Probably about the same as every other railroad.

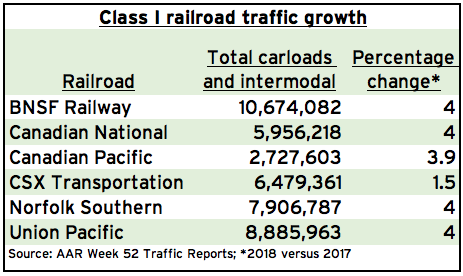

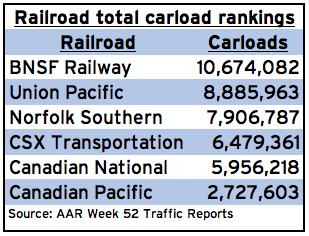

Five of the big six Class I systems ran neck-and-neck and ended 2018 with 4-percent traffic growth, according to a review of the railroads’ Association of American Railroads weekly carload reports for the final week of the year.

CSX Transportation, which continued to tweak its service offerings amid its shift to Precision Scheduled Railroading, was the lone outlier with overall volume growth of just 1.5-percent.

The final traffic tallies, which the railroads will release during quarterly earnings later this month, may differ slightly from the Week 52 data.

But the AAR numbers show the big picture: Broad traffic gains amid strong freight demand.

Some analysts, however, have said that the year was a missed opportunity for railroads, which failed to fully capitalize on tight trucking capacity and soaring trucking rates. Service issues across the industry prevented Class I railroads from gaining more volume.

While not an apples-to-apples comparison, data from the American Trucking Associations supports the notion that railroads fell short.

Through November, the latest data available, trucking tonnage was up 7.2 percent for the year.

Total U.S. rail traffic was up 3.7 percent for the year, according to AAR figures that measure total carloads and intermodal units carried.

“Rail service constrained growth rates last year, by either not being adequate to entice shippers to move goods by rail intermodal instead of truckload carriers — even if truck is more expensive — or by absorbing more equipment to the point that shippers were unable to obtain adequate equipment to use intermodal to shift volumes away from truckload carriers,” says Todd Tranausky, vice president of rail and intermodal services at FTR Transportation Intelligence.

The AAR said U.S. carload traffic was up 1.8 percent for the year, while intermodal traffic grew 5.5 percent. The industry figures differ from the individual Class I weekly carload reports because they count originations, which filters out the impact of interchange traffic.

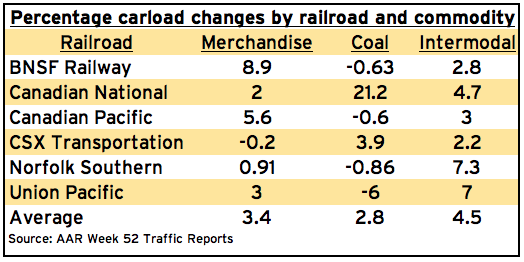

On BNSF Railway, for example, merchandise traffic grew faster than intermodal volume. This was due to strong growth in grain, chemicals, and petroleum traffic.

Canadian Pacific’s merchandise traffic also outpaced its intermodal growth, largely due to surging crude oil, chemicals, and energy-related shipments, plus growth in potash traffic.

Norfolk Southern captured the intermodal growth crown, with traffic up 7.3 percent.

Union Pacific wasn’t far behind, with intermodal volume up 7 percent thanks in large part to winning the contract to handle ONE Alliance international intermodal traffic.

Coal traffic was a mixed bag. It was down slightly on three railroads (BNSF, CP, and NS), down sharply on Union Pacific, and up on CSX and Canadian National. Export coal traffic drove the coal surge on both CSX and CN.

In the case of CN, the reopening of mines in Western Canada, along with a sharp increase in exports via the Port of Mobile, Ala., was behind its 21-percent rise in coal volume.

Part of it stems from changes the railroad made to its intermodal network in 2017.

E. Hunter Harrison, who was then the railroad’s chief executive, scuttled its hub-and-spoke system of handling intermodal traffic between low-volume origins and destinations. That resulted in a loss of 7 percent of the railroad’s intermodal traffic and made 2018 versus 2017 comparisons difficult.

Considering that — and interline service changes made with UP and BNSF in the fall — CSX’s 2.2-percent intermodal volume gain looks much more robust than the numbers would otherwise suggest.

CSX was the only Class I railroad to show a decline in merchandise traffic. This is likely the result of shippers diverting traffic to the highway and rival NS as CSX suffered service problems in the summer and fall of 2017 amid Harrison’s rapid-fire rollout of major operational changes.

Some of that traffic returned to CSX rails in 2018 — but not all of it.

The Class I railroads are expected to report record and near-record financial results later this month for the fourth quarter and full year.

CSX still can’t grow traffic with the industry.