WASHINGTON — BNSF Railway has urged federal regulators to take steps to protect cross-border traffic to and from Mexico as part of any approval of the proposed Canadian Pacific-Kansas City Southern merger.

But BNSF dropped its plan to pursue trackage rights over KCS to the Laredo, Texas, gateway in its Monday regulatory filing, which was posted to the Surface Transportation Board website on Wednesday.

Two-thirds of CPKC’s projected traffic growth is expected to come from cross-border traffic to and from Mexico, BNSF notes.

“The increasing importance of Mexican trade means that now more than ever U.S. farmers, industries and consumers need to be assured of fair and competitive access to Mexico over U.S. rail carriers,” BNSF says. “The Board must make sure that the Transaction, with the creation of a new Class I Mexican access juggernaut in the combined CP-KCS system, does not diminish that important access to Mexico for U.S. rail shippers.”

To meet merger-related volume and revenue growth expectations, CPKC will have every incentive to manipulate rates in an attempt to divert traffic away from competing routes, BNSF argues.

BNSF is concerned that CPKC control of KCS de Mexico would crimp interchange traffic bound to and from Laredo, the most important rail border crossing between the U.S. and Mexico.

“Foreclosure at Laredo is not an idle or theoretical concern,” BNSF warned. “Following the acquisition in 2005 by KCS of Tex Mex and the predecessor to KCSM, BNSF’s rail movements across the KCS-controlled Laredo border crossing dropped precipitously. Over time, BNSF has concluded that it has become virtually impossible to compete for certain Mexico business over Laredo if KCS can also serve the business on the U.S. side of the border.”

BNSF claims that KCS has used its control over pricing of cross-border movements to freeze BNSF out of the market. Mexican regulations require KCS de Mexico to provide non-discriminatory pricing for cross-border movements regardless of the U.S. railroad involved. BNSF contends that KCS raises its rates in Mexico on movements that could be handled by either KCS or BNSF, then reduces KCS’s rate for the U.S. portion of the move, effectively allowing the higher KCS de Mexico rate to subsidize the U.S. portion of its rail move.

Absent conditions to protect the Laredo gateway, the larger CPKC system will further lock BNSF out of Mexico, BNSF contends.

If conditions placed on the CPKC merger prove ineffective at maintaining competition at the Laredo gateway, BNSF says it will seek direct access to Mexico by competing for Mexican rail concessions. KCS currently holds the concession to operate KCS de Mexico. In 2027, however, the concession could be opened to competition.

For now BNSF scuttled plans to seek trackage rights over KCS between the current interchange at Robstown, Texas, and Laredo. “Since BNSF would only need the trackage rights under future conditions not known today, it would not be possible to prepare a detailed market analysis and operating plan necessary to satisfy the Board’s regulatory requirements for a trackage rights application,” BNSF explained.

Houston, we have a problem

BNSF warned that CPKC’s plans to double its traffic through the Houston terminal without proposing any capacity improvements is a recipe for trouble.

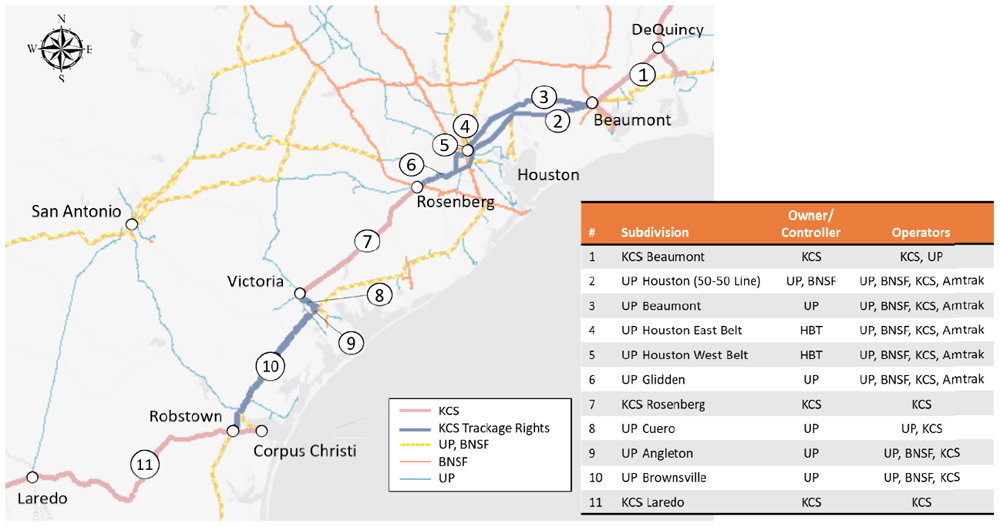

“To reach the Laredo gateway from the north and east, KCS must traverse Texas over a tangle of connected line segments owned, controlled and operated by some combination of KCS, BNSF, UP, and Houston Belt & Terminal Railway Co. This route requires movement through Houston itself,” BNSF noted.

BNSF reminded regulators that the Union Pacific-Southern Pacific merger resulted in gridlock in Houston that soon became a systemwide meltdown that eventually cascaded throughout the rail network in 1997-98.

CPKC could tie up Houston by routing an additional eight to 11 trains per day through the terminal complex, BNSF says, noting that much of CPKC’s new traffic will come at the expense of BNSF and UP routes that bypass Houston. “Yet Applicants have not identified a single dollar for new capacity that they propose to add in the Houston area to accommodate this substantial increase in traffic,” BNSF says.

“If Applicants’ plan is just to wait and see what happens, they are putting at risk the fluidity of a critical node in the national rail network at a time when supply chain congestion is a significant issue for the U.S. and global economies,” BNSF wrote. “If their plan is to try to make BNSF and other railroads – and by extension their customers – pay for the capacity that is needed to accommodate the increased CP-KCS traffic under existing cost-sharing arrangements for the lines at issue, their strategy is equally misguided.”

The STB should restrict CPKC traffic increases until the merged railroad identifies, funds, and completes capacity improvement projects on shared routes in Texas, BNSF says.

BNSF also raised concerns about capacity elsewhere on the CPKC system, including Ottumwa, Iowa, where BNSF’s Ottumwa Subdivision crosses CP’s Laredo (Mo.) Subdivision at grade. CPKC projects traffic would quadruple through Ottumwa, to a total of 18 trains per day. The use of longer trains would block BNSF’s line during crew changes, BNSF says, so the STB should require CP to shift its crew change point to eliminate potential interference with BNSF operations.

BNSF said a tripling of traffic on CP’s Davenport Subdivision in Iowa may hurt service on BNSF’s trackage rights over CP to reach Clinton, Iowa. BNSF asked the board to monitor the situation and reserve jurisdiction to address the issue.

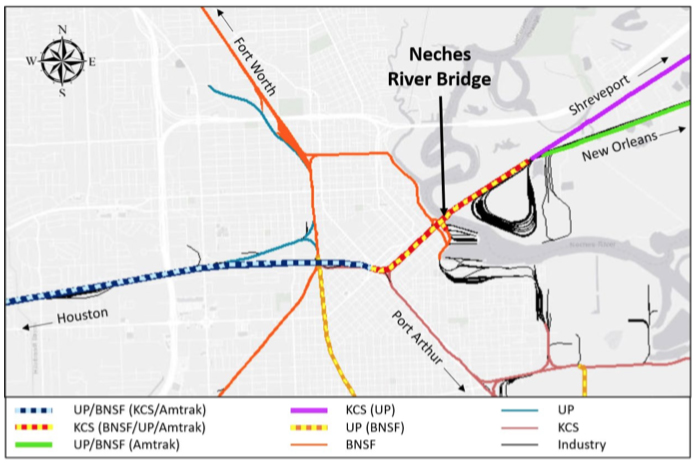

And BNSF said CPKC would have to address the Neches River Bridge bottleneck in Beaumont, Texas. The KCS-owned span is also used by BNSF, UP, and Amtrak. West of the bridge, lines radiate to Houston, Fort Worth, and Port Arthur, while east of the bridge lines diverge to Shreveport, La., and New Orleans. CPKC’s merger application does not propose capacity improvements in the area despite projected traffic increases, BNSF says.

BNSF requests conditions

BNSF asked the board to impose several conditions on the CP-KCS merger. They include:

— CPKC must keep the Robstown interchange and Laredo gateway open on commercially reasonable terms and abide by previous agreements related to KCS’s purchase of the former Tex Mex Railway linking Robstown and Laredo.

— Require CPKC to adopt a fair rate-setting process that will ensure BNSF access to Mexico through Laredo.

— Require CPKC to fully fund merger-related capacity improvements on lines owned by BNSF or other railroads.

— Prohibit CPKC from increasing traffic across Texas without first funding and completing capacity projects on trackage rights routes.

— Shift CP’s crew-change location in Ottumwa so it doesn’t interfere with BNSF operations.

— Impose a five-year oversight period on the merger to monitor CPKC’s compliance with conditions.

— Require CPKC to report service metrics involving the Laredo gateway and at locations where significant traffic growth is expected.

— Reserve jurisdiction to impose further conditions, including trackage rights, during the oversight period if open gateway commitments aren’t working or if congestion or service problems arise.

One thing that no opposition filing mentions when they talk about CPKC taking up capacity. is that if CPKC succeeds, then they won’t need to run as many of their own trains over the same trackage.

Depends. If CPKC wins traffic from UP that used to go north from Laredo it will have to go through Houston instead of San Antonio. Houston becomes that much more congested.

I remain puzzled. As I see it, new traffic on CP-KCS comes from traffic already on on other routes. Seems only new traffic by rail comes from that which is borne roadways. What am I missing?

Like UP’s filing this input from BNSF does have merit for the same reason: Houston. Because of previous mergers BNSF is dependent on Uncle Pete for fluidity through the Houston area and adding more traffic to the mix will not help anybody. Will CPKC really increase rail traffic as they have touted? I’m not holding my breath. But even a small growth in ton-miles will result in Space City going back to, “Houston, we have a problem.”

I think this whole thing is pretty entertaining. It’s a double-edged sword for CP-KCS: On the one hand, one of the benefits of the merger will be oodles of new business and all these additional trains; On the other hand, all this traffic (if it materializes) could create choke points and in the case of South Texas (and elsewhere), it affects all the other railroads. As another example about how Amtrak doesn’t give a rip about its long distance trains, logic would dictate that Amtrak should be filing a complaint about plugging up the railroad from Rosenburg to the Louisiana border. Especially considering that UP wants millions and millions of dollars to operate the Sunset Limited daily, which would be inconsequential compared to the congestion of 11 more trains per day through Houston.

It’s not a question of the “big guys” being poor sports and complaining about the “little guys.” The reason that CP+KCS will still be the “little guy” after the merger is that while their combined route structure will create some single-line opportunities, it won’t create any routes that are more efficient to operate than the competition. If the lucrative traffic that CP-KCS claims is going to be result from the merger is really a real thing, then either NS or CN would have gone after KCS long ago.

Personally, I doubt that the windfall of traffic CP-KCS projects is going to happen, but in the case about Houston, BNSF is correct. The only thing worse than having to operate through the Houston terminal at all is being the only railroad whose only route to/from Mexico requires operating through the Houston terminal with no other options. If BNSF gets trackage rights from Laredo to Robstown, (using northward as an example) its route from Laredo will still be superior to that of CP-KCS even though beyond Robstown is UP trackage rights to Algoa (between Rosenburg and Galveston). From Algoa, traffic CAN bypass Houston via Rosenburg and Temple, and even trains that enter the Houston terminal on UP trackage rights can escape by continuing on the UP via Palestine (directional running north) or BNSF via Teague. CP-KCS is stuck with their one option. Without a doubt, however, the best route out of Mexico at Laredo is the ex-MP UP route which is even the best way for traffic that needs to go to/through Houston, and by far the best way for traffic that doesn’t because it stays far to the north or west.

BNSF’s complaint about Ottumwa is also valid. Eastward trains cross BNSF at grade and then confront the 1.6% Rutledge Hill, a special challenge for coal trains received from BNSF at Ottumwa which must first head into the CP Ottumwa yard and reverse direction before tackling the hill.

While it’s easy to claim Goliaths are just picking on David, part of the reality here is that these issues being raised are highlighting the operating inefficiencies of the merged railroad. If we only accept the CP-KCS side, next we’d be hearing that Ethel Merman (may she rest in peace) would be performing “Everything’s Coming Up Roses” at the merger celebration.

I remember mentioning Ottumwa and Rutledge hill when this merger was proposed. It looked like a conflict to me and now BNSF has echoed that. Also, I’ve stood at the base of the hill near the diamonds. It looks a helluva lot steeper than 1.6% but I’ll trust the railroad knows their grades.

Mark, there is an easy fix for the BNSF coal train problem, CPKC can make a lower bid in conjunction with UP when the bid comes up next time. This would reduce BNSF’s problem at Ottumwa.

Yeah. They could get it from UP at Clinton, Iowa. But the power plant at Muscatine is Mid American Energy owned by the same company which owns BNSF: Berkshire Hathaway. So part of that might be keeping it “all in the family.” I don’t know what configuration of power is used now, but several years ago BNSF was delivering the train to CP at Ottumwa with a standard three-unit consist which wasn’t enough to get the train up the hill to Rutledge. CP often didn’t have extra power or the train had to be doubled which hindered reliability and cycle time so the edict went out to fullpower the thing out of Lincoln: 6 units, 3 on each end so the train could just reverse at the CP Ottumwa Yard and go. As easy as that was for CP, they also ended up paying twice the horsepower hours for a really short trip and where just as much time was spent unloading as transit from/to Ottumwa….. Or as we used to say, “We’re not happy until you’re not happy.”

While I agree with the logistical issues of CPKC traversing the Houston metro, I don’t have sympathy with BNSF.

If they want access to the Mexican market, pull out your wallet and start building your bridge over the Rio Grande and interchange before Laredo. Don’t let the STB determine your fate with regards to this “critical” market. If you are as competitive as you say you are, then go after it.

For a bunch of railroads that resent regulation, I am sure seeing a lot of whine on this proposed merger.

BNSF, CN, CSX, NS & UP are like vultures circling over CPKCs long range plans laid bare before the STB looking for some low hanging fruit. Whatever happened to making money the old fashioned way, “earning it” fairly? Sure some the details may have merit, but all of them put together are like on, or feasting on a wounded critter.

A lot of RRs are asking for a lot of conditions, some of which go beyond preserving competition. However, existing gateways do need to be kept open to preserve competition, especially at Laredo. However, if BNSF or UP get the Mexican concession in the future, they should also be expected to keep the Laredo and other border gateways open to the other railroads.

When BN was gobbling up one railroad after another formulating the current BNSF, were they concerned at all about all the other smaller railroads? Asking for a smart friend.

No way smart friend. They could care less. Same with UP,CSX, NS. The only one with a lot of railroads to put together was Conrail because they were all bankrupt. An look at the fight over the split of Conrail CSX an NS had.