U.S. railroads originated 1,055,386 carloads in August 2019, down 4.6%, or 50,672 carloads, from August 2018. U.S. railroads also originated 1,089,849 containers and trailers in August 2019, down 5.4%, or 61,839 units, from the same month last year. Combined U.S. carload and intermodal originations in August 2019 were 2,145,235, down 5%, or 112,511 carloads and intermodal units from August 2018.

In August 2019, eight of the 20 carload commodity categories tracked by the AAR each month saw carload gains compared with August 2018. These included: petroleum and petroleum products, up 3,612 carloads or 7.8 percent; all other carloads, up 3,090 carloads or 13 percent; and stone, clay, and glass products, up 2,567 carloads or 7.5%. Commodities that saw declines in August 2019 from August 2018 included: coal, down 36,301 carloads or 9.9 percent; crushed stone, sand, and gravel, down 5,751 carloads or 5.4 percent; and grain, down 5,365 carloads or 6%.

“While the strength of the overall economy remains unclear, in the last quarter it has become much more evident that the portion of the economy which generates freight — manufacturing and goods trading — has weakened significantly,” said AAR Senior Vice President John T. Gray. “Total U.S. freight carloads have fallen on a year-over-year basis for seven straight months, and that’s true even after excluding coal and grain, the major rail commodities least sensitive to overall economic health. Year-over-year intermodal volumes, typically a reliable indicator of consumer spending and intermediate manufacturing demand, have fallen for seven straight months. We had a similar pattern in 2016, when rail traffic was weak and the overall economy wobbled but didn’t fall down. Railroads are hopeful that the uncertainty plaguing economies here and abroad will dissipate soon and solid economic and industrial growth will return.”

Excluding coal, carloads were down 14,371 carloads, or 1.9%, in August 2019 from August 2018. Excluding coal and grain, carloads were down 9,006 carloads, or 1.4%.

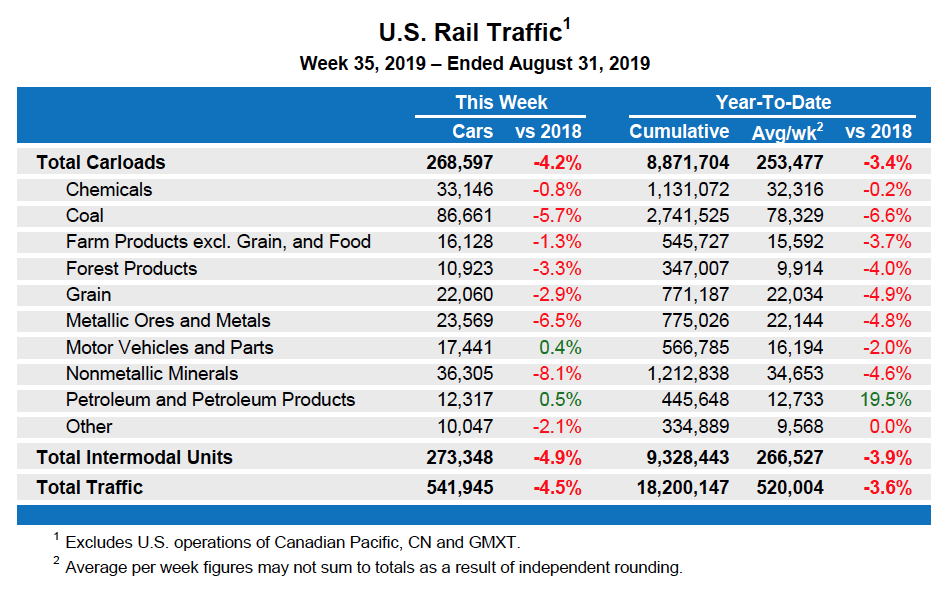

Total U.S. carload traffic for the first eight months of 2019 was 8,871,704 carloads, down 3.4%, or 310,246 carloads, from the same period last year; and 9,328,443 intermodal units, down 3.9%, or 375,964 containers and trailers, from last year.

Total combined U.S. traffic for the first 35 weeks of 2019 was 18,200,147 carloads and intermodal units, a decrease of 3.6% compared to last year.

Week Ending Aug. 31, 2019

Total U.S. weekly rail traffic was 541,945 carloads and intermodal units, down 4.5% compared with the same week last year.

Total carloads for the week ending Aug. 31 were 268,597 carloads, down 4.2% compared with the same week in 2018, while U.S. weekly intermodal volume was 273,348 containers and trailers, down 4.9% compared to 2018.

Two of the 10 carload commodity groups posted an increase compared with the same week in 2018. They were petroleum and petroleum products, up 66 carloads, to 12,317; and motor vehicles and parts, up 61 carloads, to 17,441. Commodity groups that posted decreases compared with the same week in 2018 included coal, down 5,196 carloads, to 86,661; nonmetallic minerals, down 3,209 carloads, to 36,305; and metallic ores and metals, down 1,629 carloads, to 23,569.

North American rail volume for the week ending Aug. 31, 2019, on 12 reporting U.S., Canadian and Mexican railroads totaled 375,177 carloads, down 3.3% compared with the same week last year, and 366,771 intermodal units, down 3.3% compared with last year. Total combined weekly rail traffic in North America was 741,948 carloads and intermodal units, down 3.3%. North American rail volume for the first 35 weeks of 2019 was 24,824,719 carloads and intermodal units, down 2.5% compared with 2018.

Canadian railroads reported 85,954 carloads for the week, down 1.3%, and 74,292 intermodal units, up 2.2% compared with the same week in 2018. For the first 35 weeks of 2019, Canadian railroads reported cumulative rail traffic volume of 5,311,241 carloads, containers and trailers, up 1.8%.

Mexican railroads reported 20,626 carloads for the week, down 0.4% compared with the same week last year, and 19,131 intermodal units, down 0.4%. Cumulative volume on Mexican railroads for the first 35 weeks of 2019 was 1,313,331 carloads and intermodal containers and trailers, down 3.3% from the same point last year.

— An Association of American Railroad’s news release. Sept. 4, 2019.

The railroads have diminished themselves over the decades. Profits over market share. Now their base commodities are in decline. Yes, the transportation sector is soft, but the railroads it is a fundamental issue overall. One has to ask with all the cost cutting through PSR, why have those efficiencies translated to more competitiveness in shorter haul segments of business?

It seems like it is time to restructure our portfolios.

“The trucking industry is already in a recession. That isn’t good, when shipping is the lifeblood of the economy, moving goods along its tar-paved arteries.”

https://www.barrons.com/articles/trucking-industry-is-in-a-recession-will-economy-follow-51565880739

@Curt Warfel

This is exactly what UP said in their recent forecast. Increase rates to take up slack in profits..

Trump has nothing to do with this. All across the nation you can find communities where Class Ones have turned their back to. All these require the two basic tenants of life: food and shelter. Yet, the railroads have given these to trucking. My hometown of 42,000 hasn’t received a load of lumber by rail in over 30 years!

Trump’s policies are a disaster for America. CSX will not need to run any trains if this keeps up and they’ll be able to close all yards. Hunter would be pleased.

I fully expect the railroad industry’s solution to this freight recession will be the same as it was in 2016; jack rates on captive traffic and cut resources to the bone. Then; when the recovery rolls around; jack rates on captive traffic even higher and delay adding resources back till the railroad is on the verge of seizing up.

This has been the apparent management strategy for the past 14 or so years.