OMAHA, Neb. — Union Pacific has stopped building its new classification yard in Texas, idled the humps at yards in Oregon and Arkansas, and plans more yard rationalizations in the coming months as it switches freight cars fewer times under its new Precision Scheduled Railroading operating plan.

UP has paused construction at the $550 million Brazos Yard outside Hearne, Texas, for two reasons: Its switching capacity isn’t needed now but longer passing sidings are. The railroad had touted Brazos as its largest capital project in history, and as recently as March said it was still a vital yard that it might use differently than originally designed. [See “Union Pacific remains committed to new Texas hump yard, but may use it differently,” Trains News Wire, March 6, 2019.]

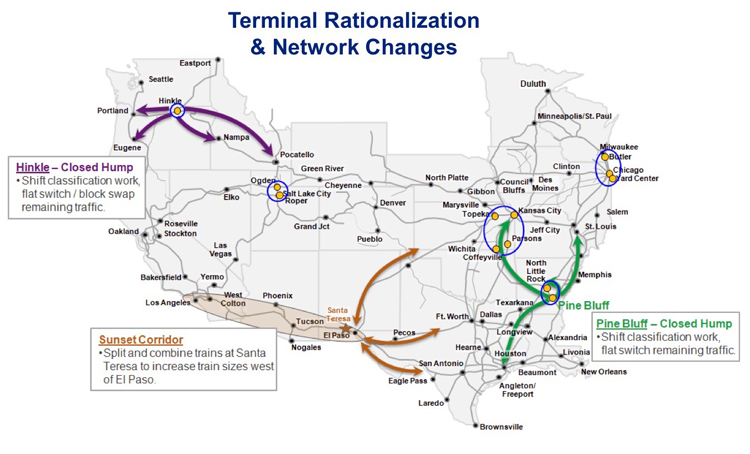

“The remaining capital dollars planned for Brazos in 2019 will be reallocated to siding extensions on the Sunset Corridor and a block-swapping yard in Santa Teresa, which will add to our network flexibility,” Chief Operating Officer Jim Vena told investors and analysts on the railroad’s earnings call Thursday morning.

Santa Teresa, in New Mexico, is just west of El Paso, Texas, on the former Southern Pacific Sunset Corridor that links Southern California and Texas. UP will split and combine trains at Santa Teresa to increase train lengths west of El Paso.

Running longer trains — which reduces train starts and locomotive and crew requirements — is a key element of the Precision Scheduled Railroading operating model UP began implementing in October.

The Unified Plan 2020 also calls for a reduced emphasis on major terminals as cars are pre-blocked at origin and sent further into the network before being switched.

Vena emphasized that the hump shutdowns at Hinkle, Ore., and Pine Bluff, Ark., were the result of reduced switching volumes, not a desire to idle humps.

“I don’t wake up in the morning and say ‘I am going to shut down another hump yard,” Vena says.

Converting hump yards to flat-switching facilities is a byproduct of reducing car handlings en route and bypassing intermediate switching. It’s not a goal in and of itself, he says.

“There is nothing wrong with a hump yard. It’s the most efficient way to handle 1,800-2,000 cars a day,” Vena says. “There is nothing better. It’s low cost, it works well.”

But more yard closures or conversions to flat-switching are likely by the end of June as UP continues to fine-tune its operating plan, officials said.

Also among the targets: Consolidating UP’s network of intermodal terminals in the Chicago area.

UP executives did not provide a timetable for resuming work at Brazos Yard, which sits at the strategic junction of seven main lines. They also did not say whether the yard would be built as a hump yard or a flat-switching facility where trains would pause to swap blocks of traffic.

UP’s terminal rationalizations will contribute to the railroad’s plan to gain at least $500 million in productivity savings this year amid its shift to an operating plan based on PSR principles.

Don Armstrong: Are you an actual railroad customer?

Yes, railroading is shrinking for the all mighty dollar for Wall Street. The suits know it as they laugh all the way to the bank. By the time regulation returns there will be but a fraction of the business left. Look what happened to the passenger train until Amtrak came along. Drive the Interstate highs and uou will discover where all the business is going. Companies don’t give a hoot about PSR they just want their stuff on time for the lowest the lowest cost.

Watching an industry shrink itself into oblivion. Not pretty. It will be worst when a strong, harmful re-regulation is in place. It’s coming, shippers will be screaming for it.

@Steven Bauer: I have driven through there once and don’t care to again.

If I could post before and after photos here I would. B&O CT Robey used to have a parking yard (Lincoln Yard) between Wood Street and Wolcott Street where they stored passenger coaches for Grand Central Station. There was an engine shop, roundhouse/turntable west of that at Wolcott and Damen. Wolcott and Wood both used to go under the yards. Wood still does but Wolcott was probably filled in as the entrance is fenced off and you can;t drive under anymore.

I checked with CNW history and it says CNW bought Robey in 1983 (prior to UP) and renamed the merged yard Global 1 in 1984.

When Grand Central was torn down in 1971, Robey lost much of its purpose and it existed as an island because it was never connected to the main B&O network. It had to traverse the Rock Island at Beverley to reach home rails to the east. It was made worse when the US Corp of Engineers made B&O build a new Chicago River bridge in 1930. (which still stands in the upright position)

@Steven Bauer: The CB&Q Western Ave yards, the CNW Wood Street Yards (“Potato Yard”) and the B&O CT Robey yards (At Damen) were all next to each other. Today it is the BNSF Western Ave yard, and the other 2 were merged into what is now Global 1.

Much of this was actually thought of over 10 years ago under Jim Young. I had the pleasure of speaking with him at Santa Teresa in August of 2011 and he specifically mentioned, although without great detail, that UP was looking to ratcheting up their intermodal presence over the course of 15-20 years while looking at where they could wring out old bottlenecks from not only their own original network, but also the inherited bottlenecks from MP, CNW, SP, and SSW. During that time, Mr. Young also mentioned that they would be looking into more long-term (50 plus years in future) strategic locations for classification work.

As to Paul Bouzide’s question about G4’s utilization, what started out as an up-start yard in 2010, less than 3 years later it would become the busiest intermodal terminal on the system with well over 500,000 lifts a year. Also, G4 sends and receives intermodal containers from NS (and possibly CSX) which thus adds to its importance for UP.

John, if you are referring to what we call the “Extension Yard” east of the CTA overhead as former BOCT Robey St you may be correct, and if you are, then I stand corrected on that end of it. All I ever saw that used for was storing empties or cuts of inbounds that couldn’t be spotted on the ramp tracks because the place was full. All I have ever known the whole place as since starting with the CNW in 94 is either G1 or just Wood St. I never did care for taking a train in our out of that place and I haven’t been in there in nine years and don’t miss it.

@Stephen Roberts anecdotally there’s been a lot of disappointment inside of and outside of UP with their direction regarding investing in the infrastructure for growth since Jim Young unfortunately passed.

Creating more profit while cutting real estate and workers always sounds great. The trouble is when you are a customer and your material is not delivered or your product does not get picked up or delivered when promised then it kills your profits. Eventually many firms go to trucks to move their product or they all get together and complain about lack of competition from the railroads.

Mr. Bauer has it right.

It’ll be interesting to see what shakes out. Since Yard Center is still used for Texas and Mexico domestic intermodal (lots of lucrative auto parts traffic in both directions thus lucrative) shifting to Global IV would add miles and face some amount of congestion around Dupo and East StL. In addition the Wabash trackage rights from KC might portend more traffic to G4. So how utilized or expandable is G4? And how many more trains – albeit IM not land barges – can the Alton handle without a political reaction from Amtrak? Many sidings on the Alton (with fast turnouts sure) are passenger train meet short. You can see some of them from parallel I-55.

Don’t sound the death knell for G3 either. The dray from Rochelle to Joliet (Chicago’s distribution center warehousing region) is around 100 fairly uncongested miles. G2 is closer at 50 miles but more traffic congestion. And there’s not a lot of room to expand G2. G3 is also a good block swap location for steel wheel interchange to eastern carriers. Yes only 36 miles from G1 to Joliet but even more congested.

On the carload side the Hinkle hump shutdown is old news already. But it’s interesting that they’re going to close Pine Bluff, which suggests that North Little Rock will be bidirectional again? Doesn’t mean the end of Cotton Belt southbound and MoPac northbound directional running but does add some circuity (more tolerable for carload than domestic intermodal) to get off the Cotton Belt into NLR and back out to the Cotton Belt again.

But what are they gonna do about “their network of (intermodal) terminals in Southern California?

Corporate suicide! Customer service just went into the tank!……again!

I imagine Yard Center will be closed with IM traffic shifting to G4..

John Rice, unless I haven’t been paying attention the last 26 years I have been running trains, Global 1 was an old CNW facility (Wood Street yard), not the BOCT. As for what they shoot in and out of the place, there are trains to and from the LA area, and Z trains for Portland and Salt Lake. G2 is not just PNW traffic. There are trains to and from Lathrop, a westbound Z for Oakland, westbounds to Seattle, and eastbounds from Portland.

G4 is not just Long Beach stuff, and not all of it travels the Alton. This of course does not include various shuttle moves between the various facilities.

I hope they can pull it off. Maybe I am seeing the teething troubles of implementation. Pre-implemtation of precision railroading there was so much traffic and now there seems to be nothing, but angry customers who were used to getting service when they need it in a just-in-time fast paced buisness world. Now we service them to balance out our manifest trains when space is available. I watch the BNSF line next door, the line is a parking lot because of the buisness that they picked up that used to run down our route. I see unit frac trains, unit grain trains, unit ethanol, unit DDG. Stuff that we used to haul. Now what we have fits on 2 manifest trains 1 in each direction. Luckily we still have the infrastructure, people (all though many are leaving for other companies) and sales force. We have to grow buisness again and just get back to where we were and surpass. Bring the ethanol producers, back to shipping to the national market instead of the local markets where they can reach with truck. Work with customers to grow their business as well as ours. Not force them into finding alternatives.

Utilize our hump yards for what they were meant to do. Moving large amounts of customers products safely and efficiently. Flat switching does wonders but there is only so much they can do when your growing buisness faster then the flat yards can handle. Other precision railroads solutions to too much traffic are simply embargos like the CN answer when their yards couldn’t handle the traffic we are the UP we set the path for other railroads to follow, not follow other failed systems.

@Lyle Petrick, here are some interesting UP numbers from their financial statements on their Web Site:

2014

Revenue $23,988 billion

Net Income $5,180 billion

Interest Expense $561 million

Long Term Debt $11,018 billion

Outstanding Shares 897 million

2018

Revenue $22,832 billion

Net Income $5,966 billion

Interest Expense $870 million

Long Term Debt $20,925 billion

2019 Q1

Long Term Debt $23,409 billion

Interest Expense – 1 Quarter – $247 million

Outstanding Share 719 million

Revenue in 2018 was only 95% of revenue in 2014, but they were able to squeeze more net income out of less revenue in 2018, with net income being 15% higher than 2014.

Of course, earnings per share are up with less shares outstanding.

They also have invested approximately the equivalent of what they have borrowed each year in to their capital budget, which is a good use of borrowed funds – using them to acquire long lived assets, much as an individual will borrow to purchase a house.

It is the age-old story – if they can control costs and become more efficient, they can generate net income, and if they can start increasing revenue, they will generate more net income.

Of course, if they lose too much traffic and have a high debt load with high annual interest expense payments, that will be when they could have difficulties. It appears their interest expense may exceed $1 billion in 2019.

But that is the same for any company in any industry – they must manage it closely.

The market seems to think UP can continue to carry more debt – they have a high bond rating and have no trouble selling bonds at reasonable interest rates.

Time will tell how UP’s story plays out.

@Braden Kayganich: Proviso currently services UP North, & UP Northwest (Seattle-Tacoma) and if needed services via UP Nelson (KCMO redirect via St Louis) line if redirected. Global IV captures traffic from the UP Alton line (usually from Long Beach). Rochelle sorts containers (Usually from Oakland) because Proviso doesn’t have room and most containers come from the west or the Alton lines anyway. Global 1 (the former B&O CT yard on Damen) is still used for containers (usually from Texas) and excess are stored on Canal Street. Some of the tracks on Canal are gone, and they store empties, piggybacks and empty TTX flatbeds.

If UP had an easy way to get the former CE&I (Global 1) over to Global IV at Joliet without tying up the Alton line, I think they would. CN has the EJ&E now.

This cost cutting gimmick is for short term profits. That’s it. Once assets are sold of. They’re gone. Logistical suicide. I like the short lines and regional more than ever. They are the real railroaders.

What did The Rock do that would be called precision scheduled railroading today?

I wonder if the recently announced trackage rights over NS between KC & Springfield, IL are related to the consolidation of Chicagoland intermodal terminals.

If the UP/SP split of The Rock had occurred, UP would have its own Chicago – KC line today. Instead they rely on trackage rights over others.

I can’t believe how fast UP is commiting financial suicide for activist investors. We are chasing customers off and storing assets so fast. At this rate we will be like GE just a shell of its former self totally looted. At least We will have good dividends for a few years. Kind of like the the Rock Island in the pre merger attempt with UP. The Rock practiced a version of what would become precision railroading and if left to run its course will end with same results. I wonder if management will stand up to these activist investors before they do permanent damage to the company and the economy or if government will be forced to intervene as Matt Rose and Warren Buffett fear.

Still waiting on the story on a Class I railroad, any class I railroad investing in marketing and train agents to actually grow traffic. At this point putting more faith in consolidation of Class I and more route miles being handed over to short lines and regionals

Switch cars less is definitely a good idea.

Tomorrow there will be an announcement that a new stock buyback has been authorized. Got to get money from somewhere.

UP’s planning to consolidate Global I and Global II it sounds like, and did they ever shut down Canal St.? I haven’t been by there in a few years. UP should’ve never built Global III. If anything Proviso should have been entirely converted to a ramp. Building a new hump at Rochelle would’ve made more sense.

If I remember correctly, some years back, didn’t Wheeling & Lake Erie kill off a perfectly good hump yard at Brewster and substitute block switching? Last time I was there, it seemed to be working just fine.

Sounds a bit like CSX’s New Baltimore fiasco, and NS’s at Greencastle; on again, off again, on again, and around we go.