COLUMBUS, Ohio — The city of Cincinnati’s plan to sell the Cincinnati Southern Railway to Norfolk Southern — which had been in jeopardy — has been revived by the state legislature.

WXIX-TV reports that, after the state House and Senate passed versions of a transportation bill with conflicting language regarding the sale, a conference committee on Tuesday restored language allowing the funds from the sale to be used for capital projects.

That language was a key facet of the city’s plan to sell the railroad, since Cincinnati uses the current annual lease payments for capital funding. Without that clause in the transportation bill, it could only have used sale proceeds to pay down public debt.

The language approved by the committee will specifically identify Norfolk Southern as the buyer, places limits on principal in a trust to be managed by the CSR Board of Trustees, and allows the board to submit the question of a sale to be submitted to voters only in 2023 or 2024, and only once. Voter approval is required for the city to sell the railroad.

State Sen. Nickie Antonio (D-Cleveland), a member of the transportation and conference committees, told WXIX that some members of the senate “wanted some guardrails around the sale of the railway. … This is a local concern. What the legislation does is enable the people in the community to make the decision.”

The House and Senate will each vote on the compromise version of the bill today (Wednesday, March 29). If it passes, Gov. Mike DeWine must sign it by Friday.

Cincinnati, the Cincinnati Southern board, and Norfolk Southern announced an agreement to sell the railroad — the nation’s only municipally owned interstate rail line — in November [see “Norfolk Southern to buy CNO&TP …,” Trains News Wire, Nov. 21, 2022]. NS and predecessor Southern Railway have leased and operated the route as subsidiary Cincinnati, New Orleans & Texas Pacific since 1881. But while the city currently receives about $25 million annually from the lease, the sale is structured so those payments will increase to $60 million a year or more.

Along with the question over the use of funds, the sale has faced opposition over safety concerns arising from the Feb. 3 NS derailment in East Palestine, Ohio.

It would only make sense if the City received the full purchase price of $1.6 billion at the closing of the sale, and then placed it in an irrevocable trust that had a stipulation in the trust document that only 75% of the annual earnings could be withdrawn annually to preserve the corpus.

$1.6 billion averaging 5% annually on investments (some years higher thant 5% and some years lower than 5%) would generate $80 billion in year 1. A withdrawal of 75% of those earnings would be $60 million.

But the corpus would continue to grow so the annual earnings should grow, and therefore the annual withdrawals should grow.

So it works only if the sale proceeds are deposited in an irrevocable trust and the corpus is never touched. But done right it would work to the benefit of citizens of the City of Cincinnati.

I believe the Commonwealth of Virginia has regretted selling the RF&P to CSX.

Yeah but VA bought half of the physical trackage last year (one of the two main tracks), which they can operate on, as opposed to having a share of a stockholders interest.

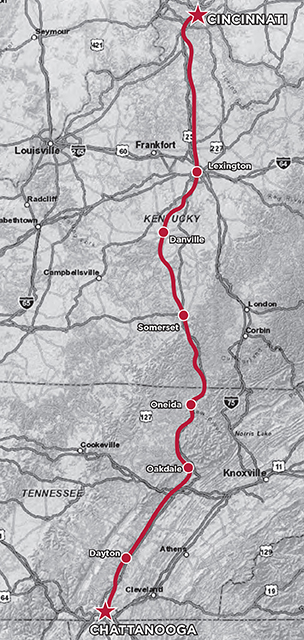

Amtrak should maybe consider operating a new Auto Train using that (Cincinnati- Chattanooga) rail line as a portion of the route. Once the proposed Cleveland-Columbus-Cincinnati passenger train becomes operational, an Auto Train could initiate from Niagara Falls, NY via Cleveland, Cincinnati, Chattanooga, Atlanta, Jacksonville, ending in Sanford, FL. This route would allow for double-decker Auto Train cars to travel for Canadians going to Florida, and potentially other U.S. travelers along the way, such as on/off stops in Ohio. Thus bypassing Amtrak’s height-restricted NEC.

Ignoramuses in the Ohio state Legislature, but what else is new?

Would not want to do anything crazy with the proceeds of sale like “pay down public debt”.

Yeah. Safety concerns are just ignorance rising to the top. NS will still be running it no matter what. But I think Cincinnati would be better off in the long run keeping it. Those $60 million payments end eventually.

Safety concerns?

Do those morons realize the potential purchaser has been operating the line for the last 141 years or so?

When their attitude is “What’s in it for me”…they probably don’t.

NS is a big enough system; they don’t need to own any more rails. In fact, they should be forced to sell some, such as the Lehigh, Sunbury and Binghamton lines in Penna. and NY.

Foxes in the Hen House.