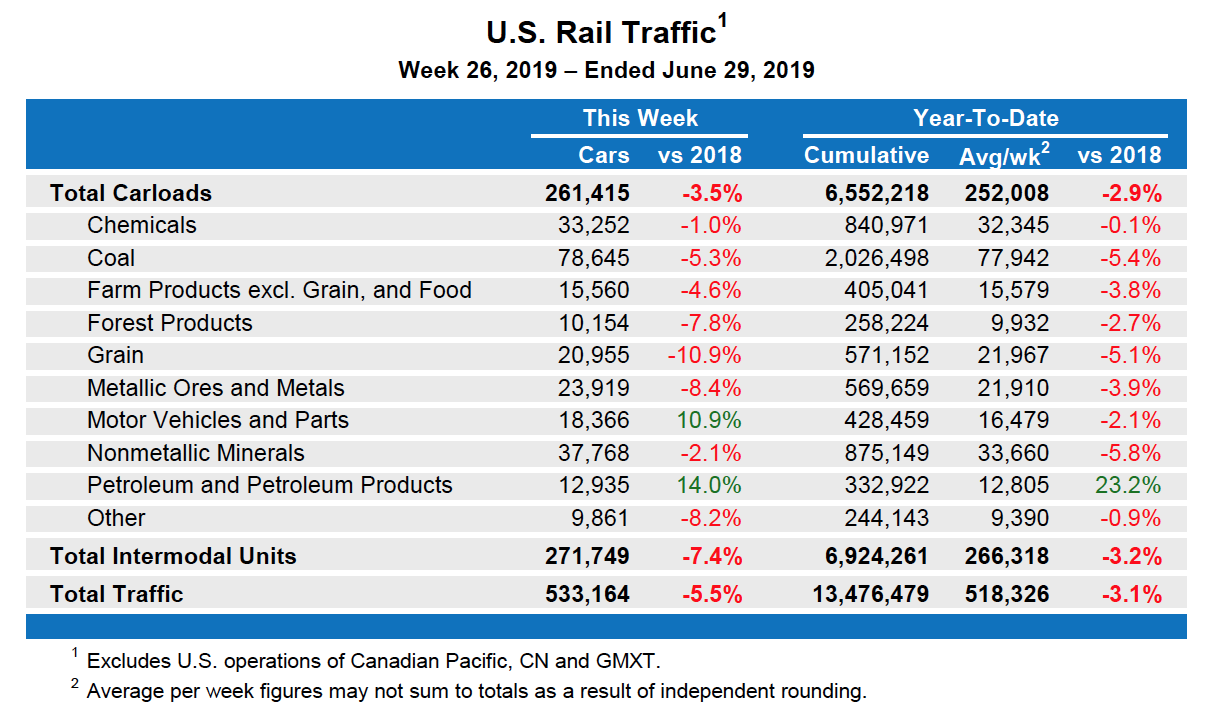

Total U.S. carload traffic for the first six months of 2019 was 6,552,218 carloads, down 2.9%, or 195,168 carloads, from the same period last year; and 6,924,261 intermodal units, down 3.2%, or 229,247 containers and trailers, from last year.

Total combined U.S. traffic for the first 26 weeks of 2019 was 13,476,479 carloads and intermodal units, a decrease of 3.1% compared to last year.

Week Ending June 29

Total U.S. weekly rail traffic was 533,164 carloads and intermodal units, down 5.5% compared with the same week last year.

Total carloads for the week ending June 29 were 261,415 carloads, down 3.5% compared with the same week in 2018, while U.S. weekly intermodal volume was 271,749 containers and trailers, down 7.4% compared to 2018.

Two of the 10 carload commodity groups posted an increase compared with the same week in 2018. They were motor vehicles and parts, up 1,810 carloads, to 18,366; and petroleum and petroleum products, up 1,593 carloads, to 12,935. Commodity groups that posted decreases compared with the same week in 2018 included coal, down 4,424 carloads, to 78,645; grain, down 2,555 carloads, to 20,955; and metallic ores and metals, down 2,204 carloads, to 23,919.

North American rail volume for the week ending June 29, on 12 reporting U.S., Canadian, and Mexican railroads totaled 372,456 carloads, down 1.3% compared with the same week last year, and 360,828 intermodal units, down 5.3% compared with last year. Total combined weekly rail traffic in North America was 733,284 carloads and intermodal units, down 3.3%. North American rail volume for the first 26 weeks of 2019 was 18,361,240 carloads and intermodal units, down 2.0% compared with 2018.

Canadian railroads reported 89,337 carloads for the week, up 5.2%, and 70,692 intermodal units, up 2.2% compared with the same week in 2018. For the first 26 weeks of 2019, Canadian railroads reported cumulative rail traffic volume of 3,921,662 carloads, containers and trailers, up 2.1%.

Mexican railroads reported 21,704 carloads for the week, down 0.1% compared with the same week last year, and 18,387 intermodal units, down 0.6%. Cumulative volume on Mexican railroads for the first 26 weeks of 2019 was 963,099 carloads and intermodal containers and trailers, down 3.7% from the same point last year.

— An Association of American Railroads news release. July 3, 2019.

PSR is?

You don’t think PSR has something to do with it?

Trump is out to destroy the US economy.