U.S. railroads originated 927,084 carloads in February 2020, down 7.3%, or 73,058 carloads, from February 2019. U.S. railroads also originated 997,683 containers and trailers in February 2020, down 8.9%, or 96,897 units, from the same month last year. Combined U.S. carload and intermodal originations in February 2020 were 1,924,767, down 8.1%, or 169,955 carloads and intermodal units from February 2019.

“Total U.S. rail carloads in February were down 7.3% driven almost entirely by coal. Excluding coal, carloads in February were down just 0.8%, their best showing in a year,” said AAR Senior Vice President John Gray. “In February, 10 of the 20 commodity categories we track saw year-over-year carload gains, the most in more than a year.”

In February 2020, 10 of the 20 carload commodity categories tracked by the AAR each month saw carload gains compared with February 2019. These included: chemicals, up 3,718 carloads or 2.9%; petroleum and petroleum products, up 3,488 carloads or 7.2%; and all other carloads, up 2,875 carloads or 12%. Commodities that saw declines in February 2020 from February 2019 included: coal, down 67,770 carloads or 21.1%; crushed stone, sand and gravel, down 10,557 carloads or 12.5%; and grain, down 5,350 carloads or 6.4%.

“There’s a huge amount of uncertainty regarding the coronavirus situation, but to date the impact on U.S. rail traffic appears limited. That could change if, for example, sharp declines projected by U.S. ports occur in the weeks ahead,” Gray said. “Supply chain disruptions related directly or indirectly to the coronavirus may have played some unquantifiable role in the decline in U.S. intermodal volumes in February, but intermodal has been falling for more than a year. The headwinds facing railroads that pre-date the virus include lingering trade impacts and economic uncertainty; severe winter weather in parts of the country; blockades in Canada that shut down rail traffic there and impacted domestic traffic too.”

Excluding coal, carloads were down 5,288 carloads, or 0.8%, in February 2020 from February 2019. Excluding coal and grain, carloads were up 62 carloads, or 0%.

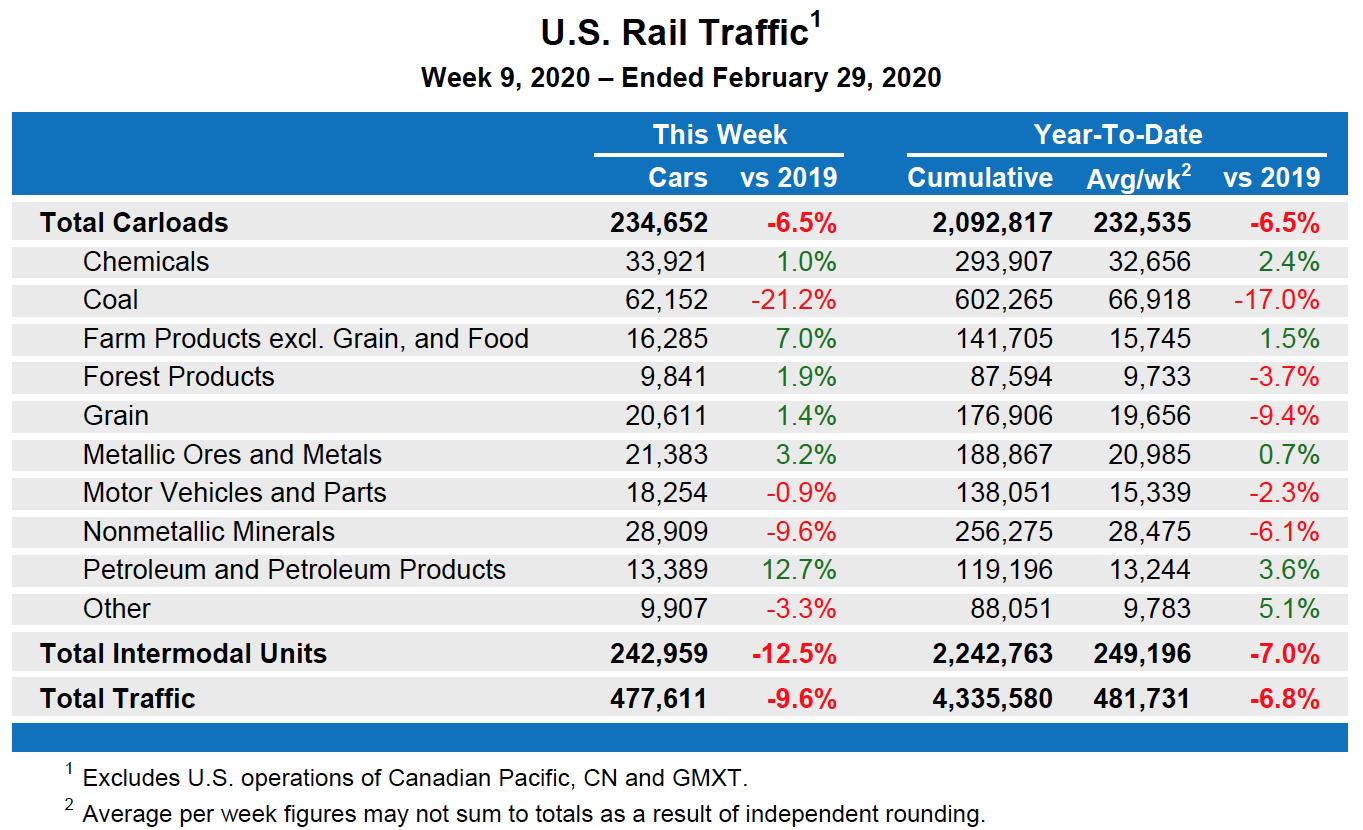

Total U.S. carload traffic for the first two months of 2020 was 2,092,817 carloads, down 6.5%, or 146,168 carloads, from the same period last year; and 2,242,763 intermodal units, down 7%, or 167,978 containers and trailers, from last year.

Total combined U.S. traffic for the first nine weeks of 2020 was 4,335,580 carloads and intermodal units, a decrease of 6.8% compared to last year.

Week Ending Feb. 29, 2020

Total U.S. weekly rail traffic was 477,611 carloads and intermodal units, down 9.6% compared with the same week last year.

Total carloads for the week ending Feb. 29 were 234,652 carloads, down 6.5% compared with the same week in 2019, while U.S. weekly intermodal volume was 242,959 containers and trailers, down 12.5% compared to 2019.

Six of the 10 carload commodity groups posted an increase compared with the same week in 2019. They included petroleum and petroleum products, up 1,506 carloads, to 13,389; farm products excluding grain, and food, up 1,071 carloads, to 16,285; and metallic ores and metals, up 654 carloads, to 21,383. Commodity groups that posted decreases compared with the same week in 2019 included coal, down 16,712 carloads, to 62,152; nonmetallic minerals, down 3,069 carloads, to 28,909; and miscellaneous carloads, down 343 carloads, to 9,907.

North American rail volume for the week ending Feb. 29, 2020, on 12 reporting U.S., Canadian, and Mexican railroads totaled 335,568 carloads, down 4.2% compared with the same week last year, and 318,401 intermodal units, down 12.4% compared with last year. Total combined weekly rail traffic in North America was 653,969 carloads and intermodal units, down 8.3%. North American rail volume for the first nine weeks of 2020 was 5,932,245 carloads and intermodal units, down 5.1% compared with 2019.

Canadian railroads reported 80,166 carloads for the week, up 3.9%, and 58,116 intermodal units, down 14.4% compared with the same week in 2019. For the first nine weeks of 2020, Canadian railroads reported cumulative rail traffic volume of 1,259,604 carloads, containers and trailers, down 2%.

Mexican railroads reported 20,750 carloads for the week, down 5.8% compared with the same week last year, and 17,326 intermodal units, down 2.7%. Cumulative volume on Mexican railroads for the first nine weeks of 2020 was 337,061 carloads and intermodal containers and trailers, up 7.2% from the same point last year.

— From an Association of American Railroads news release. March 4, 2020.

In other news: Railroads will continue to fire workers, rip up more yards/ mainline, and scrap engines/rolling stock. Union Pacific and other class I’s intend to get out of the railroad business and invest in bitcoin and Bernie Sanders.

Thank you Mr Brown.

Aha! We have our first comment proclaiming how railroads are dying and declining in a booming economy. It wouldn’t be a trains.com comment section without it! I agree, this is totally because of PSR and management, and has nothing to do with other economic factors, such as a slump in manufacturing. And we all know that all the freight has gone to trucks, even though trucking volumes are also struggling. And forget the fact that excluding coal and grain, carloads saw a negligible decline. Of course, when coronavirus related shutdowns start to impact intermodal volumes in a few weeks, it will be because of the big bad PSR railroad management.

The only industry going backwards in a booming economy.