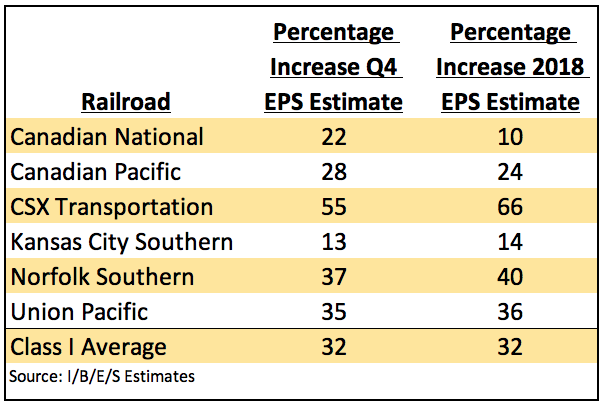

For the fourth quarter and the full year of 2018, Wall Street analysts expect the six publicly traded Class I railroad earnings per share to increase by 32 percent, on average, according to a Trains News Wire review of I/B/E/S estimates.

Analysts expect CSX to sit atop the industry with earnings per share growth of 55 percent for the quarter and 66 percent for the full year, according to I/B/E/S, as the railroad continues its financial turnaround under Precision Scheduled Railroading.

With an operating ratio of 60.3-percent for the first nine months of the year, CSX may report a full-year operating ratio below 60 percent, which would reach a three-year target well in advance of the timeline spelled out at the railroad’s investor day in March.

Next up is Kansas City Southern, which is due to report its earnings on Friday. Analysts expect 13 percent earnings per share growth for the quarter, and 14 percent for the year, according to I/B/E/S.

Question marks for KCS include intermodal volumes in Mexico and the impact of congestion on its cross-border traffic.

Canadian Pacific will report earnings on Jan. 23. The consensus estimate for CP’s earnings per share is up 28 percent for the fourth quarter and 24 percent for the full year.

Union Pacific and Norfolk Southern — two railroads adopting operating plans based on the principles of Precision Scheduled Railroading — are due to report earnings on Jan. 24.

UP, which last week said it would post a full-year improvement in its operating ratio due to a better-than-expected December, is expected to show earnings per share gains of 35 percent for the quarter and 36 percent for the year, according to I/B/E/S.

The railroad is expected to provide an update on its shift to Precision Scheduled Railroading. It’s unclear whether new Chief Operating Officer Jim Vena — who began work today — will participate in the earnings call with analysts and investors.

UP’s stock surged more than 8 percent in one day last week after the railroad announced the hiring of Vena, a respected PSR veteran who served as Canadian National’s operations chief from 2013 to 2016.

Analysts expect NS earnings per share to rise 37 percent for the quarter and 40 percent for the full year, according to I/B/E/S.

NS is expected to provide detail on its improved operating metrics. But otherwise the earnings call should be relatively short on details as the railroad has an investor day scheduled for Feb. 11 to cover its new operating plan and longer-term financial outlook.

CN closes out the publicly traded railroads’ earnings reports on Jan. 29. The consensus estimate is for earnings per share growth of 22 percent for the quarter and 10 percent for the year, according to I/B/E/S estimates, as congestion-related costs weighed on CN’s financial results and volume growth in the first nine months of 2018.

The railway is expected to provide a detailed update on how new track capacity, along with additional locomotives and crews, helped it restore service levels on its busy Edmonton-Winnipeg-Chicago corridor.

BNSF Railway, a unit of Berkshire Hathaway, is expected to report its quarterly and full-year earnings alongside its parent company on or around Feb. 22.

Short line and regional railroad operator Genesee & Wyoming, meanwhile, is scheduled to report its financial results on Feb. 6. The consensus estimate for G&W’s earnings per share growth is 19 percent for the fourth quarter and 29 percent for the year, according to I/B/E/S.

As far as CSX goes is the rise in earnings a short term thing because of drastic cuts in spending or a long term pattern of revenue growth. I would have the same question for the other railroads as well.

But you really never see their prosperity as it feeds the Fat Cats. CSX has used the same worn out and tell nothing image on its blue boxcars for over thirty years now. How about telling the nation?