Canadian Pacific Kansas City CEO Keith Creel is the calm in the center of an international storm that threatens to engulf his railroad.

With the 2023 merger of Canadian Pacific and Kansas City Southern, Creel’s CP made a $31 billion all-in bet on the combined railways’ ability to tap growing free trade in North America.

But now the second Trump administration has launched a trade war that puts Canada and Mexico squarely in its tariff crosshairs. Canada and Mexico have said they will respond in kind. Where this ends no one can say.

Certainly none of this looks good for CPKC, which earns 41% of its revenue from cross-border shipments and is the only railroad that connects all three countries. Perhaps no other company has more riding on the outcome of the spat involving the U.S. and two of its largest trading partners.

Yet Creel says the threat is overblown. Although the Trump administration aims to reduce U.S. trade imbalances, Creel says the economies of the U.S., Canada, and Mexico are inextricably linked. You just can’t unscramble the omelet.

“These three countries have never been more integrated than they are today,” Creel said last week, noting that near-shoring of production to Mexico has only accelerated since the pandemic exposed weak links in global supply chains.

Trade disputes will be ironed out, Creel contends, and so CPKC will be able to exploit its unique ability to provide single-line service to all three countries.

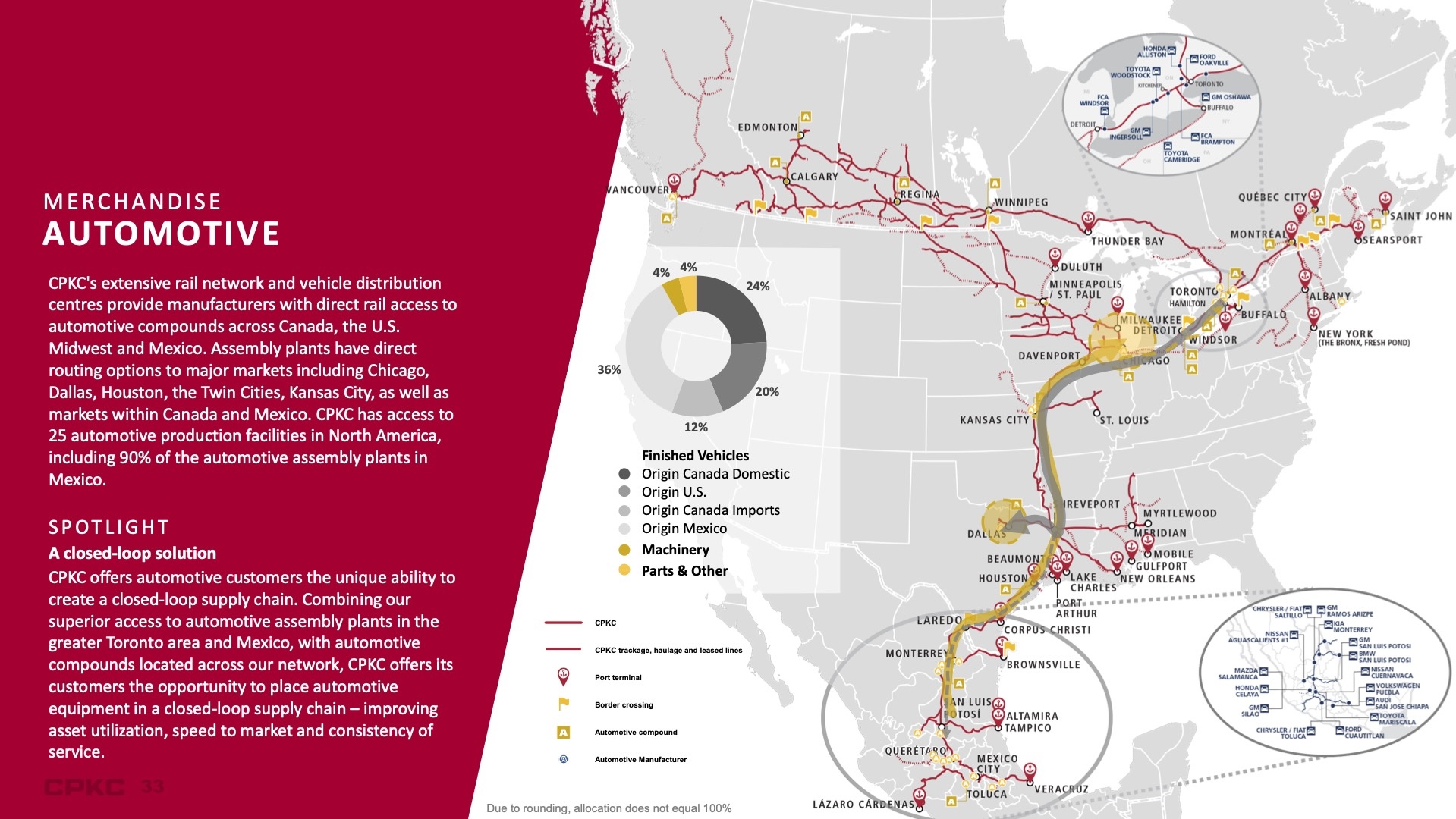

Take auto production, for example. For now, auto and auto parts imports from Mexico and Canada are exempt from the latest round of 25% tariffs. Roughly 16 million new light vehicles are sold in the U.S. annually. Assembly plants in the U.S., however, only have the capacity to build around 10 million cars and trucks. Plants in Mexico and Canada help plug that production gap.

And increasingly it’s CPKC that’s bringing those vehicles to the U.S., thanks in no small part to its innovative closed-loop auto rack supply system. Periodic shortages of auto racks have plagued assembly plants, particularly in Mexico — so much so that automakers resort to short-sea shipping across the Gulf of Mexico to deliver vehicles to U.S. ports.

CPKC has solved this problem for General Motors. The railway picks up auto racks loaded with Silverado pickups at GM’s assembly plant in Oshawa, Ontario, and delivers them to the auto ramp it opened in June in Wylie, Texas, outside Dallas. CPKC then forwards the empty auto racks to GM assembly plants in Mexico, where they’re loaded with Chevy and GMC sport utility vehicles. CPKC then hauls them north to auto ramps in the U.S. and Canada, and completes the loop by returning the empties to Oshawa.

CPKC’s auto traffic was up 23% last year. The best any other Class I could muster was 1% growth, while CPKC rival Canadian National saw its auto volume drop 10%. Other automakers are expected to join CPKC’s closed-loop system, which conceivably could involve as many as eight Ontario assembly plants and 15 in Mexico.

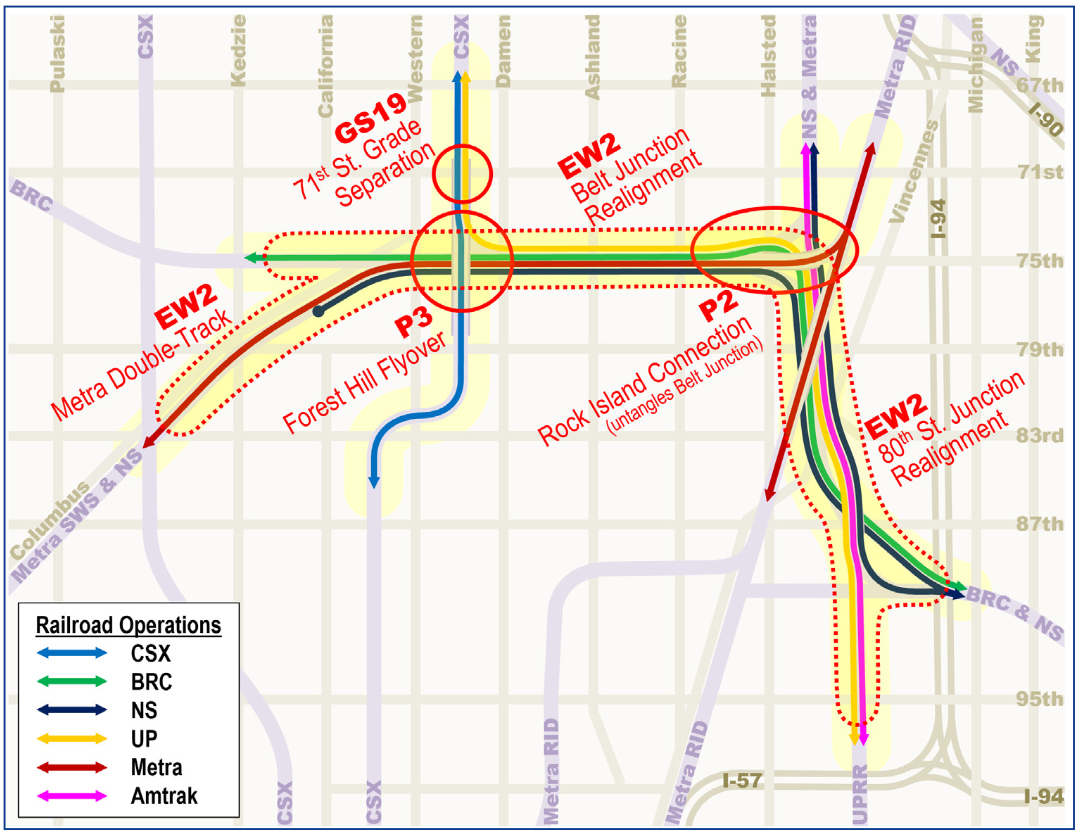

Cross-border intermodal is another area that Creel says will keep growing. Schneider is bullish on CPKC’s Mexico Midwest Express service, which is up more than 40% so far in the first quarter. And Schneider executives see twice as much potential volume coming from truck conversion in the joint CPKC-CSX lane linking the Southeast with Texas and Mexico via their new Alabama interchange.

CPKC also is tapping a new intermodal market: Cross-border, temperature-controlled food shipments. Via an Americold cold storage facility scheduled to open this summer at CPKC’s intermodal terminal in Kansas City, the railway will handle southbound shipments of beef and pork to Mexico. The containers will return northbound with loads of Mexican produce, food, and beverages bound for the Midwest, Southeast, and Canada.

Creel concedes that his railway is not tariff proof. If tariffs ultimately make U.S. markets less attractive to Canadian and Mexican companies, then those exporters are going to look elsewhere, he says. In this scenario, CPKC could become a land bridge fostering trade between Canada and Mexico.

Some observers say Creel is doing his best to put lipstick on a pig. No one wins a trade war, they say, and tariffs will raise prices, change consumer spending habits, and ultimately reduce the amount of cross-border freight available to CPKC. Plus, any increase in trade between Mexico and Canada could never fill the hole tariffs may blow in their trade with the U.S.

The $31 billion questions: Will tariffs once again merely be a negotiating tool? Or will they signal the beginning of the end of CPKC’s ability to cash in on North American trade? For now all CPKC can do is keep its fingers crossed — and hope the storm blows over.

You can reach Bill Stephens at bybillstephens@gmail.com and follow him on LinkedIn and X @bybillstephens

“Have YOU gotten a 38% raise?”

Have you convinced your bosses to stake $31 billion to merge with another company and come out on the other end still working and alive professionally?

He took the risk, therefore he gets the rewards.

Hey, I’d like to go to the Wall Street casino with marked cards and a sleepy, drunk dealer (STB) and gamble with house money. Betcha I’d win, just like Keith. That was Keith’s risk.

These guys make money even when mergers fail… ever hear of breakup fees?

“In connection with KCS’ termination of the CN merger agreement, KCS will pay CN the USD$700 million cash “Company Termination Fee” as well as the USD$700 million cash “CP Termination Fee Refund” provided for in the CN merger agreement.”

Yes, CP paid the breakup fees to CN in light of their merger.

$27.2 billion for KCS and $1.4 billion to CN to cover any/all breakup fees.

With all that cash on hand, you would still think CN could fix their signal shunt problems between Effingham and Carbondale Illinois.

Regardless of the regulatory or market conditions, Creel still had to sell it to his board and to the KCS board. If he had failed, he would be probably riding horses on EHH’s family horse farm in West Palm Beach, Florida.

Creel’s advocacy of more free trade means more rustbelt in Canada and the US. He doesn’t care… compensation $20.1 million in 2023, a 38% increase from the previous year. More rustbelt, more money for Keith.

Have YOU gotten a 38% raise?

Alabama-born Creel and his mentor, Memphis-born Hunter Harrison, were a double-barreled demolition derby at CN and CP. Creel really showed his understanding of Canada by displaying American and U.S. Marine Corps flags outside his office at CN’s Macmillan Yard in Toronto, but no Canadian flag.

Today’s CP in eastern Canada is a shadow of its former self while CN’s traffic in, out and through Toronto is booming. Let’s hope Creel soon rides off into the sunset with his saddlebags stuffed full of the money he’s pulled in from completing the CP-KCS merger while doing nothing to make it really work for the good of all three countries.

Greg and Gregg —- CP Rail in eastern Canada gets from Detroit to KCMO by means of Elgin, Illinois. Look on a map and tell me of that makes any sense.