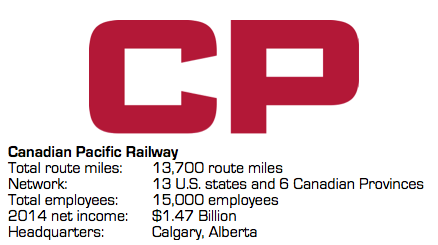

Discussing his company’s flirtation with CSX in October 2014, Canadian Pacific Chief Executive Officer E. Hunter Harrison mentioned that CP had looked at Norfolk Southern, too. Harrison allowed that only a “fine line” divided CSX and NS as potential merger partners, and if CP’s management techniques were applied to another railroad, “we’d get some pretty powerful numbers.”

Since then, the railroad industry’s fortunes have turned for the worse, hurt by declining carload traffic, an unexpected crash in energy prices that cooled off the crude-by-rail boom, and an accelerating trend away from coal as an energy source. Through Nov. 14, U.S. rail carload traffic in 2015 had declined 4.8 percent compared with 2014, dragged down by double-digit drops in coal loads beginning in February.

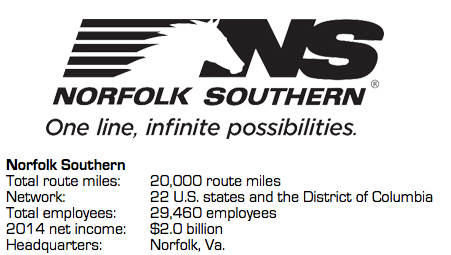

But cost-cutting can’t make up for this kind of top-line erosion. Through 2015’s third quarter, NS net income declined over 28 percent from 2014 levels, largely due to lower revenue, and NS stock dropped from the $110 range in December 2014 to around $80 in October.

Sensing NS’s weakness, Harrison and CP’s board made their move. In a Nov. 9 letter to NS Chairman and CEO James Squires, Harrison argued that “combining our two great organizations will allow us to form an integrated transcontinental railroad with the scale and reach to deliver unsurpassed levels of safety and service to our customers and communities while also increasing competition and creating significant shareholder value.”

CP offered to exchange $46.72 in cash (all figures in U.S. dollars) and 0.348 shares of stock in a new holding company owning both railroads for each NS share, with a total deal value of about $28 billion.

When Harrison met with Squires on Nov. 13, he got a cool reception, according to the Wall Street Journal. NS, whose management previously had expressed reservations about a new round of mergers, grudgingly announced afterward that it would evaluate this “low-premium, non-binding, highly conditional indication of interest” in accordance with its legal responsibilities. The proposal is unlikely to win the board’s endorsement. Why? The proposal offers NS stockholders just a nine percent bump from current prices, and saddles them (as continuing owners) with the risk that CP may not be able to extract synergies after the transaction closes.

To realize these objectives, though, CP will have to close a deal with NS’s board — a higher offer can’t be ruled out — and then secure the approval of both the U.S. and the Canadian governments. NS believes “any consolidation among Class I railroads in North America would face significant regulatory hurdles,” specifically convincing the Surface Transportation Board that the combination would mitigate any anti-competitive effects.

CP has answers for that argument, though. Echoing concepts that Harrison floated a year ago during the CSX uproar, CP said that if the combined railroad failed to provide “adequate service or competitive rates,” it would let a competing railroad serve disadvantaged shippers. Also, CP would make through rates over any gateway with connecting carriers, ending the practice of “bottleneck” pricing.

Looking at a map, it’s difficult to see how a CP-NS combination would lend itself to traditional merger-related efficiencies. The new holding company presumably would close the equivalent of one corporate headquarters, but there aren’t many parallel lines or redundant facilities to rationalize. CP might have to sell the former Milwaukee Road line to Kansas City and its operations over NS between Chicago and Detroit to address competitive concerns, if anyone wants to acquire them. Possibly CP trains could be rerouted to NS terminals in the Chicago area, permitting the railroad to vacate and redevelop Bensenville Yard, which (being next to Chicago O’Hare International Airport) represents an outstanding real estate opportunity.

CP claims the combination would go a long way toward improving the performance of the crucial Chicago terminal, which its president, Keith Creel, called “the Achilles’ heel of the industry” on Nov. 17. According to CP, the merger would “create fluid routes through under-utilized hubs,” freeing up capacity in Chicago for future traffic growth. CP didn’t name these hubs, though. The existing tunnel between Detroit and Windsor, Ont., won’t clear double-stacked domestic containers, and a CP-backed project to bore a new tunnel that would was idled earlier in 2015. Buffalo is another option, but the only region NS serves directly from that gateway is New England, ironically over the portion of the Delaware & Hudson it recently bought from CP. Perhaps CP is thinking of the Indiana Harbor Belt, since the combination would achieve Harrison’s long-sought objective of controlling his own belt line through the Chicago area.

Leave ns alone Harrison don’t ask for a merger. Ns doing fine they need a merger

The Allentown portal would work as well. Coming down from Buffalo and onto the RBMN and over to the Upper Lehigh Line, Into Allentown,Bethlehem area and then on to Philadelphia and end points along the NJ Coast. The Upper Lehigh Line has plenty of room for expansion. At one time it was 3 tracks wide. Not much if anything is in the way. Most, if not all the bridges are still intact and in use. An even crazier idea would to buy the RJ Corman Allentown operations since it's basically abandoned anyway. and use that as an overflow.

In addition to New England, Buffalo hub can easily provide access metro NYC/Philly/NJ via NS yards at Allentown (as trains 36T/37T currently do) and Oak Island. Intermodal traffic could also easily reach NS facilities in NJ via the Southern Tier line and either the ex-D&H/ex-LV or CNY (ex-Erie Delaware line).

The photo caption which identifies the location as "Northwood, Ohio" is know as "Vickers" to railroaders.

"Buffalo is another option, but the only region NS serves directly from that gateway is New England, ironically over the portion of the Delaware & Hudson it recently bought from CP"

I think the author overlooked NS's Buffalo line, which runs from Buffalo to Harrisburg.

Why would CP go after just KCS or NS when they could go after both? They would fit very well together, but with 3 lines to Kansas City they might have to sell the former Gateway Western. I could see BNSF, UP, CN, and/or CSX being interested.

If this happens, and I hope that it doesn't, how many current shippers might decide to switch to truck service exclusively?

Why in the world would CPRS have to sell it's mainline to Kansas City? CPRS NEEDS to have that link to the Kansas City gateway; particularly from the Twin Cities. I've said it before and I'll say it again – CPRS SHOULD be going after KCS – not NS.