Bash Canadian Pacific Kansas City Day – otherwise known as Feb. 28, the deadline for comments on the CP-Kansas City Southern merger – has come and gone. What have we learned from the flurry of regulatory filings from other railroads, shippers, and lineside communities?

The Class I railroads behaved like you’d expect: Following a tradition in the industry, they lined up against a merger that’s not theirs. That’s partly because railroads want to protect their turf and keep CPKC’s paws off their traffic. And that’s partly because merger reviews are the one time when rival railroads can try to alter the competitive landscape or settle old scores.

Canadian National, which last year lost the battle for KCS after an unfavorable regulatory ruling, is making life difficult for CP. Its filing sows seeds of doubt about CP’s traffic and revenue growth figures, upon which the operating plan and environmental assessment are built. Some of the other Class I railroads reached similar conclusions. What the Surface Transportation Board will make of this is anyone’s guess. But there’s always an element of uncertainty in traffic forecasts, particularly when a merger introduces more competition and it’s unclear what traffic the merged railroad will win and at what rates.

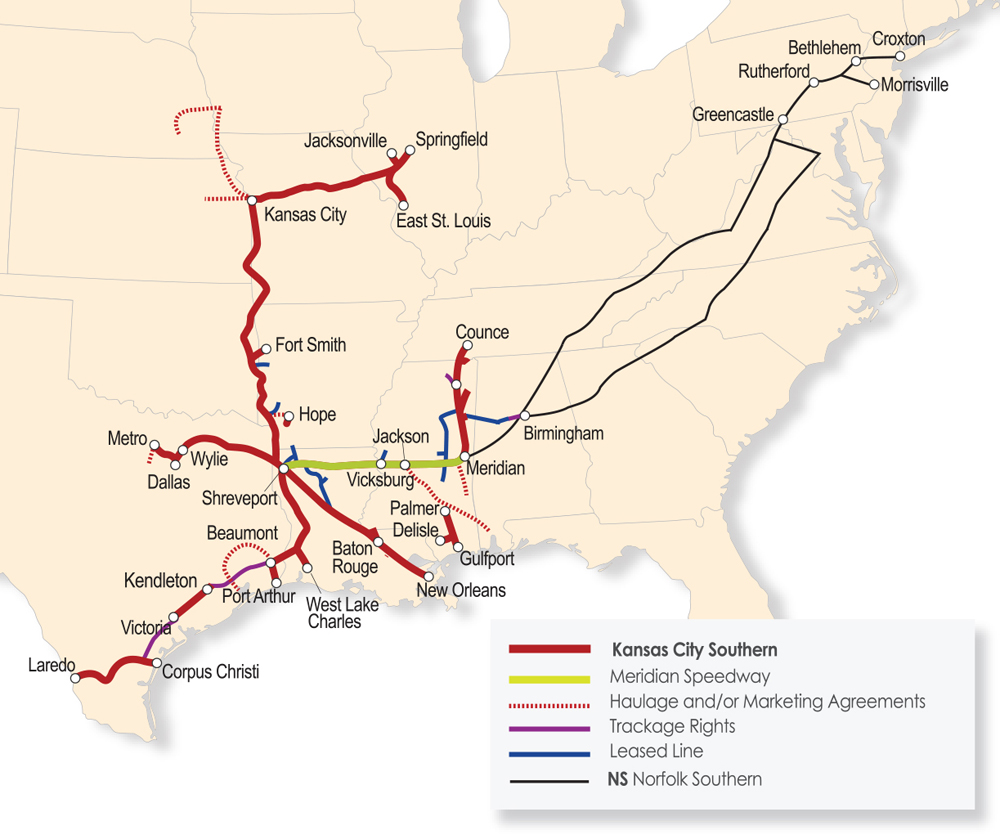

Meanwhile, CPKC finds itself under Class I attack on the northern reaches of the KCS system, its midsection, and its southern flank across Texas.

First, CN wants to create its own route to Kansas City by prying away Kansas City Southern’s former Gateway Western trackage linking Springfield, Ill., with KC and St. Louis. CN’s request that CP be forced to divest the Gateway Western is reminiscent of Conrail’s failed attempts to scoop up Southern Pacific’s eastern lines during the Union Pacific-SP merger in 1995 and 1996. The key difference is that Conrail wanted SP’s crown jewel — access to Gulf Coast chemical plants and its Cotton Belt main lines to St. Louis. CN wants to create a new single-line route from Kansas City to Eastern Canada that it says would convert 80,000 shipments from truck to rail annually, or a third more than the entire CPKC merger. There’s no precedent for a carve-out like what CN is proposing. And it seems to be a long shot under the old merger review rules under which CPKC is being judged.

Second, Norfolk Southern dropped a bombshell by saying it aims to buy the KCS intermodal terminal outside Dallas, an option it gained as part of the Meridian Speedway joint venture with KCS. NS handles most of the traffic at the Wylie Intermodal Terminal now, but Dallas is a critical component of CPKC’s intermodal growth plans. CPKC’s projected growth would put the terminal near capacity, which NS sees as a threat. You’d have to think CP and NS will come to some sort of agreement.

Also on the Meridian Speedway front, CSX Transportation came out of left field with a proposal to break the exclusive arrangement KCS and NS have for intermodal traffic moving between Meridian, Miss., and Shreveport, La. In a nutshell, CSX wants the ability to interchange with CPKC at Meridian via Genesee & Wyoming short line Meridian & Bigbee. It’s hard to see the STB undoing the privately negotiated Meridian Speedway agreement that dates to 2006, particularly when it doesn’t have anything to do with the CPKC merger.

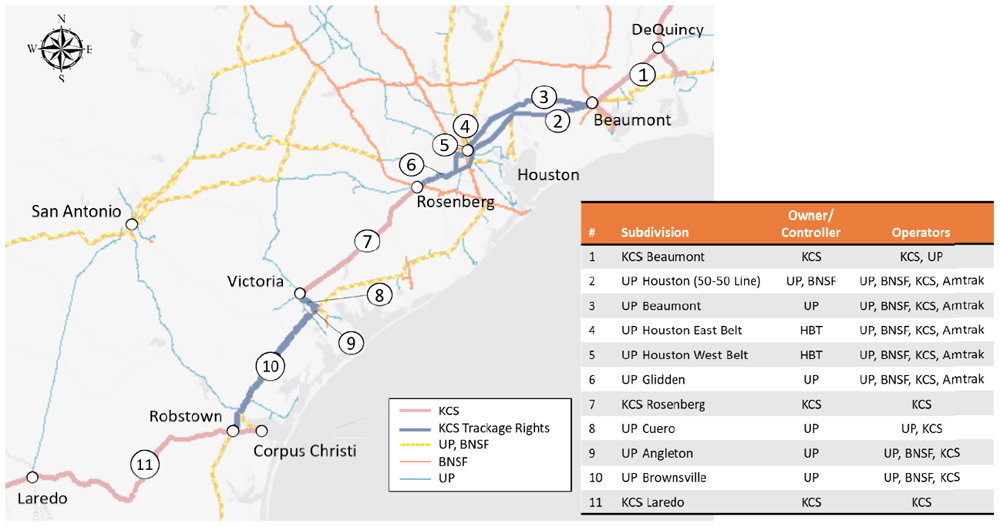

And third, BNSF Railway and Union Pacific sounded the alarm about CPKC’s projected traffic increases across Texas, which come without any plans for adding capacity on KCS trackage rights routes between Beaumont and Robstown. KCS’s cross-border traffic currently has to thread the needle on UP trackage rights through Houston. BNSF and UP say the eight to 12 additional daily CPKC trains – a doubling of current KCS traffic levels – would pose a risk to the fragile Houston terminal complex, which famously melted down after the UP-SP merger. And so they’ve taken the unusual step of asking the STB to bar CPKC from adding trains until capacity is in place. This will catch the STB’s attention. Ultimately, the railroads will sort this out or risk having the board do it for them.

All of the Class I railroads had grievances over how CPKC might try to strangle interchange traffic, particularly at the Laredo gateway, the busiest U.S.-Mexico rail border crossing. And they urged the STB to put teeth behind CP’s promise that it would keep all gateways open on commercially reasonable terms. To a certain extent these interchange requests are the pot calling the kettle black: All railroads want to maximize their length of haul and hand traffic to an interchange partner at the most advantageous point.

Expect CP to file a robust reply to these Class I challenges on the April 22 deadline. The common thread: The other systems fear increased competition from CPKC.

Shipper associations almost universally backed approval of the merger, so long as the STB imposes certain conditions – many of which CP and KCS made a part of their merger application. This is a big deal because regulators put a lot of weight on shippers’ views.

But some of the shipper groups requested that reciprocal switching be imposed on the CPKC system, either at limited locations or systemwide. This is a long-term shipper goal, which has nothing to do with the CPKC merger. And it would be unfair for the STB to require reciprocal switching on the smallest Class I system while letting their bigger rivals off the hook. The same can be said of the shipper groups’ requests for various ways to challenge rates.

The Class I merger review process offers trackside communities a unique opportunity to demand improvements, such as overpasses, they’d have no shot at getting any other way. Two filings at deadline, one from Chicago suburbs and the other from the Minneapolis area, are at opposite ends of the spectrum.

The Coalition to Stop CPKC, made up of eight towns along CP’s Elgin Subdivision west of Chicago, made demands that can only be described as outlandish. They claim that up to $9.5 billion — yes, billion with a B — is required to mitigate the impact of freight-train traffic rising from the current three per day to 11 per day. The price tag is more than double the cost of the 70 improvement projects envisioned as part of the CREATE plan in and around Chicago. This is utter nonsense, and the STB should recognize it as such.

In contrast, the county that includes Minneapolis simply identifies potential merger-related traffic and grade-crossing issues, asks CP to study them, and then fund necessary improvements. This is the right and reasonable way to go about it.

You can reach Bill Stephens at bybillstephens@gmail.com and follow him on LinkedIn and Twitter @bybillstephens

Why should CP-KCS be forced to give up it’s Springfield to Kansas City (Gateway Western) line. CN’s partner (Illinois Central) ran it into the ground then spun it off. The first owner went bankrupt after buying that trackage, Gateway Western did better. KCS finally found a use for it. Now crybaby CN wants it back.

As for NS, they want to protect their investment in the Meridian Speedway. If CP-KCS doesn’t want to keep the status quo on that line, CP should reimburse NS for it’s investment at today’s value or NS should be to purchase outright that line and the Wylie Terminal. In exchange for trackage rights to Wylie over KCS, KCS could still have trackage rights to serve it’s other Mississippi & Allabama lines (to Gulfport, Mobile, ETC.)

And Screw CSX. They could have made the same deal with KCS that NS made in 2006.

Having been an active participant in the CN-EJE merger process, one suspects the STB will “strongly recommend” the new CPR and the upset Chicago suburbs agree to some kind of voluntary mitigation agreements along the CN-EJE pattern. The local precedence is obvious for all to see. The CN-EJE VMA’s included the Matteson train-watching platform.

James, I disagree on the similarities on the CN-EJE merger and this one on CP coming out of Bensenville.

The EJ&E was down to what? 6 or 7 movements a week, most of them at night at 15mph. CN has clearly bumped that up (based on observations at the tower in West Chicago). One day I saw 5 CN movements alone.

EJ&E was a north-south route that had been under utilized for many years, so some form of remediation was warranted. IDOT and local traffic planners needed ways to accept the new rail usage patterns being thrust at them.

The CP Elgin sub, (an E-W line) while only doing 3 freight movements a day, still have a very active Metra schedule on the same line. These are all higher speed moves and on a line where people expect traffic to occur at any time. Regional traffic planners have been aware of this line and its use for both service types for several years. The only change will be the volumes per day.

I just don’t think the requirements to remediate are nearly the same.

Bill, great analysis of the pre-merger gymnastics. I agree with your point on reciprocal switching being imposed on CPKC. Shipper groups may have brought this up in merger comments to get RS on everyone’s mind before next week’s (March 15 & March 16) STB hearing on this topic. And, as you point out, this has nothing to do with the CPKC merger.

If I was running the STB, I’d ignore all other Class 1 requests and (those of entities demanding money for mitigation) and approve the merger as is. Let the market decide what kind of infrastructure improvements need to be made and paid for.

Why doesn’t CSX just try and negotiate a deal to move traffic through Meridian? Seems to me CPKC would welcome the traffic if done correctly. I’m sure NS would have a fit over it.