“How we work is not going to change. Precision railroading is our gold standard,” Chief Operating Mike Cory told investors and analysts on CN’s earnings call Tuesday.

Starting last summer, CN saw much stronger-than-expected traffic growth in Western Canada and from Winnipeg, Manitoba, to Chicago. The railroad coagulated as it was caught short of crews, power, and track capacity. And it’s been trying to catch up ever since.

“With all the volume growth, the capacity improvements we are making, we’re adapting our scheduled operating plan to meet the changing demands,” Cory says. “This will ensure our precision railroad model continues to lead the industry in both operating ratio and service offering.”

“Our focus on scheduling the workload of assets, whether they be car inspectors, locomotives or track capacity, is embedded in our DNA,” Cory says. “To put it simply, it works. This focus will produce the right balance of cost and profitable growth as we continue to leverage our precision railroad model.”

CN improved its operating performance in the second quarter despite handling record tonnage, particularly across capacity-constrained Western Canada.

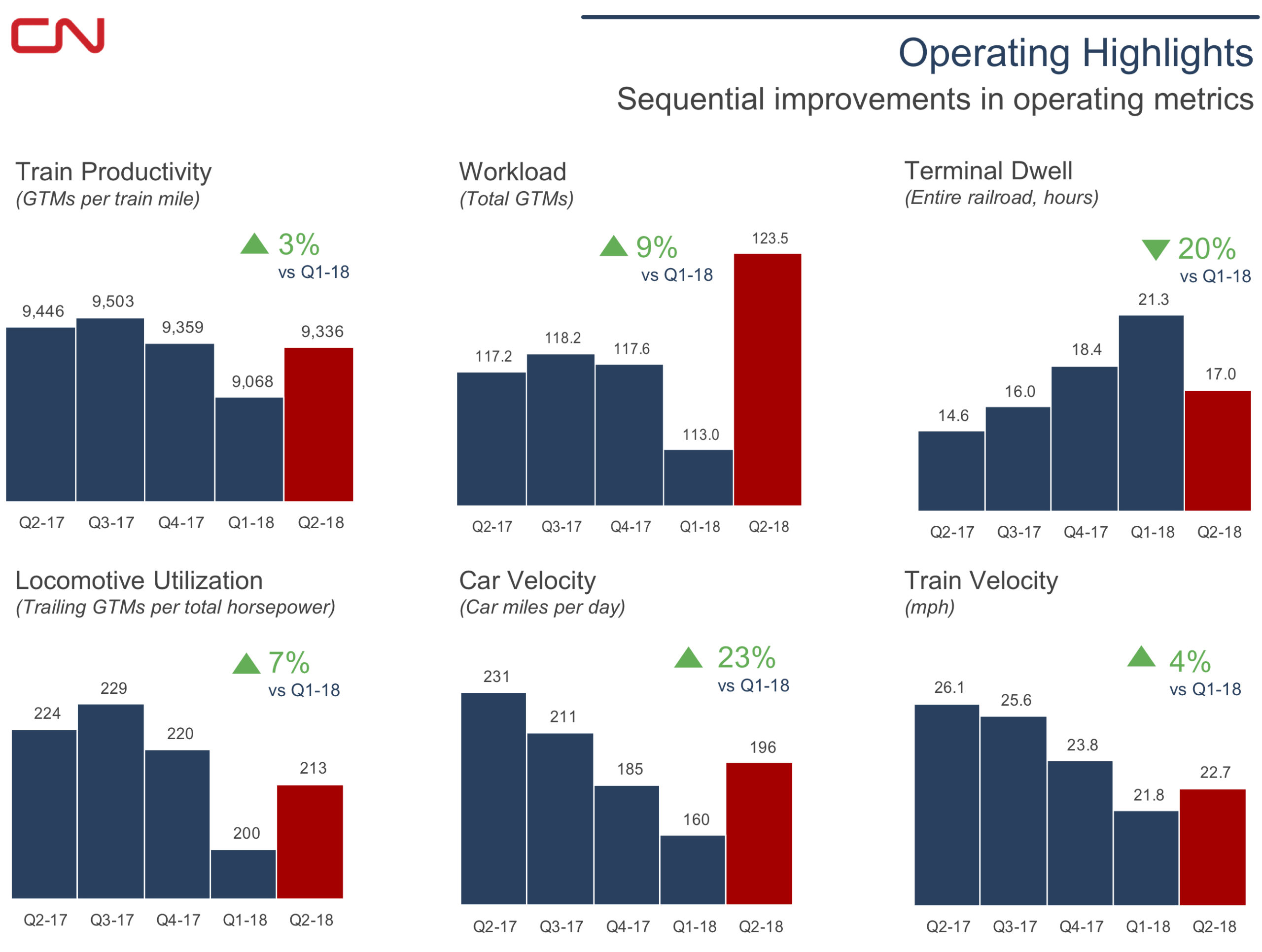

“Overall, we saw better operating performance in a quarter where we handled the largest workload in CN history,” Cory says. Gross ton-miles were up 8 percent compared to the first quarter — and were 5 percent above the previous record workload.

“This quarter was centered on catching up on the volume, gaining back the confidence of the customers, and sequentially improving our operating metrics in line with reducing cost,” Cory says.

CN’s operating improvements are the tale of two railroads: One that’s making progress digging itself out of capacity problems and one that’s still not back to normal.

Terminal dwell was down 20 percent compared to the first quarter but up 16 percent compared to the second quarter of a year ago. Likewise, average train speed was up 4 percent compared to the first quarter, but remained 13 percent below last year’s second-quarter average of 26.1 mph.

That’s essentially how CN executives have said the recovery would play out: Improvement from quarter to quarter, with performance lagging 2017 levels until capacity projects are complete in November.

“We will have quite the network by the fourth quarter,” CEO Jean-Jacques Ruest says.

CN took delivery of the first 10 new GE ES44AC locomotives in June, and will have another 10 delivered by the end of the month. Some 350 conductors were qualified during the second quarter, and another 900 are currently in training and will be qualified by the end of the year.

The influx of new employees contributed to a rise in CN’s train accident rate for the quarter, Cory says. The railroad is taking steps to improve its training program, as well as have experienced conductors mentor the new hires as they enter service. Main line accidents were down, while incidents rose in yards where new hires are concentrated.

For all the hate placed against Harrison and his Precision Scheduled Railroading, I’d like to know what parts people like and don’t like. It sure seems like it’s working. (Yes, I understand there are problems, like cutting too much just to gain profit, but the basic principles of getting the freight delivered in a timely and reliable manner seems reasonable to me.

Yes, retiring the SD60F’s (5500’s) may have been a little premature. This is called Precision Railroading: right-sizing the railroad for today’s traffic (but not necessarily for tomorrow’s).

Nevertheless, the SD60F’s were oddball units, and it made sense to retire them before the secondhand SD60’s (5400-5489), because the latter can and are being used as yard switchers and road-switchers (some 5400’s have even been equipped with RCO).

For now, the slightly-newer cowl-bodies C40-8M’s (2400-2454 and BCOL 4601-4626) are still used in regular service, but they will probably be retired before the fleet of secondhand C40-8’s and C40-8W’s, for the same reason.

I read many articles on here about CN being power short and leasing locomotives but also read articles on the retirements of solid serviceable power for scrap. Cowl Units, GPs, SDs, GEs. Wouldn’t it be more cost advantage to use the assets you already have then complain about being power short?