One glance at the volume levels at CSX’s top 10 terminals shows why the railroad is quickly moving to convert its hump yards to flat-switching facilities: The only hump that clears Harrison’s hurdle is Waycross, Ga.

And out of the other 11 hump yards CSX operated last year, only three — Selkirk, N.Y.; Nashville, Tenn.; and Willard, Ohio — processed more than 1,400 cars per day, according to CSX’s annual report. But they are likely to handle less traffic under Harrison’s operating plan.

“It’s not just changing it for the sake of changing switching operations,” Cindy Sanborn, CSX’s chief operating officer, told an investor conference today. “It is part of the larger plan of making transit across the network faster.”

CSX is making sweeping changes to its operating plan, including bypassing intermediate terminals to move traffic as efficiently, quickly, and reliably as possible.

“If there’s not enough cars that want to go there to support the infrastructure needed to maintain and utilize the hump, then we simply don’t need it,” Sanborn says. “We can move over into flat-switching operations.”

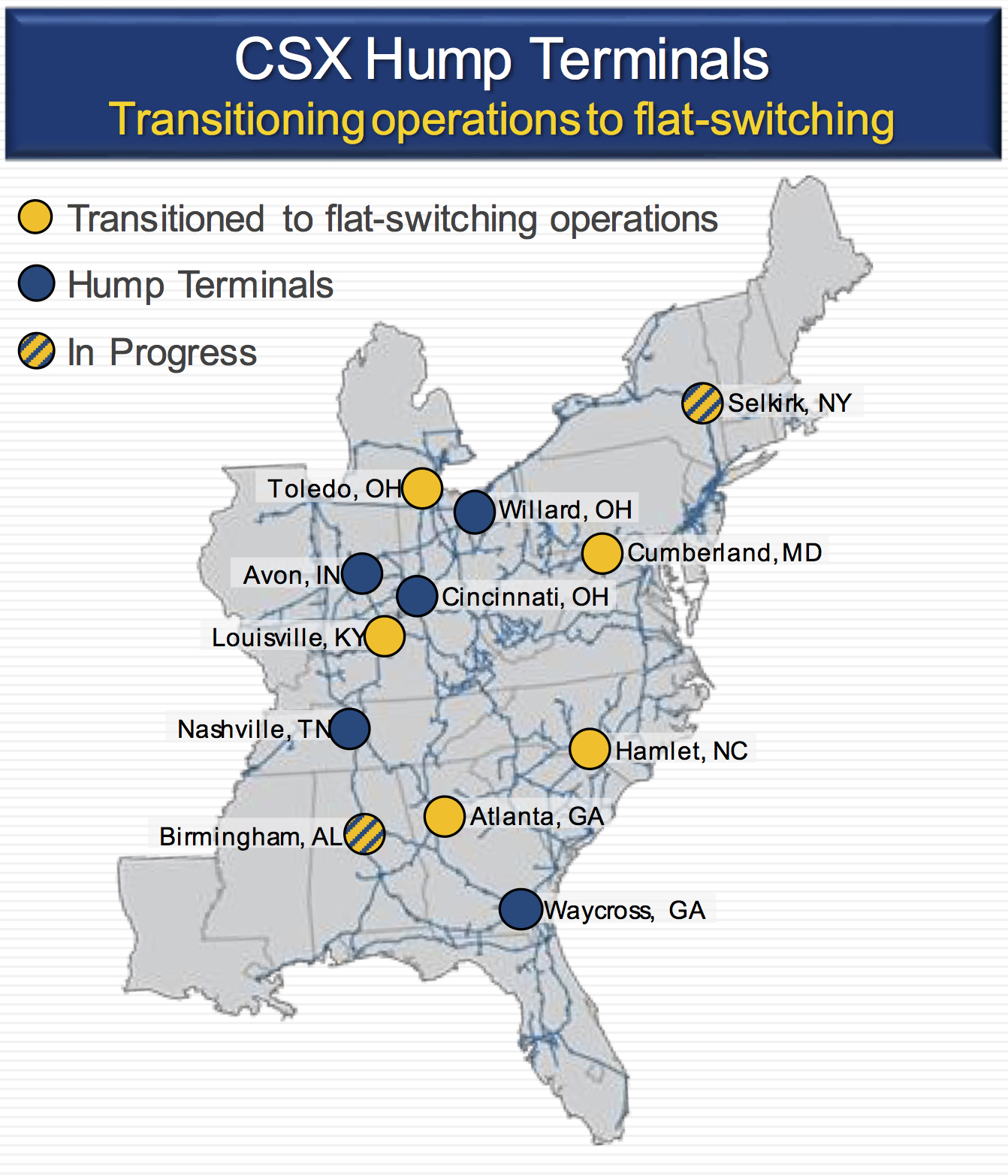

Sanborn today confirmed that CSX is transitioning the Birmingham, Ala., and Selkirk hump yards to flat-switching facilities, the sixth and seventh humps to be shut down since Harrison became chief executive in March. When those moves are complete, CSX will be left with five active humps.

But not for long.

“There’s not a specific number we’re aiming at, although it feels like we’ll probably be in two to three humps left when we are finished,” Sanborn told the Wolfe Research conference.

CSX has not yet said how much it expects to save by closing humps. But when Harrison was at CP, and idled four of the railway’s five humps in late 2012, he pegged the annual savings at $10 million or so per yard.

At the time, the Canadian dollar was roughly on par with the U.S. dollar, which suggests that CSX could achieve similar annual savings from shutting down humps, which are both maintenance- and labor-intensive. The total is a big number: $100 million annually if 10 humps are idled.

CSX’s carload traffic has been in long-term decline, reducing the need for hump yards.

Last year, CSX hauled 2.32 million merchandise carloads, not including automotive traffic that does not move over humps. That’s 605,000 fewer merchandise carloads than the railroad carried in 2000. Put another way, the traffic loss represents 22 fewer 75-car trains per day.

Merchandise traffic is CSX’s biggest business segment. It accounted for two-thirds of the railroad’s revenue in 2016. Sanborn says implementing precision scheduled railroading has the greatest opportunity to improve CSX’s merchandise service by making it faster and more reliable. And that, she says, should enable CSX to grow its merchandise traffic.

“Concurrent with making the changes in the hump network, we also are doing a very detailed deep dive into the overall operation in general,” Sanborn says.

CSX is bringing balance to its train plan, moving some unit train traffic into the merchandise network to create the density necessary to provide daily through train service, and adding local service seven days per week in some areas.

Wolfe Research analyst Scott Group noted that Harrison has written books explaining precision scheduled railroading. So why, he asked, didn’t CSX follow his recipe before?

“You can read a book about brain surgery but that doesn’t make you a brain surgeon,” Sanborn replied.

Having Harrison at the helm is like learning from the professor who wrote the textbook, Sanborn says. Plus, Harrison has been through this several times before and has invaluable insights about making operational changes, she adds.

CSX has experienced some service hiccups when making operational changes, Sanborn says, but it has been able to quickly iron out the wrinkles.

“His active leadership has really put us on a great trajectory as we implement precision scheduled railroading on our railroad,” Sanborn says, noting that on-time performance, train speed, and terminal dwell have all improved dramatically since Harrison arrived.

UPDATE: Full story with comments from CSX Chief Operating Officer Cindy Sanborn. May 23, 2017, 3:39 p.m. Central time.

DANIEL GLESS ….. let me unsaddle off my “high horse” …. “I R a foamer”, and observe your stance: Okay trucks and rails each have their niche in transportation. J.B. Hunt being an example. Both rubber/steel being used = maximum efficiency. Since Class 1’s (BNSF exempted) by need of money invested, have need of the stock market, ooops a dilemma comes up. That said, looks like RR’s should be more market sensitive to customer needs as short lines are doing. Okay bigger is better and must be “bottom line/each quarter” sensitive. Wall St investors are (to me) a danger to long term needs of RR’s. I think about the airline industry (to a lesser extent barge traffic). Airlines have airports/controllers/etc. government supported. (I am NOT suggesting “gubmint dispatchers”) Just saying, RR’s so often get jilted. The big airlines, where do they travel? Only the lucrative market cities. Oh, the short hops are flown by puddle jumpers all right, at government subsidy. Rational for this…..the big airlines need more flyers from the sticks. Do the barges contribute to the Corps of Engineers for lock operations? Fees/ charges (they might pay, but doubt it, comment?)

Seems the RR’s get the shaft on MOW expenses w/some grant exceptions. Other forms of transport have federal government taking care of it all. (Again NOT in favor of nationalization….HEAVEN FORBID) I have no solutions offered to the dilemma of short sighted investors, but again seems the RR’s, as important as they are, all the time get the shaft. Oh, by the way, safety, yes, just make a law and all will be well. Never mind the little detail of the real-world hurdles to PTC. Same deal, RR gets the shaft, why are you guys dragging your feet, hurry up. Don’t you realize how important this is? Endmrw0601171223

If $100 million in annual savings can be garnered by closing down 10 hump yards, now we know how EHH’s $84 million golden parachute is going to be paid for …

This is just creating a modern well planned network. Don’t forget rail carries more freight now than ever (not counting short term economic ups and downs). Rail also carries the highest percent of ton miles over any mode. Trucks carry a bunch of short distance freight which bumps their market share. RR’s have always lost money with short distances and after deregulation they were free to dump that business.

Why are flat yards cheaper to operate than humps? Seems to me you need fewer staff and equipment for a hump.

Having E Hurricane at the helm is something you want to run from

Sounds like a push for only unit car trains and a loss for the local company boxcar deliveries.

s

Right on, Messrs. Theodore & Gless. One can either embrace change, or dither in the past. The vote’s outcome should be pre-ordained in favor of change. Let’s hope so for CSX’s sake.

I love reading these comments some are to the point and some are very uneducated! As a 25 year veteran railroad person myself this is a good thing for csx to be undergoing change, they needed someone to come in and break up the good ol boys club and insert some fresh thinking it’s easy to do things the same way we have always done it but it’s harder to change I embrace the change and look forward to see what the future holds! Also it’s real easy looking at things from the outside to point uneducated fingers and jack your jaws at people that run the railroads the railroads DO NOT RUN TRAINS FOR FUN! It’s a for profit company and when you embrace that you will be taken more seriously.

The current chief at CP is currently looking to gain more business lost after the tenure of Mr. Harrison. At least according to the news.

Mr. Gless: My wife can see that trucks carry everything and trains carry little. It does not take a pro like you to see that the railroads do a poor job gaining the nation’s freight movements.

Just as there was resistance to seeing steam locomotives vanish from our rails due to “a better way of doing things (a.k.a. diesel locomotion), coupled with (as commented upon by CSX management in these pages) the fact that parts for retarders are no longer available, and lastly – “lead, follow or get out-of-the way” – taking into account CSX’s less than stellar productivity record over the past decade (follower) is now being supplanted by true leadership, then the reduction in hump-yards is not an unexpected development. Change can be good….

Stripping CSX of the excess / under-utilized assets is not leaving a carcass, but rather a lean-mean railroad ready to maximize it’s potential in a cleaned-up physical plant.

Slash and burn management.

Every Class 1 railroad has experienced service quality melt downs. With merchandise traffic down at the present time, should it rebound railroads like CSX will certainly be choking.

When the inevitable meltdown happens, Harrison (towing his oxygen bottle) and Mantle Ridge will be long gone, enjoying the hundreds of millions in profits of a juiced stock price. Workers, shippers and the public will be left holding the bag over a stripped asset base.

Public-be-damned is alive and well in the railroad industry. Indeed, it never left.

As a former dues paying member of a rail labor union (a union which actually helped my hold my rights even when i was promoted to exempt positions on a Class 1), it is a curiosity where the Brotherhoods stand on these matters. Who is going to be there to purchase the “stuff” the rails carry?

Wonder what the Professional Iconoclast (aka L.Knieling) would have to say?

Yes CP IS doing poorly right now. It’s still bleeding business, and if the current scorched-earth policy is not reversed, it is riding into oblivion. Latest major loss is the Yang Ming container business from the port of Vancouver to Chicago, Toronto and Montreal (high volume, long-haul traffic). CN is doing better because many EHH-era policies have been reversed, notably by increasing the locomotive fleet, investing in track maintenance, hiring new employees and rebuilding HUMP yards in Gary (Kirk) and Memphis (Harrison). CN may have a future, CP does not.

Yes CN and CP are both doing rather poorly right now are they not? NO THEY ARE NOT. Both doing just fine thank you. EHH can tow an O2 bottle all he wants. He is also doing just fine.

It’s time you foamers get off your high horse and learn how its really done. Or just sit back and watch the pretty trains go by and argue amongst yourselves as to what kind of horn is on the engine that just went by.

Kip Grant, again…right on point.

When I was a kid, some 60 years ago, every factory and warehouse of any consequence had a rail siding. Box cars, gondolas and flat cars carried cargo into and away from these locations. But railroads were slow and took too long to move freight from one place to another. A truck can take a load 500 miles in less than a day. As interest rates soared in the 1970s, no company wanted its capital tied up while a railroad took a week to move a shipment. Not surprisingly, freight moved to trucks and the networks of industrial trackage and branch lines were abandoned and torn-up. Some factories and warehouses have rail facilities and might be persuaded to put more carload traffic on the rails but most of the infrastructure for carload traffic is long gone. No wonder they can’t get parts for retarders, railroads don’t need new retarders to build new hump yards.

The need for classification yards declined as carload traffic was replaced by unit trains, piggyback and containers. Classification yards have been replaced by container yards. Trucks bring containers to the yard and computers determine how to load them on cars. Blocks of loaded container cars going to the same destination don’t need to be humped. The same applies to piggyback trailers.

Railroads have to grab back traffic from the trucks. They need to handle domestic containers quickly, efficiently, and guarantee delivery in roughly the same time as a truck. There is an opportunity to handle container moves of less than 500 miles if they can figure out how to be cost and time efficient over those distances. These are big challenges and hump yards have no role to play in solving them.

Why did it take EHH to get this done? Why wasn’t Cindy Sanborn (and the rest of the CSX Board of Directors) paying attention to what EHH had done with CP and CN over the last several years, and implement some of those changes without haven’t to bring EHH on board. And he doesn’t come cheap – that’s already been proven.

All this means to me is there is no interest in increasing carloads. Reminds me of Amtrak cutting its way to “profitability.”