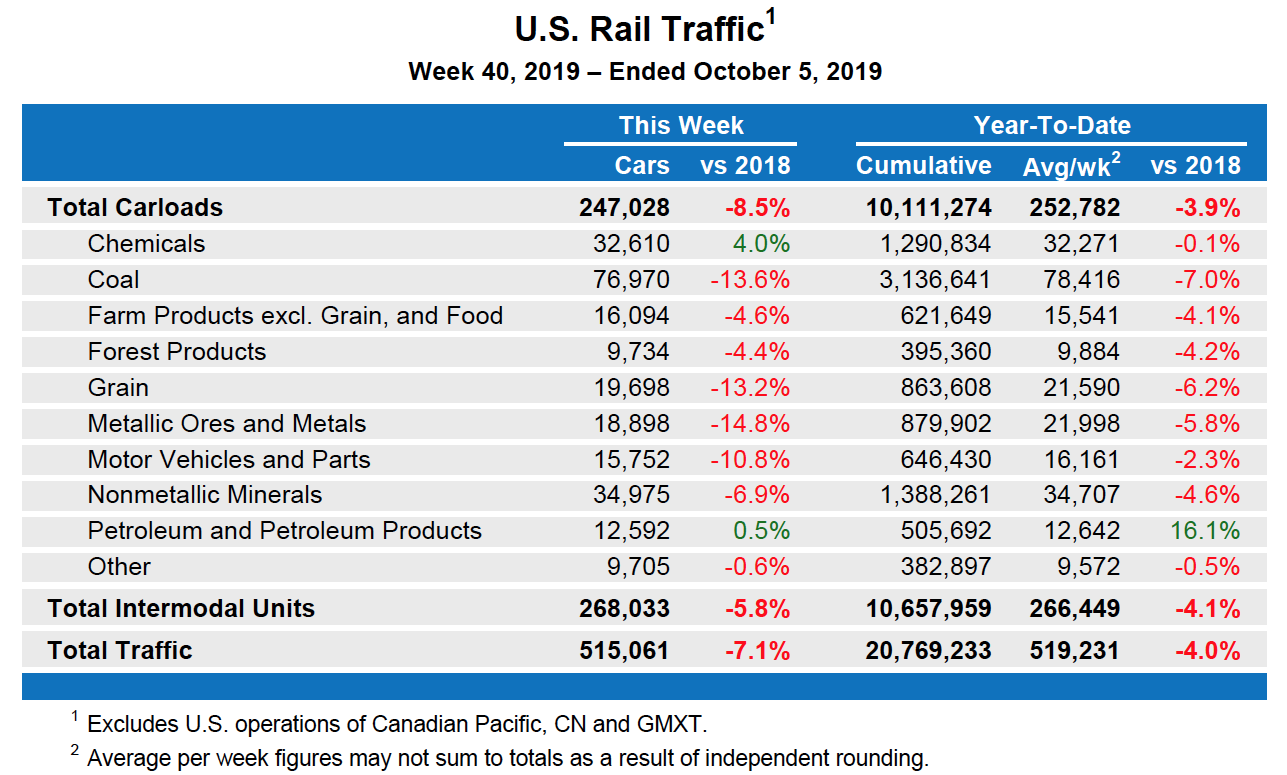

For this week, total U.S. weekly rail traffic was 515,061 carloads and intermodal units, down 7.1% compared with the same week last year.

Total carloads for the week ending Oct. 5 were 247,028 carloads, down 8.5% compared with the same week in 2018, while U.S. weekly intermodal volume was 268,033 containers and trailers, down 5.8% compared to 2018.

Two of the 10 carload commodity groups posted an increase compared with the same week in 2018. They were chemicals, up 1,247 carloads, to 32,610; and petroleum and petroleum products, up 57 carloads, to 12,592. Commodity groups that posted decreases compared with the same week in 2018 included coal, down 12,097 carloads, to 76,970; metallic ores and metals, down 3,271 carloads, to 18,898; and grain, down 2,995 carloads, to 19,698.

For the first 40 weeks of 2019, U.S. railroads reported cumulative volume of 10,111,274 carloads, down 3.9% from the same point last year; and 10,657,959 intermodal units, down 4.1% from last year. Total combined U.S. traffic for the first 40 weeks of 2019 was 20,769,233 carloads and intermodal units, a decrease of 4% compared to last year.

North American rail volume for the week ending Oct. 5, 2019, on 12 reporting U.S., Canadian and Mexican railroads totaled 343,401 carloads, down 8.6% compared with the same week last year, and 360,046 intermodal units, down 3.9% compared with last year. Total combined weekly rail traffic in North America was 703,447 carloads and intermodal units, down 6.3%. North American rail volume for the first 40 weeks of 2019 was 28,351,266 carloads and intermodal units, down 2.9% compared with 2018.

Canadian railroads reported 76,176 carloads for the week, down 11.7%, and 72,550 intermodal units, up 3.6% compared with the same week in 2018. For the first 40 weeks of 2019, Canadian railroads reported cumulative rail traffic volume of 6,073,046 carloads, containers, and trailers, up 1.2%.

Mexican railroads reported 20,197 carloads for the week, up 2.9% compared with the same week last year, and 19,463 intermodal units, down 2.8%. Cumulative volume on Mexican railroads for the first 40 weeks of 2019 was 1,508,987 carloads and intermodal containers and trailers, down 2.8% from the same point last year.

— From an Association of American Railroads news release. Oct. 9, 2019.

Most of the Class I’s have driven off the carload business. Around here they jack the prices up high on purpose so people switch to trucks and they can abandon the line and scrap it. Hardly the plan for growth and it’s been the plan they’ve been following for the past 40 years. But hey, as long as it keeps Wall Street happy this quarter who cares right?

Even the volume increases for the two (2) carload commodity groups (chemicals & petroleum/ petroleum products) were rather modest. It does seem that either the railroads are walking away from certain elements of business or the industrial economy that they serve is slowing down.

The economy maybe not as robust as a year ago, but railroads offer lousy service vs trucking. Trucker s are having some challenges too, but not nearly as bad as rail. PSR and softer economy equals trouble for the railroads. Too, the railroads have not been inclined to soften rates vs trucks.

As the railroads go, so goes our national economy. Historically, rail traffic has been a reliable leading indicator of the national economy. The ride may get bumpy.

@Christophe Parker, grain is a commodity that the railroads have locked up pretty solidly. Very little of what they move by rail can be moved easily on other modes, because it is predominately high-tonnage moves from the heartland to tidewater ports or larger manufacturing plants hundreds of miles away. That keeps trucking limited to moving the harvest directly to nearby elevators and processing plants.

Most of the weakness in grain movements can be attributed to the trade war, and most of the coal decline can be attributed to declining use of coal by the nation’s powerplants and flat export volume. Auto parts are down as auto manufacturing has been essentially in a recession for the last year or so, plus the GM strike is NOT helping that at all.

The telling weaknesses, then, for the overall economy, are the metallic ores and minerals, plus intermodal.

But intermodal is also weak in part due to the trade fight. It is not a stretch to say that the economy would probably still be growing around 3% if not for the trade war. At this point it seems like we either keep going down that path and attempt to “win” or fold and get back to higher growth. Who knows, that’s above my pay grade!

Grain is interesting. Does that decline represent a lower harvest or lower market share? Is PSR cutting into grain shipments, especially on UP?

So we want our economy instead to be controlled by a dictatorship who cheats, has govt control over all of its businesses, mistreats/enslaves its citizens, and has missiles pointed at us? There are other places in the world to make things and sell stuff to.

I kind of wonder if the railroads considered going after movement of LNG. It is not without risk however it would be an addon to hauling crude oil by rail. And would give LNG the ability to use spot markets more effectively.

I had the opportunity to ride with the crew of the West Knoxville Switcher while at the University of Tennessee in the 1980s. I recall the crew talking about how the railroad “ran all the business away” and “they only cared about unit coal trains.”

During my rides we switched an industrial park. In the past, this area had enough business to receive service three times a day. When I “cubbed” it was down to once a day and I’d wager it is not even served today. Likewise, all across the nation there are places, like my hometown of 42,000, which has not received a load of lumber by rail in thirty years!

The Staggers Act was supposed to allow the railroads to grow and regain traffic lost to the competing modes. Instead, they have served the investor not the customer or the good of the nation. I say with record employment numbers and lowered carloadings its time for some form of re-regulation.

Trump is out to destroy America’s economy with his trade wars. Stand up America!