Canadian Pacific CEO Keith Creel yesterday told a shipper group that his railroad can’t win a bidding war for Kansas City Southern.

Creel also wouldn’t rule out cooperating with Canadian National and KCS on some level, and said that if CN and KCS were to merge, leaving CP as the smallest Class I railroad, CP eventually would have to find a merger partner.

“We don’t want a bidding war and it’s not something we’ll participate in. And ultimately, it’s a war that we would not win,” Creel told the North East Association of Rail Shippers, noting that CN has a bigger balance sheet to finance a more expensive deal.

“We don’t want a bidding war and it’s not something we’ll participate in. And ultimately, it’s a war that we would not win,” Creel told the North East Association of Rail Shippers, noting that CN has a bigger balance sheet to finance a more expensive deal.

CP and KCS last month reached a friendly $29 billion merger deal. But the KCS board is now weighing CN’s unsolicited $33.7 billion bid, which was announced last week.

Could Creel envision a scenario where CP could collaborate with CN and KCS and everyone can win?

“Listen, anything’s possible. We’re reasonable people at Canadian Pacific,” Creel says. “Should that happen, we’ll do our best to represent our customers’ interest. Is it possible in some instances? Yes. Is it probable? I would suggest probably not.”

Rivals CP and CN have been engaged in a war of words since CN topped CP’s offer for KCS, the smallest Class I system that is the only railroad to operate in both the U.S. and Mexico.

Creel encouraged shippers to write federal regulators about their concerns with a potential CN-KCS merger, which he said would “snuff out” rail competition at a “multitude” of locations and eliminate CP’s friendly connection to KCS in Kansas City, Mo.

CN has said a merger with KCS would boost rail competition and that it would keep all KCS gateways open.

The biggest difference between the dueling offers for KCS is that CP-KCS is a true end-to-end merger that can gain regulatory approval, Creel says. “It doesn’t take a lot of time to figure out that there’s no loss of competitive options,” he says. “That’s the most compelling difference between the two that’s undeniable.”

In a filing with federal regulators this week, CP said that there are more than 340 shipper facilities on a combined CN-KCS system that are currently served by both railroads either directly or through reciprocal switching.

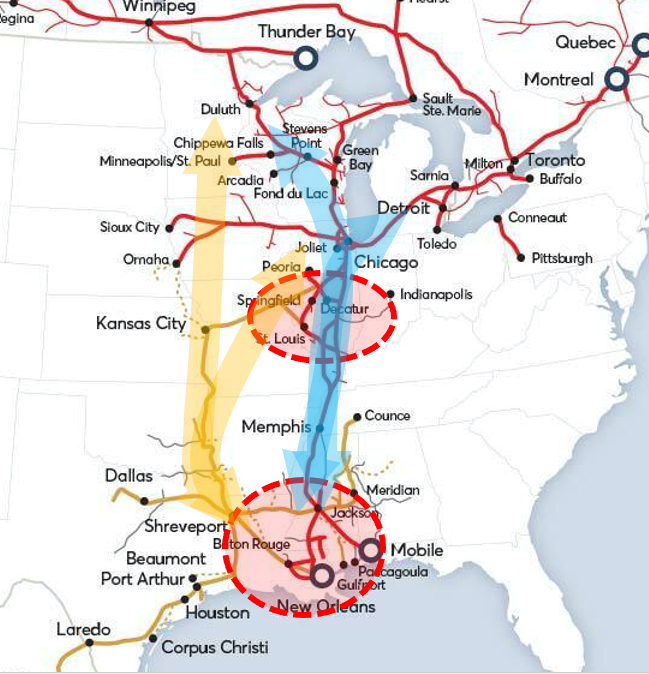

A CP review of waybill data also found “very substantial flows of traffic would suffer 2-to-1 or 3-to-2 reductions in independent rail routes as a result of a CN/KCS transaction,” the filing says. A map showed the impacts ranging from Quebec and Alberta to the Upper Midwest, the American Heartland, Texas, and Mexico.

CN contends that the only CN-KCS overlap is between New Orleans and Baton Rouge, La., where their main lines parallel each other for 65 miles. CN officials have said they would remedy the loss of competition, perhaps by divesting the KCS line.

“When you’re already talking about divestiture from the very beginning to provide a remedy to enable a deal, I would suggest it’s a bit deeper. I would suggest that the customers care,” Creel says, encouraging shippers to look at the facts.

If the KCS board ultimately selects CN’s offer, CP would have five days to respond. But Creel says CP would likely walk away and pocket the $700 million breakup fee from KCS. That’s not an insignificant sum: KCS’s total revenue for the first quarter was $706 million.

Creel says he doesn’t believe the KCS board will play “Russian roulette” with CN’s offer because it carries significant regulatory uncertainty. CP contends that CN won’t be able to place KCS in a voting trust while the merger is under regulatory review. CN has said its trust structure for KCS would be identical to CP’s and that it faces the same regulatory hurdles.

A CN-KCS combination would put CP and its customers as a disadvantage over the long term, Creel says. CP has told federal regulators that a CN-KCS combination would put it under “tremendous pressure” to find a Class I merger partner.

Despite its smaller size, CP has been able to compete successfully with CN by working closely with customers and playing to its strengths, such as shorter routes in key markets, Creel says. And over the short term Creel argues that CN will be hobbled by the “exorbitant” price it will pay for KCS, which ultimately could raise CN’s operating ratio as high as 75%.

“And then you get to a point where I can compete in markets, and share that cost advantage with my customers so that they can continue to grow whereas CN cannot,” Creel says.

But Creel says eventually CP and its customers would be at a disadvantage from CN’s far larger system, and that’s when it may have to seek a merger partner. “We’ll cross that bridge when we get to it,” Creel says.

Maybe rather than all this merger madness it is time for one entity to own the track and let operating companies compete for transport business on any route.

Like to find out when NS is going to speak up. Their investment to KCS for the Meridian speedway to Shreveport is going up in smoke. NS Traffic will suffer when CN shifts all that traffic to the Shreveport-Jackson gateway. CN will prioritize it’s trains over NS. I can see it now. All those trains that bypass Memphis or New Orleans now will be back on those routes.

The other “H*** no”, Charles.

Time to end this. Not everything is for sale to the highest bidder. There are reasons why STB has regulatory authority. CNR wants to be a monopoly on north -to -south traffic. STB’s answer should be no, no, heck no.

Talk is cheap, but it strikes me as significant that CN’s share price has declined after the merger news was announced.