WASHINGTON — U.S. rail traffic remained strong in June, with overall carload and intermodal traffic running 14.5% ahead of the same month in 2020. Year-to-date traffic at the end of the second quarter was up 13.7% compared to pandemic-depressed totals for the first half of 2020, according to statistics from the Association of American Railroads.

“U.S. rail volumes in the second quarter of 2021 reflect an economy that is in much better shape than it was but still has room to grow,” AAR Senior Vice President John T. Gray said in a press release. “In the second quarter, total U.S. carloads were the highest since the fourth quarter of 2019; carloads excluding coal were the highest since the third quarter of 2019; and intermodal and chemical volumes were both the highest for any quarter in history. Carloads of steel-related commodities were also relatively strong in the second quarter, reflecting higher demand as the industrial economy continues to recover.”

June figures found U.S. railroads originating 1,175,232 carloads in June 2021, up 19.1% over the same month in 2020. Container and trailer traffic totaled 1,389,746 units, up 10.9%

Week ending July 3 sees slight drop in traffic

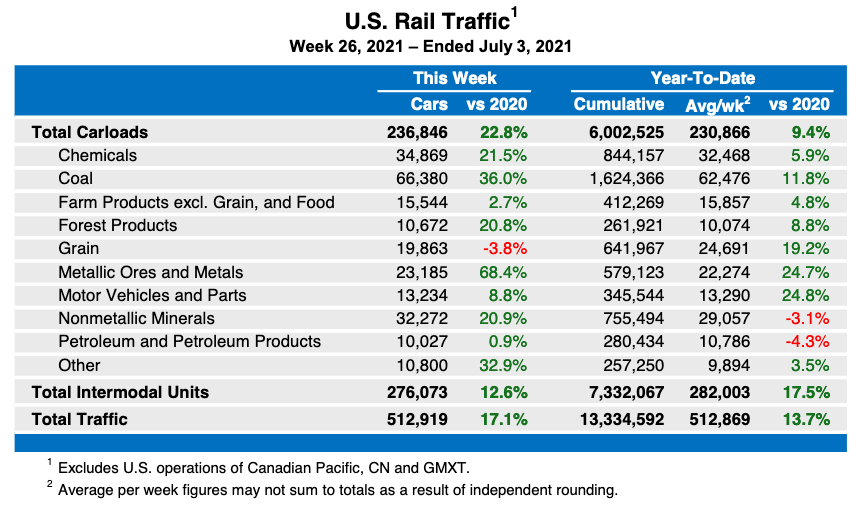

Figures for the week ending July 3 include 236,846 carloads, a 22.8% increase over the same week in 2020, while intermodal volume of 276,073 containers and trailers represented a 12.6% increase. The week’s total traffic, 512,919 carloads and intermodal units, represents a 17.1% increase over the corresponding week in 2020, but is also a slight drop from 2021’s previous week in 2021, which saw railroads originate 237,117 carloads and 279,050 intermodal units for total traffic of 516,167 carloads and intermodal unites.

North American totals for the week, from 12 reporting U.S., Canadian, and Mexican railroads, show 329,932 carloads, an 18% increase over 2020; 355,466 intermodal units, an 11% gain, and 685,398 total carloads and units, a 14.3% increase.

What is the 2019 figures compared to 2021. 2020 bad data point

A comparison of every category except coal with, say, 2005 would be interesting.