WASHINGTON — A combination of Precision Scheduled Railroading and pressure from Wall Street has prompted railroads to slash costs and raise rates while providing less reliable service, rail shippers and labor told Congress on Tuesday.

The House Transportation & Infrastructure subcommittee hearing was focused on the reauthorization of the Surface Transportation Board and how the independent agency can better regulate the industry.

“PSR is an operating methodology that has been championed by Wall Street to push railroads to improve their operating ratios and increase their bottom lines….,” says Brad Hildebrand, a former Cargill executive who represented the National Industrial Transportation League at the two-hour hearing. “Simply put, the STB needs greater statutory authority to provide effective oversight of the freight rail industry.”

The top item on shippers’ wish list: A new rule that would provide sole-served shippers with access to a second railroad through reciprocal switching. The STB will hold two days of hearings on the matter next week.

The implementation of PSR has hurt rail shippers, their customers, and the railroads themselves, says Chris Jahn, CEO of the American Chemistry Council, the trade association representing chemical manufacturers. “What we say about Precision Scheduled Railroading is that it’s doing less with less,” he says. “Our experience there is rates go up and velocity goes down.”

Recent rail service failures forced a chemical producer to curtail production at two of its plants in the Southeast by more than 115 million pounds. “These are lost sales not only for our members, and exacerbate inflation and supply chain challenges we have, but they’re also lost sales for the railroad,” Jahn says. “I think that’s really important. We can’t ship what we can’t make.”

In other cases, poor rail service has forced rail-dependent shippers to divert freight to trucks.

The Private Railcar Food and Beverage Association represents 18 major rail shippers who also own their own freight cars and have every incentive to use rail. But the group’s president, Herman Haksteen, says poor rail service is driving their business to trucks, with negative impacts on their costs, supply chains, the environment, and overburdened highways.

Our nation’s rail advantage is hemorrhaging,” Haksteen says. “The simple fact that rail volume is down, and truck volumes are up, illustrates that there is something wrong.”

Shipper groups, rail labor, and some members of Congress were critical of the deep cuts in the railroad workforce since PSR has been implemented in the U.S. over the past five years. Those cuts, combined with deep employment reductions made as traffic fell 30% during the pandemic, have also hurt rail service as traffic has rebounded.

“The workforce is stretched too far,” says Dennis Pierce, president of the Brotherhood of Locomotive Engineers and Trainmen.

Railroads are having trouble hiring new conductors for several reasons, Pierce says. Among them: A history of layoffs despite record profits, the lack of a national labor contract, harsh working conditions, and efforts to operate with one-person crews. “It’s absurd to me that there’s any doubt as to why people are not interested in hiring out at the railroads right now,” Pierce says.

Ian Jefferies, CEO of the Association of American Railroads, defended the industry at the hearing.

All companies are having difficulty hiring enough workers in a tight labor market, he notes. Rail jobs are attractive due to their high pay and good benefits, he adds.

Shipper associations told the panel that they need reciprocal switching and an easier way to challenge rates due to consolidation in the freight rail industry.

But Jefferies says current rail rates are equivalent to what rates were in 1990. And he says that mergers have not reduced rail competition, noting that no shipper served by two railroads prior to a merger ended up with service from just one railroad after the merger.

“Freight railroads form an integrated, continent-wide network and provide a 24/7 critical link in our nation’s supply chains,” Jefferies says. “Freight railroads are doing their part to maintain network fluidity and ensure there is sufficient capacity to deliver the goods upon which our economy depends through significant investments in their infrastructure and equipment, development of innovative technologies, cooperation with customers and supply chain partners, and operational enhancements.”

He warned that “overreaching, unnecessary regulations” would put railroads at risk, diminish the quality of rail service, and undermine supply chains.

The imposition of a blanket reciprocal switching rule would amount to a government-ordered transfer of wealth from railroads to some of their largest customers, Jefferies contends. It also would snarl operations and be a disincentive for railroads to invest in their networks, he says.

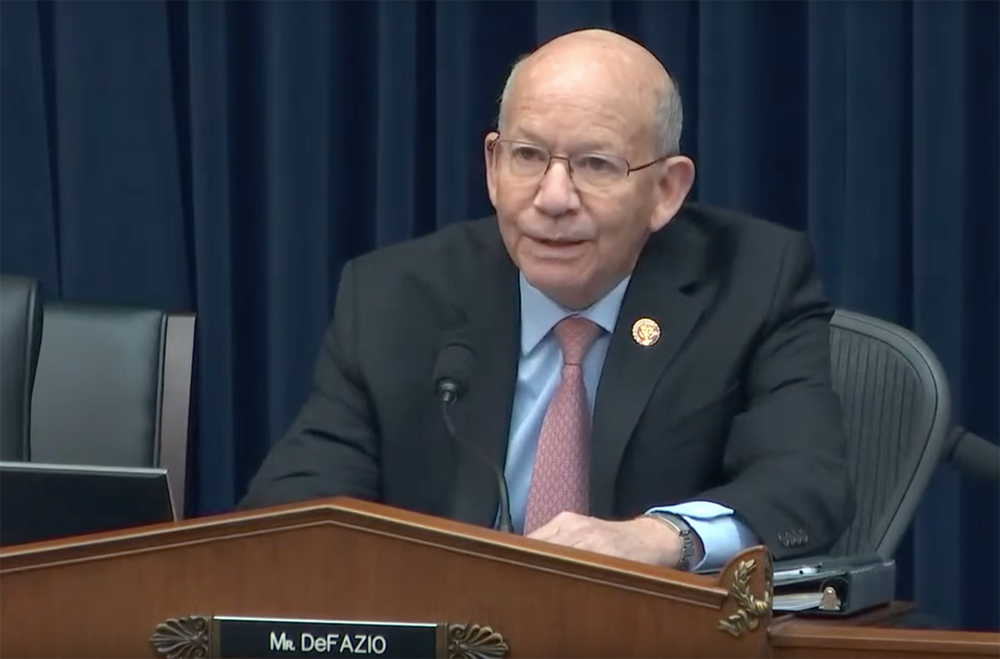

Committee Chairman Peter DeFazio, D-Ore., opened the hearing by saying that Wall Street is destroying the freight railroad industry. Share buybacks are favored over investments in rail infrastructure, he says, while the push to reduce costs and boost profits has made the railroad industry less resilient and less willing to serve smaller shippers.

“Our national policy to reduce the transport sector’s carbon emissions cannot be achieved if the freight railroads are cutting service to less lucrative shippers,” DeFazio says. “We need the freight railroads to be serving more customers at a time when the overall volume of goods transported in the country is skyrocketing.”

DeFazio also was highly critical of PSR, which he says “has spread like a disease through the industry.”

Stock buy backs have destroyed many basic industries. Money that could have been spent to improve industry operation or to increase sales forces and marketing has been wasted to keep stock price up. The beneficiaries of high stock prices are stock funds whose balance sheet look better, company management who are partially compensated in stock, and traders. Only someone like Buffet who actually is an “investor” seems to see this in the long run. Meanwhile the American industrial base continues to disappear.

Great comments. I’ll add a few.

2 class ones asked to add a couple of 4 or 5 car trains several years ago and their only progress is to tell the world that both railroads are going to fall apart if its attempted.

5 class ones all going to drown because 1 or 2 railroads dream of adding a half dozen daily trains to the North American network.

A passenger railroad that doesn’t seem to get it, if I take your train today ,I may want to return tomorrow. Similar to taking a taxi to supper tonight only to find I cant get one back until next Tuesday. any alarm bells yet?

The only solution I can see to the problem of Wall Street influence is to ban stock buy-backs by Class One RR’s or only allow them with Federal permission.

PSR can be stopped by a Federal law on the length of the train.

I don’t agree with outlawing one-person crews. Europe’s experience with them proves there can be a place for them under certain conditions.

One other possibility that’s worth considering if local switching is such a problem–Class One’s subcontract local delivery/switching to smaller companies.

The irony of this report is that “Congress” doesn’t have a very good track record lately of running itself efficiently.

Steven: I wish DeFazio would read yesterday’s post about Amtrak. Government cannot even run its own railroad well.

PSR is a terminology that Hunter coined to deceive customers and regulators of the true nature of its implementation. Only dispatch trains when maximum profits can be obtained regardless of customer service requirements. PSR is neither Precision nor Scheduled.

Precision Railroading has really taken the industry backwards, slower transit times, most train yards cannot efficiently build or absorb the monster long trains, many of the humps should never have been closed, not enough spent on capital improvements, intermodal and car load business lost due to lousy service. It is no mistake that BNSF which was smart enough to stay away from precision railroading is doing the best. The only class one to gain market share!

Seems to me if the RRs actually served their customers, treated their employees decently, and didn’t try to run a bare bones operation, this issue wouldn’t be before Congress. So, if they don’t want to serve their customers reliably, Congress can help fix that for them via the STB. Somewhere along the way it became all about profit & shareholders instead of the serving the customers.

DeFazio is retiring at the end of this term. If he does nothing then that means he has a cushy job consulting for some firm tied to railroads. If he does something, it means he is tied to a cushy job at either a paving company or a logistics company that uses trucks. If he goes all out to break the ice and looks at reforms in policy, it means he is going fishing when his term is up.

Are the ducks coming home to roost?

Defazio is not wrong.

If the useless RR executives would simply read these forum pages each day they would know that yes, the ducks are coming home to roost. De Fazio is not wrong.