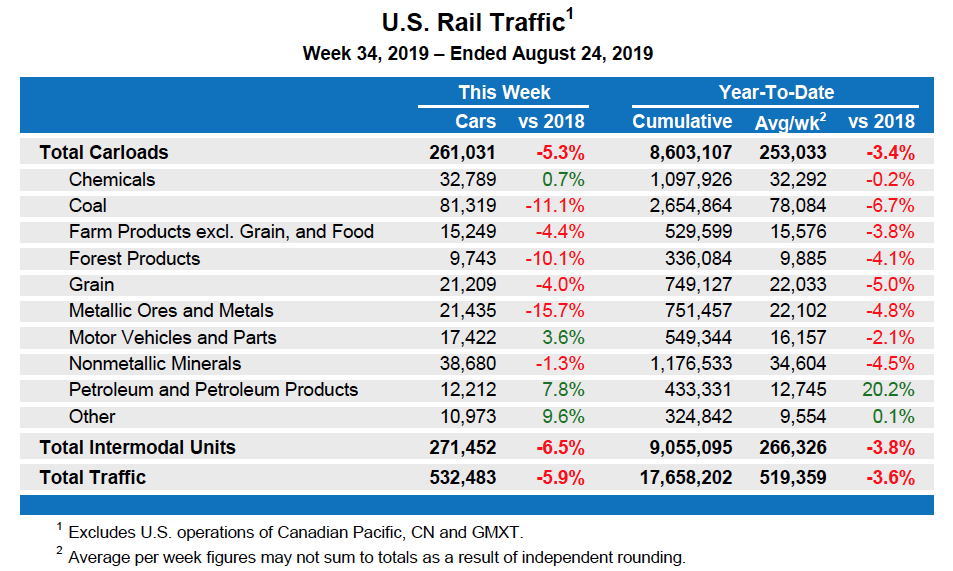

For this week, total U.S. weekly rail traffic was 532,483 carloads and intermodal units, down 5.9% compared with the same week last year.

Total carloads for the week ending Aug. 24 were 261,031 carloads, down 5.3% compared with the same week in 2018, while U.S. weekly intermodal volume was 271,452 containers and trailers, down 6.5% compared to 2018.

Four of the 10 carload commodity groups posted an increase compared with the same week in 2018. They included miscellaneous carloads, up 961 carloads, to 10,973; petroleum and petroleum products, up 888 carloads, to 12,212; and motor vehicles and parts, up 609 carloads, to 17,422. Commodity groups that posted decreases compared with the same week in 2018 included coal, down 10,166 carloads, to 81,319; metallic ores and metals, down 4,003 carloads, to 21,435; and forest products, down 1,093 carloads, to 9,743.

For the first 34 weeks of 2019, U.S. railroads reported cumulative volume of 8,603,107 carloads, down 3.4% from the same point last year; and 9,055,095 intermodal units, down 3.8% from last year. Total combined U.S. traffic for the first 34 weeks of 2019 was 17,658,202 carloads and intermodal units, a decrease of 3.6% compared to last year.

North American rail volume for the week ending Aug. 24, 2019, on 12 reporting U.S., Canadian, and Mexican railroads totaled 365,385 carloads, down 4.2% compared with the same week last year, and 361,888 intermodal units, down 5.4% compared with last year. Total combined weekly rail traffic in North America was 727,273 carloads and intermodal units, down 4.8%. North American rail volume for the first 34 weeks of 2019 was 24,082,771 carloads and intermodal units, down 2.5% compared with 2018.

Canadian railroads reported 83,339 carloads for the week, down 2.1 percent, and 73,322 intermodal units, up 0.9% compared with the same week in 2018. For the first 34 weeks of 2019, Canadian railroads reported cumulative rail traffic volume of 5,150,995 carloads, containers and trailers, up 1.9%.

Mexican railroads reported 21,015 carloads for the week, up 1.4% compared with the same week last year, and 17,114 intermodal units, down 13.2 percent. Cumulative volume on Mexican railroads for the first 34 weeks of 2019 was 1,273,574 carloads and intermodal containers and trailers, down 3.4% from the same point last year.

— An Association of American Railroads news release. Aug. 28, 2019

Right on Mr. Norton particularly your comment on the industry at large. PSR is a fig leaf for Wall Street and the dissolution of railroad assets and service. Seems as though the STB is walking around with their collective hands in their pockets and dithering.

not surprising considering the class ones are doing anything they can to get rid of business

If you care about the “global economy” then Trump’s not your man.

Trump and his gang of clowns are a disaster for the global economy. It may take decades to recover after this idiot is in prison.

I totally agree with the comments thus far. If you need tangible, visible evidence simply drive from the Wisconsin border to the Indiana border on 294 and count the number of trucks.

And these numbers usually presage a general recession.

Trucking volumes have been dropping since beginning of the year too, though. While I agree the railroads generally are their own worst enemy; I believe what we are seeing is a freight recession – similar to what occurred back in I believe 2016.

They are running traffic off in record numbers. When deregulation came, the goal was to allow railroads to be more competitive. Now, forty years later, the railroads are manipulating traffic, not to grow the industry, but to grow the favor of wall street. The railroad is less relevant to communities today then in 1980.