GRANDE LAKES, Fla. – Union Pacific’s intermodal on-time performance improved in January, but the reliability of the railroad’s merchandise and automotive traffic deteriorated, partly due to the impact of the idling of the hump at Davidson Yard in Fort Worth, Texas.

For the first time, UP provided separate trip-plan compliance statistics for its intermodal and manifest/automotive traffic during an investor conference on Tuesday morning.

“We’ve made substantial progress with our intermodal service product, which greatly improves our ability to be competitive in these markets,” Chief Financial Officer Jennifer Hamann says.

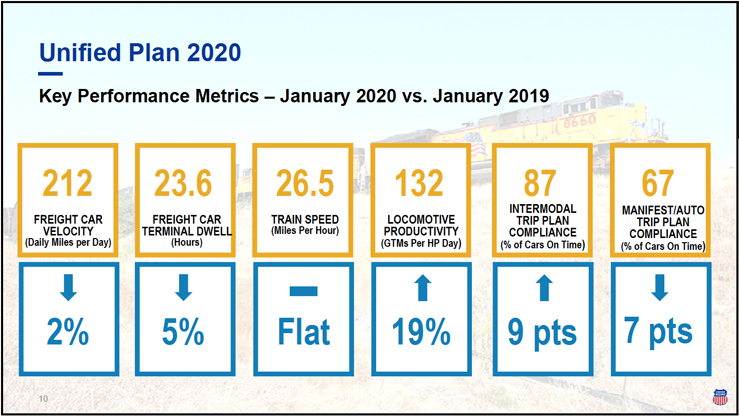

UP’s intermodal trip plan compliance hit 87% in January, a 9-point improvement over January 2019.

Intermodal analyst Larry Gross says UP is closing in on the level of service needed to grow.

“On-time performance to the receiver’s dock needs to be in the 90% range,” he says. “This is not to say that it needs to be as fast as truck, but reasonably consistent. Truck reliability often runs into the high 90% range. There is also an issue of what exactly is defined as ‘on-time.’ Intermodal’s definition tends to be a lot looser than truck, which generally is to the minute.”

The railroad’s carload traffic did not fare as well over the same period. Trip-plan compliance for merchandise and automotive traffic sank 7 points, to 67% – meaning that a third of UP’s carload traffic arrived late.

“The manifest and autos number reflects the difference in traffic mix year over year, as well as some impact from the hump yard closure we noted in our fourth quarter call,” Hamann said.

On Jan. 22 UP idled the hump at Davidson Yard and converted it to a flat-switching facility, the fifth such move since it adopted a Precision Scheduled Railroading operating model in 2018. See “Union Pacific idles Fort Worth yard jump; railroad executives say more changes are likely,” Trains News Wire, Jan. 23, 2020.

About half of the yard’s volume was parceled out among nine smaller terminals in the Texoma Service Unit in Texas and Oklahoma. Major operational changes often produce service issues that are eventually ironed out.

UP also has been shifting more finished vehicle traffic out of its unit-train network and into merchandise trains as part of a drive to boost train length and move tonnage on fewer, but longer trains.

Average train length is up 17%, or by 1,200 feet, since the railroad launched its Unified Plan 2020 in October 2018.

Terminal dwell improved 5% in January, while train speed was flat, and car miles per day slipped 2%.

Hamann says UP still expects its overall traffic volume to be up this year despite a slow start.

Bulk traffic is off 14% through February, thanks largely to a 30% drop in coal volume. Coal is down due to record low natural gas prices that make it uncompetitive as a fuel for generating electricity. In addition, coal-fired power plants have large stockpiles due to the warmer than usual winter.

Premium traffic, which includes intermodal and automotive business, is down by 13%.

The lone bright spot to date is the railroad’s Industrial Products segment, which was up 2% amid rising chemicals, plastics, and construction traffic in the Gulf Coast.

Hamann says UP’s more consistent service allows the railroad to better compete with trucks for temperature controlled food and beverage service under the railroad’s Cold Connect program, which links growers on the West Coast with consumers in the Northeast.

UP late last year took delivery of the first of 300 new refrigerated boxcars, she noted. They feature improvements such as hybrid refrigeration units, double-sealed doors, and customized air distribution pressure to better preserve food.

But despite the new cars UP’s reefer fleet continues to shrink. The railroad’s industry-leading reefer fleet is down 23% over the past five years, according to the railroad’s annual reports.

Hamann spoke at the Raymond James 41st Annual Institutional Investors Conference.

Volume is down, 2020 v 2019 weather is more favorable, blaming a hump closure for car mile and trip compliance smells like BS.

I believe UP uses a +28 hour window of grace on shipment performance. So, if the original UP trip plan had noon placement today, and they placed it by 3:59 PM tomorrow, that’s “on time”.

Last time I worked there (2016), auto parts in domestic 53 containers (mostly but not entirely in the Mexico <-> Chicago/Memphis lanes) was part of the Automotive group, not Intermodal. Which made revenue comparisons (for example) with BNSF a bit apples and oranges.

Still making money. With such poor performance, look for more people to lose their jobs.