WASHINGTON — A major grain shipper opposes Canadian National’s effort to force Canadian Pacific and Kansas City Southern to divest the KCS line linking Springfield, Ill., and Kansas City.

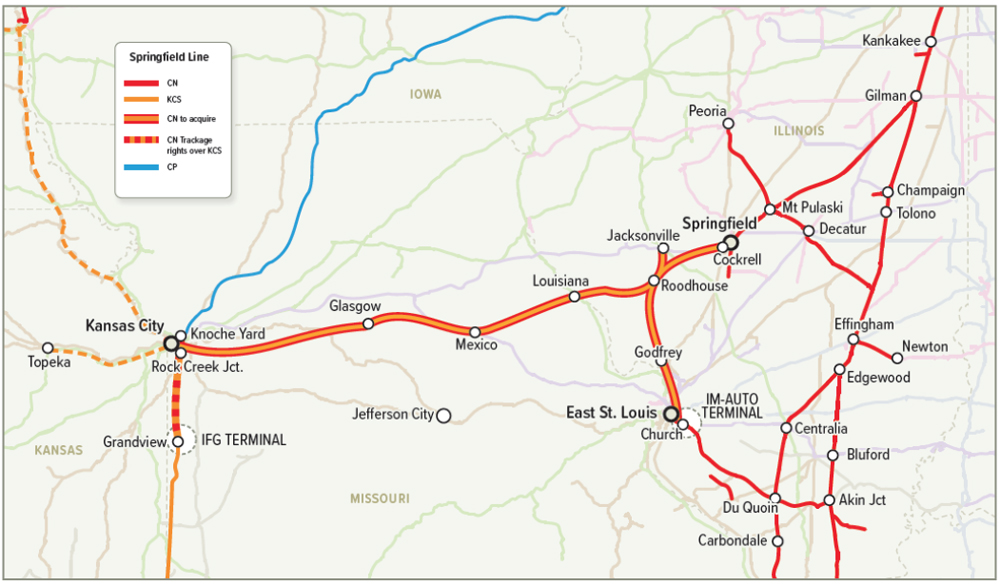

Earlier this year CN asked the Surface Transportation Board to condition approval of the CP-KCS merger on divestiture of KCS’s Springfield Line. CN promises to spend at least $250 million to create the Springfield Speedway, a new single-line route linking Kansas City with Detroit and Eastern Canada via the Illinois capital.

But Bartlett Grain Co., which opened a grain loading facility on KCS in Jacksonville, Ill., in 2013, says a divestiture to CN would end the single-line service it currently enjoys for grain shipments to Mexico. The $25 million Jacksonville facility includes a loop track that can accommodate 100-car unit trains.

“Nearly all of our shipments from Jacksonville go to Mexico,” Bartlett President Bob Knief wrote to regulators this week. “We made that investment to support shuttle service to Mexico that is a direct move from origin to destination on KCS.”

Last year Bartlett shipped nearly 11,000 cars from Jacksonville to its three unloading facilities in Mexico, which it purchased and expanded over the past seven years. “Bartlett does not want to jeopardize its substantial investments in delivering grain to the Mexican market and serving central Illinois grain producers,” Knief wrote.

CN has proposed preserving existing competition by providing CPKC with haulage rights access to customers on the route, as well as to interchange with Eastern railroads at East St. Louis.

But Bartlett fears that a CN takeover of the line would strand its Mexico investments.

“Adding an unnecessary handoff between CN and CPKC (whether CN begins to serve the plant directly or serves the plant by providing haulage to KCS) to move our grain to Mexico makes no sense when we have an efficient shuttle operation,” Knief wrote. “We don’t want our single line service to Mexico to be converted into a joint line move with haulage to Kansas City for handoff to CPKC to go to Mexico.”

Knief asked the STB to reject CN’s divestiture proposal and noted his support for the CP-KCS merger. The company is considering making additional investments in both the U.S. and Mexico if the merger is approved.

Knief also aimed to dispel concerns that CPKC would force shippers to choose CPKC service to Mexico by foreclosing Kansas City Southern de Mexico interchange with BNSF Railway and Union Pacific at the Laredo gateway.

“For many of Bartlett’s facilities, such as Council Bluffs, Iowa, we could choose service to Mexico via UP, BNSF, or KCS. Since 2005 we have directed most of our traffic to Mexico from those facilities to Mexico via KCS-KCSM routes,” he explained. “I can state categorically that we were never forced to choose those options. UP and BNSF options were always available to us, but we chose KCS single-line routes on the merits because they best met our transportation needs by serving our end-markets best.”

Just leave well enough alone CN and Let the CP Kansas City Southern Merger take Place

KCS takes grain to Mexico and they are working on a auto parts logistics center in Jerseyville, that KCS and Jersey County have invested in.

CN can’t duplicate this type of service plain and simple and they want to be somehow compensated for their lack of vision or aversion to financial risk.

KCS provides a service the customer actually LIKES and and is taking the risk. Why punish them? Tell CN to pound sand.

Solution: Don’t force sale of KCS’ KC=Springfield-STL line to CN. CPKC should offer CN trackage rights over it to KC from both Springfield and STL, as well as between Springfield and STL. In return, CPKC should ask for trackage rights over CN between Springfield and CP’s existing rights on NS & CSX south of Chicago. This would provide CPKC a much shorter and faster route beween KC and Detroit and reduce Metra’s concerns about increased freight traffic on their Milwaukee West line.

CN won’t do it? That would show they aren’t actually interested in increasing competition.

Excellent proposal!

That was my though a while back. Maybe just haulage rights. The BNSF haulage on CSX has worked well. The CN just getting haulage will allow CP / KCS to keep the route fluid. CN trackage rights might gum up the works. Haulage enables CP to negoiate required upgrades for the haulage. If a serious upgrading is neded for each Round trip that CN want to run then it easier for CP to require same.

CP can require no land barges that cannot fit in present sidings but CN can pay to lengthen sidings with 10 – 20 mile separations.

CN wants to pay to upgrade route any way.

Heck if they really, really want access to Kansas City, they could always buy what remains and rebuild the Rock Island Line from St. Louis!! (Hee! Hee!)

(I do realize this route was not ideal to begin and certainly does not provide the short-cut to Detroit)

Mr. Rowell: “…CPKS should ask for trackage rights over CN between Springfield and CP’s existing trackage rights on NS & CSX south of Chicago.” You do mean east of Chicago, correct? CP has trackage rights on NS’ ex-New York Central from Rock Island Jct (CP509) to Butler, IN (CP358) and from there on NS’ ex-Wabash to the Detroit area. I’m not sure over what CSX lines CP has rights over. So over what routing would CP go between Springfield and the NS Chicago Line? Thinking as I’m writing, would it be over the Gilman Line, the ex-IC to the cloverleaf interchange at Matteson, the ex-EJ&E to Griffith, IN, and the ex-GTW to South Bend? CP437, just west of the old NYC station, has crossovers allowing movement GTW/CN to/from the NS.

How ironic. It was said that the KC extension of the Chicago and Alton, built in the late 19th Century, led to the downfall of the railroad in the early 20th Century. C&A found itself in competition with Missouri Pacific, Wabash, Santa Fe, and Burlington, each with superior lines and a greater market reach.