U.S. railroads originated 1,264,100 carloads in July 2019, down 4.8%, or 64,406 carloads, from July 2018. U.S. railroads also originated 1,314,333 containers and trailers in July 2019, down 6.1%, or 84,878 units, from the same month last year. Combined U.S. carload and intermodal originations in July 2019 were 2,578,433, down 5.5%, or 149,284 carloads and intermodal units from July 2018.

In July 2019, six of the 20 carload commodity categories tracked by the AAR each month saw carload gains compared with July 2018. These included: petroleum and petroleum products, up 6,465 carloads or 11.5 percent; all other carloads, up 2,866 carloads or 9.9 percent; and metallic ores, up 2,456 carloads or 7.7%. Commodities that saw declines in July 2019 from July 2018 included: coal, down 43,954 carloads or 10.3 percent; crushed stone, sand and gravel, down 6,350 carloads or 5.1 percent; and primary metal products, down 4,884 carloads or 9.9%.

“Rail traffic in July, as in many other recent months, was held back by declines in three of the largest rail traffic segments, coal, grain, and intermodal,” said AAR Senior Vice President of Policy and Economics John T. Gray. “Despite a summer heat wave of historical proportions, very low prices for natural gas have seriously weakened the seasonal demand for coal-generated electrical power. These same low natural gas prices appear to have allowed chemical production to pretty much hold steady even in the face of the uncertainty around foreign trade which has been the source of much of the recent growth in chemical production. With 50% of rail intermodal business which is overseas — including international trade, both imports of consumer and intermediate manufacturing components and exports such as food products — trade policy uncertainty continues to drag down this traffic segment. Export grain movements are also facing increasingly serious headwinds from threats to trade policy stability.”

Excluding coal, carloads were down 20,452 carloads, or 2.3%, in July 2019 from July 2018. Excluding coal and grain, carloads were down 16,794 carloads, or 2.2%.

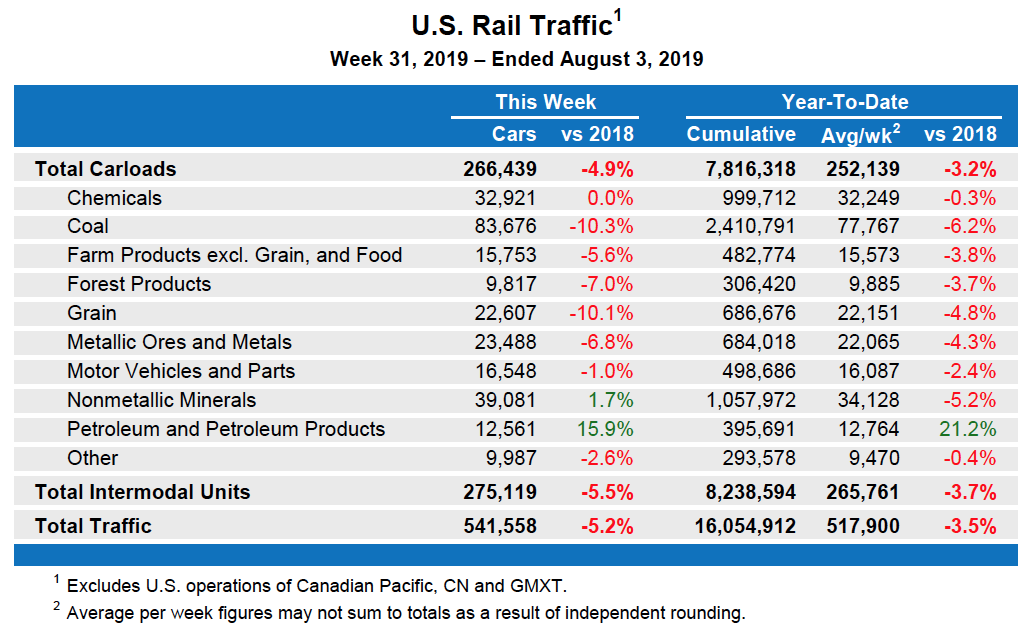

Total U.S. carload traffic for the first seven months of 2019 was 7,816,318 carloads, down 3.2%, or 259,574 carloads, from the same period last year; and 8,238,594 intermodal units, down 3.7%, or 314,125 containers and trailers, from last year.

Total combined U.S. traffic for the first 31 weeks of 2019 was 16,054,912 carloads and intermodal units, a decrease of 3.5% compared to last year.

Week Ending Aug. 3

Total U.S. weekly rail traffic was 541,558 carloads and intermodal units, down 5.2% compared with the same week last year.

Total carloads for the week ending Aug. 3 were 266,439 carloads, down 4.9% compared with the same week in 2018, while U.S. weekly intermodal volume was 275,119 containers and trailers, down 5.5% compared to 2018.

Two of the 10 carload commodity groups posted an increase compared with the same week in 2018. They were petroleum and petroleum products, up 1,724 carloads, to 12,561; and non-metallic minerals, up 669 carloads, to 39,081. Commodity groups that posted decreases compared with the same week in 2018 included coal, down 9,657 carloads, to 83,676; grain, down 2,533 carloads, to 22,607; and metallic ores and metals, down 1,706 carloads, to 23,488.

North American rail volume for the week ending Aug. 3, on 12 reporting U.S., Canadian, and Mexican railroads totaled 368,128 carloads, down 4.5% compared with the same week last year, and 368,028 intermodal units, down 4.1% compared with last year. Total combined weekly rail traffic in North America was 736,156 carloads and intermodal units, down 4.3%. North American rail volume for the first 31 weeks of 2019 was 21,896,352 carloads and intermodal units, down 2.3% compared with 2018.

Canadian railroads reported 81,433 carloads for the week, down 3.6%, and 75,261 intermodal units, up 2.9% compared with the same week in 2018. For the first 31 weeks of 2019, Canadian railroads reported cumulative rail traffic volume of 4,684,404 carloads, containers and trailers, up 2%.

Mexican railroads reported 20,256 carloads for the week, down 3.8% compared with the same week last year, and 17,648 intermodal units, down 10.4%. Cumulative volume on Mexican railroads for the first 31 weeks of 2019 was 1,157,036 carloads and intermodal containers and trailers, down 3.4% from the same point last year.

— An Association of American Railroads news release Aug. 7, 2019.

this is how you know a recession is right around the corner!

What are trucking companies reporting as far as freight volumes right now? I’d like to see if this is economic or as much PSR-related sloughing off of “less profitable” traffic.

Mini economic pop.. Probably won’t see any growth until 3rd Qtr 2020. could come sooner but the indexs are proving otherwise..