The pandemic-related collapse of rail traffic in April — U.S. carload volume down 25%, intermodal off 17% — was unprecedented as large sectors of the economy shut down.

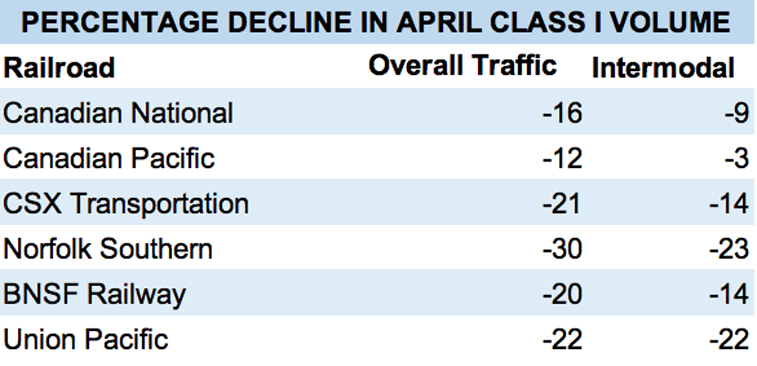

The impact varied on the big six Class I systems, however, with Canadian railways faring better than their U.S. counterparts, thanks in no small part to record volumes of grain that both Canadian National and Canadian Pacific moved during April. Canadian intermodal traffic also was down less than U.S. volumes.

BNSF Railway, CSX Transportation, and Union Pacific traffic sank 20%, 21%, and 22%, respectively, last month, according to weekly carload data reported to the Association of American Railroads.

The industry outlier in April, as in the first quarter, was Norfolk Southern. Its traffic was off 30% last month, with coal down 52%, merchandise by 33%, and intermodal slumping 23%.

Coal volume was down 30% at UP, 37% at CSX, and 38% at BNSF. Norfolk Southern’s outsized decline in coal was driven by extremely high utility stockpiles, a mild winter, and record-low natural gas prices that have made coal uncompetitive as a fuel for generating electricity at plants it serves, NS executives say.

Wall Street analysts attributed the larger NS declines in merchandise and intermodal traffic to the railroad’s focus on boosting profit margins, which likely sent some traffic to the highway amid loose truck capacity and lower diesel prices. The railroad’s revenue per unit was up 4% in the first quarter, the 13th straight quarterly rise.

“They are focusing in the short-term on yield over volume,” independent analyst Anthony B. Hatch says.

It’s too soon to tell whether that will lead to slower growth or a loss of traffic to trucks, Hatch says. And now the economic upheaval caused by the pandemic will make it difficult to reach conclusions about the potential impact of pricing on the railroad’s volume trends, he says.

In response to its steeper traffic declines, NS cut this year’s capital expense budget more deeply than other Class I systems. NS now aims to spend around $1.5 billion this year, a 25% reduction that for now puts its spending below that of the other five big systems.

“To me it’s a little concerning,” Hatch says, particularly reducing spending on information technology. Companies involved in developing electric and autonomous trucking, he points out, are not cutting back on their technology spending.

The AAR put April’s traffic declines in historical context.

“Any industry that’s been around for 190 years has experienced a lot, but railroads have never faced something quite like what they’re facing now: huge swaths of their customer base shut down, with no clear idea when things will get better,” the AAR wrote in its Rail Time Indicators publication.

“The good news is that this too shall pass,” the AAR says. “The bad news is that nobody yet knows when that will happen or how long it will take.”

“Our only certainty is that successful navigation of these unknowns will require flexibility, innovation, and determination — all characteristics the rail industry has demonstrated in past emergencies and that will see the industry through this one too,” the AAR says.

Don’t go giving them ideas! I once speculated on turning the Boston & Albany into a private toll road for trucks. With automated driverless trucks running back and forth DON’T GIVE THEM ANY MORE IDEAS!! But unbelievable operating ratios. Of course the New York Westchester & Boston for awhile had a low operating costs for passenger traffic–until you took into account the capital costs–until the traffic started to disappear.

No business, if it wants to stay in business long term, throws customers away. The railroads are cutting their own throats in the pursuit of the almighty OR.

The real problem is that railroads are making largely PERMANENT changes to address a TEMPORARY issue.

This is what the owner operators want the railroads out of business i think truckers are working within the railroads just to run them out and when it is over they will charge anything they want because their is no other way to move it .

When Union Pacific throws the towel in on running unit trains like Cold Connect you have to wonder if they really want to carry anything but the lowest of the low hanging fruit of freight traffic? Today’s railroad industry is pathetic. Remember, carloads were even decreasing during a rebounding economy! They have ran off a staggering amount of business with glee. Refusing to put up a fight, they surrender vast areas of the country to trucking. Here in North Alabama we have recently located a Target distribution center, a Toyota engine plant and a Polaris assembly line. Large industries with none using the railroad. The amount of local rail business run off is equally concerning. Today’s railroad managers know nothing about success unless it involves reduction. Lets save them the embarrassment of destroying the industry and pave over all the rails for truck highways now. Morons.