Intermodal has long been the rail industry’s growth engine. But it hasn’t been firing on all cylinders in recent years. Yes, 2018 was a record-setting year for volume, and 2021 was intermodal’s second-best year ever. That’s all well and good — except that intermodal hasn’t been keeping pace with economic growth and has lost market share to the highway.

As intermodal analyst Larry Gross points out, since 2015 the economy has expanded at a compound annual growth rate of 2%, import container volume has grown at a 5.3% pace, and long-haul truckloads have increased 3.5% annually. Total intermodal volume has lagged. It’s grown at just an average of 0.2% since 2015, with domestic volume growing at an 0.9% clip and international volume shrinking by an average of 0.7% annually.

“Seven years of underperformance cannot be explained away by special circumstances and one-off issues,” Gross says. “The intermodal offering in its current form is not resonating with its target markets. Is it realistic to expect that intermodal will suddenly regain traction if nothing changes in what it is offering to its customer base?”

That’s an important question for the industry, especially when you consider that the thermal coal used to generate electricity is going away and most carload commodities are stagnant or declining. If railroads are to see meaningful growth, intermodal has to lead the way.

You can point to a bunch of factors that are behind intermodal’s anemic performance:

- The ongoing shift of imports to the East Coast, which makes containers less likely to ride the rails compared to boxes that arrive at West Coast ports.

- Norfolk Southern’s 2015 decision to pull the plug on its Triple Crown RoadRailer network, leaving it with just the Detroit-Kansas City lane. The rest of Triple Crown’s volume migrated back to the highway.

- The pruning of steel-wheel interchange in Chicago as railroads implemented Precision Scheduled Railroading and simplified their intermodal networks in 2017-18. Service was dropped altogehter between many origin-destination pairs.

- Rapid growth in trucking during the pandemic, when kinks in the supply chain made cargo owners prioritize speed.

But by far the biggest reason why intermodal growth has slowed is unreliable service. The one-two punch of crew shortages and intermodal terminal congestion has clobbered rail service over the past couple of years. So loads have hit the roads.

Most of that traffic will be perfectly happy to return to intermodal once service rebounds to normal levels, says Oliver Wyman consultant Adriene Bailey, who has experience as an intermodal customer and as a railroader at CSX Transportation and Southern Pacific.

But railroads will have to get much more reliable if they want to rev up intermodal growth. Even when railroads are operating well, intermodal trains may arrive 5 to 10 hours ahead of schedule or up to a day late. “With that wide range of variability, how are you ever going to get a reliable service product?” Bailey asks. “In order for railroads to take share, they have to get service right.”

Beyond becoming more reliable there’s no one answer to reigniting intermodal growth.

Railroads could be more flexible on pricing on a lane-by-lane basis, which Bailey says would allow them to attract new domestic traffic. Railroads also need to figure out how to be more effective competitors in short-haul intermodal lanes as more imports arrive at East Coast ports that are closer to inland consumers, she says.

Gross says railroads need to do three things to break out of the intermodal doldrums.

First, they need to develop more robust networks that serve secondary markets. “They need to get away from the skeletal network concept where volume is gathered by long drays and then put on massive trains,” he says. “Railroads keep trying to impose a simple network on a market that’s inherently complex.”

Second, they need to introduce new services aimed at medium lengths of haul. A prime example would be connecting cities that are within 500 miles of the Mississippi River, the de facto dividing line between the eastern and western railroads. Except for Norfolk Southern-Kansas City Southern interline service linking Dallas and Atlanta via the Meridian Speedway, railroads don’t really serve so-called watershed traffic.

Third, they need to figure out how to become a viable competitor to trucks. “The industry needs to stop thinking there’s some exterior force that’s going to push traffic back to the railroad,” Gross says, citing things like a shortage of truck drivers, high fuel prices, and shippers’ desire to reduce emissions by shifting freight from road to rail.

Instead, he says railroads need to offer the right combination of service, reliability, and rates that will attract traffic from the highway. In other words, railroads need to make shippers want to use intermodal.

There’s a massive incentive for retailers to move consumer goods by rail due to their aggressive goals to reduce greenhouse gas emissions. Intermodal is like an easy button because its carbon footprint can be up to 75% lower than truck, according to railroads’ online carbon estimator tools.

Environmental concerns will be an effective tiebreaker for shippers considering intermodal, Gross says. “But if the choice is substandard service and paying more, it’s a pipe dream,” he says of growth tied to reducing emissions.

The combination of an intermodal volume lull and a return to full train-crew staffing is expected to allow the big four U.S. railroads to get service back to normal levels by midyear. The trick will be to maintain service – and then improve it – so that intermodal customers gain the confidence they need to put more volume on rails.

You can reach Bill Stephens at bybillstephens@gmail.com and follow him on LinkedIn and Twitter @bybillstephens

One of my favorite oxymorons – railroad management.

Right up there with “government worker.”

The stats and comments about Schneider and JB Hunt are interesting but actually a bit irrelevant in the light of the size of the U. S. motor carrier market. Total trucking revenues for 2022 were around $875 billion. To tap into more of this vast amount, the suggestions for better short-haul economics, better reliability, and more competitive costs will have to be taken on board by the railroad industry — and likely re-think completely their long-standing approach to be a wholesaler of line-haul transport, leaving the “retail” work to intermodal marketing companies.

I’d submit also that in many markets, especially in the West, the railroads will need massive investments in physical plant to be even remotely competitive. The classic example is the “I-5 Corridor” in which UP’s largely 19th Century route (yes, there’s the Natron Cutoff from the 1920s, which doesn’t help much) is up against a fast, well engineered, and much shorter super highway provided at very low cost to the truckers. I’ve worked on several freight projects for the I-5 corridor, and have seen the economics — slow and unreliable will never garner more than a small sliver of that marketplace.

Correct James. Both JBH and SCHNL represent a fraction of total Motor Carrier miles. Howevr SCHNL was tired of playing second fiddle to BNSF’s preferred partner JBH. So some relevancy is there.

Added circuity is the problem with intermodal. Those additional miles equal greater cost of service. While you’re correct about the I-5 Corridor’s speed. It’s not the speed but reliabilty is where the Truckers beat the Rails. Shippers don’t care who’s the fastest. They want relaibility. If your schedule says A-to-B in 40 HRS shippers expect that. Not consistently showing up 10 HRS late..

BNSF is currently restricted by a tunnel in the Deschutes Canyon this is why they can’t move double-stacks in the I-5 Corridor. UP doesn’t offer enough frequency in the I-5. Yet this may be a line capacity issue. You’re not going to garner business offering 1 departure/day in IM.

The statement above how the C1’s are trying to apply a simplified network to the complex cog known as intermodal pretty much sums up the picture

More silliness. 99 percent of trucking companies have 25 or fewer employees. How exactly would you suggest marketing to these folks? Remember the old adage that for any business 80 percent of your revenues come from 20 percent of your customers? Certainly, true here!

Within that one percent according to Transport Topics in 2020 there were 38 carriers with annual gross revenues in excess of $1 billion, include JB Hunt, Schneider, Knight-Swift, FedEx and UPS, Inc. (all of whom own intermodal containers). My favorite carrier in this segment is #12 Estes Express, an LTL carrier with $3.6 billion in annual revenues who also owns a fleet of 852 domestic intermodal containers.

And we should not overlook the handful of refrigerated carriers in the $500 to $999 million annual revenue range that operate refrigerated intermodal carriers (including KLLM and Marten).

The I-5 argument is interesting. This a major freight lane where UPRR has the inherent advantage, and it will be interesting to see if Schneider can help them make it work. But for BNSF it is largely irrelevant.

BNSF in investing billions of dollars in improving what is already the finest intermodal franchise in North America. They opened up the Abo Canyon bottleneck and completed double tracking the entire Southern Transcon except for four miles of single track on bridges. The they bought out Dennis Washington and re-acquired the former NP main line. At the same time, they completed a second bridge across Lake Pend Oreille.

Congestion and capacity issues in Southern California threatened gridlock so they are making a billion-dollar bet at Barstow. The Barstow investment opens up a world of opportunities as well as keeping the Southern Transcon fluid.

The most serious unsolved problem is the looming terminal capacity crunch in Chicago. But BNSF will solve that one too. Who has the time or money to worry about short haul intermodal? Maybe in 10 or 20 years.

Finally, the one critical question that NONE of you have asked, is WHERE IS FEDEX??? UPS and FedEx are the two largest for-hire transportation companies in the world. Every railfan and railroader knows the UPS story but why is FedEx such a reluctant intermodal user.

Mr. Saunders with all due respect you do not know what you are talking about. The JB Hunt-BNSF relationship is a true collaborative partnership governed by an exclusive contract originally negotiated personally by two legendary individuals named Johnny Bryan Hunt and Michael J. Haverty. I know because I was there. Santa Fe in effect granted Hunt “most favored nation status” as part of the legally binding deal.

Those of us who were there know that the one requirement JB had was for a true partnership where both parties had equal amounts of “skin the game”. And as it turned Mr. Haverty wanted exactly the same thing. It was a marriage made in heaven.

And it was the extraordinary trust and mutual respect between these two gentlemen which allowed us to operate the partnership (and move loads) for almost two years before we finally signed the partnership agreement.

For the real reason Schneider left I would direct readers to the most recent Schneider Annual Reports. It is all there in black and white for anyone interested in facts versus speculation.

In 2000 JB Hunt was ranked the 4th largest for hire trucking company in North America, with gross revenues of $9.6 billion. Schneider was ranked 7th with gross revenues of $4.6 billion. I think everyone would agree we asked the right partner to the dance.

When the RRs run a 3 mile long double stacked land barge once a day from A to B, averaging 1/3 the speed of a truck, is it any wonder they can’t gain share? I think they should be launching trains every 8 or 12 hours in dense markets & power them up to compete on service.

That was one of E. Hunter Harrison’s original tenets of PSR. Trains would be scheduled for a certain departure and would leave with whatever cars were available. Thus the railroads would remain fluid with large and small trains. But that meant having to keep locomotives in reserve for the larger trains that would ultimately have to be scheduled when less than preferred train lengths were released as scheduled.

Railroads saw an opportunity to do the same thing by lengthening trains to 12K-15K feet even though they didn’t have near the infrastructure in sidings and/or double track to handle trains that long. But they managed to lower their operating ratios in spite of worsening customer service and trying to manage trains by commodity as UP has shown to be a losing (for their shippers and customers) proposition, so in the execs minds all was forgiven.

Until Wall Street quits trying to manage expectations for a form of logistics they clearly don’t understand, we will only see more of the same… Railroads are the slow, but sure and less expensive form of transport. if you want fast and sure, ship everything by Federal Express or Air Cargo which would cost a boatload and require twice the shipping to get the same volume even if it could be done.

“Intermodal trains may arrive 5-10 hours ahead of schedule or up to a day late. I just don’t understand how this can happen with PSR, LOL.

When you look at it, Intermodal and PSR are mutually incompatible. Intermodal stands no chance of an operating ratio of 50. As long as PSR is in charge, intermodal can’t compete with PSR or the highway.

You guys just don’t seem to get it! BNSF’s two largest intermodal customers are UPS and J.B. Hunt. They are the first and fourth largest for-hire trucking companies in the US, respectively (2020 data). They also supply all of their own equipment. Hunt is also now the owner of the largest fleet of refrigerated intermodal containers in the business followed by KLLM.

I would respectfully submit the railroads are not really in the domestic intermodal business anymore. They have outsourced the business to the truckers. And it is the truckers who ultimately control the decision to use rail or go OTR.

The JBH-BNSF product is also the better service product when compared to traditional intermodal. Transportation is still a door-to-door business.

BNSF just opened a new terminal in Tacoma for Hunt and added new transcontinental service between Tacoma and Chicago. BNSF and Hunt still have terminal capacity issues in Chicago but the new service extension to North Baltimore helped alleviate some of that.

According to published reports in the Journal of Commerce, J.B. Hunt is now the single largest intermodal marketing company in North America, with more than 100,000 53-foot containers in service.

Willow Springs remains the only 100 percent premium intermodal terminal in the US.

And the good news is that UPS represents only 40 percent of the lifts at that facility. But the bad news is that it is running out of capacity.

In 2020 J.B. Hunt Intermodal grossed almost $5 billion in revenues and represented more than half of J.B. Hunt’s operating income by business unit.

The short haul argument is a generally a bunch of silliness. However, I will concede that in certain instances the ports have been able to make it work as part of an integrated inland port operation.

KLLM’d senior management has remained roughly the same for 20-30 years. The emphasis of the organization has been customer service, and employee support(drivers) more then any other company.

KLLM has inspire of adversity had a very low driver turnover rate, especially compared to other OTR companies. It has maintained an excellent rapport with its drivers , even in adverse times.

The values of KLLM must be compatible with those of the Santa Fe Railway since KLLM started using Santa Fe’s intermodal service in the early nineties. That was only a few years after we implemented the JBH-ATSF joint venture. We still see KLLM boxes n BNSF double stack trains operating through the western suburbs.

Yes, BNSF is something alright, but remember, they are privately owned by Warren Buffet and his Gang of Seven and don’t have to worry about what Wall Street thinks their operating ratio should be. Yet at the same time the independence that BNSF has also allows to treat certain customers differently which is why they lost the Schneider business to Union Pacific. If they would have given Schneider the same care they have given JBH, they would still have that business as well as other business that has shifted to UP. But companies each think that their green is as good as the other guys and what is BNSF’s loss may turn out to be UP’s gain although I am not sure how that will happen. UP’s current Chairman/CEO Lance Fritz who has sold his soul to Wall Street in the hopes that if he buries his railroad in enough bull$hit, something beautiful will grow. Oh to have Jim Young still alive and running the show, when UP was at it’s most profitable and powerful position.

Mr Giblin: There was a gap from 1997 until 2005 when KLLM was strictly a trucking operation. The company was having internal problems that nearly put the company out of business.

Through it all management stayed in touch with their employees (not easy in OTR). I have been out of the business for ten years, so I’ve kind of lost touch. Management personal have stayed constant as have a lot of senior drivers, from what I have seen.

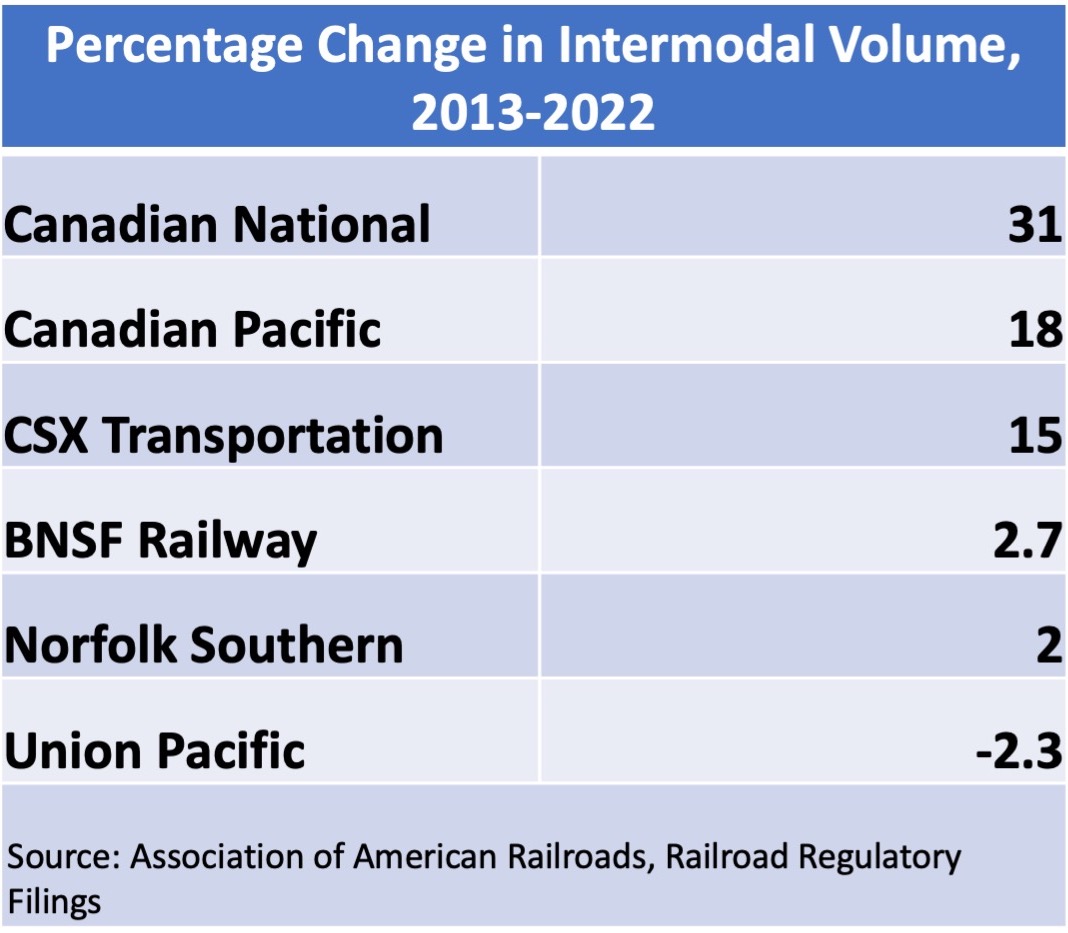

If only we could learn that the way to grow is to compete not just look at stock value.The Canadian railroads seem to be doing things differently.