For Norfolk Southern, 2024 was the second turbulent year in a row that the railroad probably would like to forget.

As the year began, NS executives held private meetings with a Cleveland-based activist investor that sought seats on the company’s board and wanted the railroad to improve its lagging financial performance in the wake of the disastrous 2023 derailment in East Palestine, Ohio.

Those talks spilled into the open on Jan. 31, when the Wall Street Journal broke the news that Ancora Holdings wanted to wrest control of the NS board and oust CEO Alan Shaw. It was the beginning of a nasty proxy battle that would come down to the wire at the railroad’s annual shareholder meeting in May.

Ancora nominated eight candidates for seats on the NS board and touted former UPS executive Jim Barber Jr. as CEO and former CSX executive Jamie Boychuk as chief operating officer. Ancora said its management team would improve the railroad’s operations, service, and profitability by jettisoning Shaw’s resilience strategy and going all-in on the low-cost Precision Scheduled Railroading operating model.

Ancora said its plan for NS would cut costs, focus on the most profitable merchandise traffic, and produce a 57% operating ratio within three years. That would be a 10.4-point improvement over Norfolk Southern’s 2023 operating ratio.

NS shot back, calling the Ancora plan a “slash and burn” strategy that would hurt the railroad’s service and safety while increasing regulatory scrutiny from both the Surface Transportation Board and the Federal Railroad Administration. Ancora’s “reckless approach,” NS said, would forego growth opportunities and damage customer relationships.

NS said its long-term strategy – which reduces the emphasis on the operating ratio over the short term and relies on not furloughing train crews during downturns – would “capture outsized gains during an economic upcycle.”

In response to pressure from Ancora, however, NS made several course corrections.

The operating ratio not only returned to management incentive plans — it became the largest single component of annual executive bonuses. NS set a sub-60% operating ratio target and cut 15% of its intermodal lanes. And to accelerate operational improvements and convince investors it remained committed to the low-cost Precision Scheduled Railroading operating model, NS brought in PSR veteran John Orr as chief operating officer. Yet NS said it remained firmly behind its strategy of balancing service, productivity, and growth with a focus on safety.

Some of the unions representing NS craft employees sided with management. But the Brotherhood of Locomotive Engineers and Trainmen and the union representing maintenance of way workers, both of which initially backed Shaw in the opening days of the proxy battle, flipped to supporting Ancora. The BLET even signed an agreement with Ancora that would have granted engineers various concessions if the activist investor prevailed in the proxy contest.

At the railroad’s May 9 shareholder meeting, investors delivered a split verdict. They spared Shaw, voted out independent chair Amy Miles, and elected three of Ancora’s insurgent candidates. Shareholders backed Ancora’s desire for change but sought to give Shaw & Co. more time to prove the railroad’s service and resilience strategy.

Although Ancora’s candidates gained three seats on the railroad’s 13-member board, it was far short of the majority that the Cleveland-based activist investor had sought.

NTSB: East Palestine vent and burn unnecessary

A little more than six weeks after the shareholder meeting, the National Transportation Safety Board issued its report on the East Palestine hazardous materials wreck. The board’s conclusion: Norfolk Southern and its contractors should not have decided to vent and burn derailed tank cars carrying vinyl chloride three days after the Feb. 3, 2023, derailment.

The five tank cars were among the 38 cars of train 32N that derailed after the catastrophic failure of a wheel bearing on a covered hopper. NS feared a potential chain chemical reaction would have led to an explosion that would have sent hazardous materials and shrapnel through the town on the Ohio-Pennsylvania border.

But the NTSB’s investigation found no evidence that a polymerization reaction was under way in any of the tank cars. The NTSB said that NS and its contractors ignored evidence that suggested the threat was diminishing and that the vent and burn operation was not necessary.

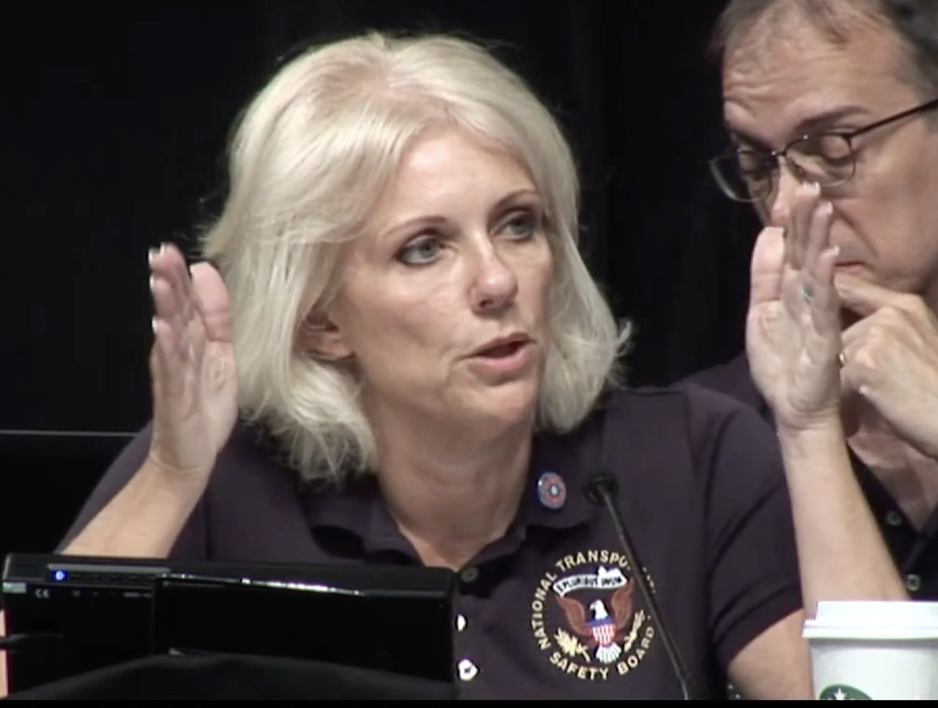

Then, at the end of the daylong June 25 hearing in East Palestine, NTSB Chair Jennifer Homendy dropped a bomb: She sharply criticized Norfolk Southern for the way it responded to the board’s investigation. NS stonewalled board requests for information, ran its own probe on the side in violation of NTSB rules, and sought to influence the board’s independent investigation, Homendy said.

“Norfolk Southern’s abuse of the party process was unprecedented and reprehensible,” Homendy said.

NS disagreed and said that it fully cooperated with the NTSB probe. In a turnabout during a July visit to the NS headquarters in Atlanta, Homendy praised Shaw for pledging to exceed the safety recommendations that the NTSB made in its East Palestine report.

Justice Department sues over Crescent delays

The Justice Department stunned Norfolk Southern officials on July 30, when it announced it was suing the railroad for causing frequent delays to Amtrak’s Crescent between Alexandria, Va., and New Orleans. It was only the second federal lawsuit filed against a host railroad for giving freight trains preference over passenger trains.

Amtrak, which gained the right of preference in 1973, had urged the Justice Department to take action against a host railroad in light of the poor on-time performance of its long-distance trains.

Justice decided to file suit against NS. All 15 of Amtrak’s long-distance trains that operate on the Class I railroads failed to meet federal on-time performance standards last year, as did the vast majority of state-supported routes that operate on host railroads.

It was unclear why the Crescent was targeted — it did not have the worst on-time performance record. But some industry observers suspect that politics played a role in the decision to single out Norfolk Southern. The Justice Department had faced criticism from lawmakers on Capitol Hill after it reached a settlement with NS regarding East Palestine — a decision made before the NTSB released its report on the wreck. The suit against NS, observers said, would show Justice Department critics that it was not soft on the railroad after all.

A CEO’s fall from grace

NS CEO Alan Shaw survived the proxy battle and the fallout from the East Palestine wreck, which cost the railroad $1.6 billion. But he could not maintain the board’s support after a brief investigation found that he and the railroad’s top lawyer had engaged in a consensual relationship in violation of company policy. Shaw and Chief Legal Officer Nabanita Nag were both dismissed on Sept. 11.

The NS board unanimously named Chief Financial Officer Mark George as president and chief executive officer. “While we are deeply troubled to learn of this situation, I am proud of our board for addressing it swiftly,” George wrote in a memo to employees. “Now, we need to get this behind us. We have a lot of work ahead of us, and our focus remains unchanged. We must continue to become even safer, drive further productivity, and continue to build the confidence and business of our customers.”

George joined NS in 2019 from conglomerate United Technologies Corp., where he was global chief financial officer for its Otis Elevator Co. and Carrier Corp. subsidiaries.

Claude Mongeau, the former Canadian National CEO who chairs Norfolk Southern’s board, in a separate memo addressed the events that led to the dismissal of Shaw and Nag and said that the scandal doesn’t diminish operational improvements the railroad has made.

“Mark has played an integral role in our process,” Mongeau said of George. “He is deeply familiar with Norfolk Southern’s operations and the industry; he knows the key players and he brings decades of financial and operational expertise. Importantly, Mark embodies our corporate values and our safety culture, making him the ideal fit to lead Norfolk Southern.”

Two days later, George made his first public comments since being named CEO. Norfolk Southern, which has struggled to maintain consistent and reliable service in recent years, will no longer put up with mediocre operational performance, George told an investor conference.

“The tolerance for poor performance inside of rails has always bothered me,” George said.

“I spent 30 years inside of another industrial conglomerate, United Technologies, and I’ve seen the world operate differently without a whole lot of patience for anything other than excellence on the operations side,” George said.

Norfolk Southern remains committed to the service and resilience strategy that was introduced in December 2022, Chief Marketing Officer Ed Elkins said at the Surface Transportation Board’s growth hearing on Sept. 17. “The No. 1 question I’ve heard from our customers over the past few days is … are we committed to our previously announced strategy? And I want to be clear that the NS strategy is a company strategy developed by the entire leadership team, not one individual,” he said. “And as such the core tenets of our strategy remain unchanged: Service, productivity and growth with safety as the foundation.”

NS also remains committed to the profitability and productivity targets it established during the proxy contest. Among them: Harvesting $250 million in cost and productivity savings this year, another $150 million next year, and then ultimately reaching an operating ratio below 60%.

NS makes progress

With East Palestine, Ancora, and Shaw in the rearview mirror, NS reported progress during the third quarter as operations and service improved. Its operating ratio improved 5.7 points as expenses fell and revenue grew. Shippers have rewarded NS by sending more volume its way. Through the first week of December the railroad’s traffic was up 4.2% for the year.

Proof that NS has regained its operational mojo, according to Rick Paterson, an analyst at Loop Capital Markets who closely follows railroad performance metrics: The railroad was able to quickly rebound from twin hurricane strikes in the fall. Hurricane Helene hit on Sept. 26, followed by Hurricane Milton on Oct. 9.

“Everywhere you look there’s corroboration of an immediate snapback, including total cars online, manifest on-time performance, and first-mile/last-mile performance,” Paterson wrote in a Nov. 1 note to clients. “In the ‘old days’ none of this would have occurred and, at best, we’d have an elongated trough and slow recovery over weeks or months. Now it’s seven days and done.”

“Norfolk Southern is back,” Paterson told the RailTrends conference later in November.

Also in November, NS and Ancora reached an agreement. NS and Ancora said they would work together to identify an independent director to join the board in 2025. And, as part of a standstill deal, Ancora agreed to withdraw its nomination of four director candidates at the NS 2025 annual meeting.

“We are making meaningful progress on key operational metrics, as evidenced by our strong third quarter 2024 results in which we drove productivity, grew volumes, and delivered notable margin improvement. Our strategy is unlocking the full value of the business for shareholders, customers, communities, and employees,” George said in a Nov. 14 statement. “I am confident that together with Ancora we will find the right independent director to join our Board and support our team as we continue to build on the positive momentum that is underway at Norfolk Southern.”

Previous News Wire coverage:

Report: Activist investor group aims to oust Norfolk Southern CEO Alan Shaw, Jan. 31, 2024

Activist investor seeks to install former UPS president to run Norfolk Southern, Feb. 20, 2024

NTSB chair tells Senate hearing East Palestine chemical burn could have been avoided, March 6, 2024

Norfolk Southern names CPKC executive John Orr as chief operating officer, March 20, 2024

Activist investor group would put Norfolk Southern back on PSR path, reduce operating ratio to 57%, March 26, 2024

Norfolk Southern calls activist plans a slash-and-burn strategy that would require furloughs, April 2, 2024

Norfolk Southern prunes intermodal network and puts focus on operating ratio improvement, April 5, 2024

Norfolk Southern details operations and service improvement progress and goals, April 24, 2024

Norfolk Southern shareholders back CEO Alan Shaw but give activist investors three board seats, May 9, 2024

NTSB issues 31 new recommendations in wake of East Palestine wreck, June 25, 2024

NTSB chair rips Norfolk Southern’s ‘unprecedented and reprehensible’ response to derailment probe, June 25, 2024

Justice Department sues Norfolk Southern over Amtrak delays, July 30, 2024

Buttigieg: Justice Department lawsuit necessary to get freight trains out of Amtrak’s way, Aug. 1, 2024

Norfolk Southern dismisses CEO Alan Shaw, promotes Chief Financial Officer Mark George …, Sept. 11, 2024

Norfolk Southern continues to gain on earnings, operating ratio, Oct. 22, 2024

Norfolk Southern to add new board member as part of agreement with Ancora Holdings, Nov. 14, 2024

As a long time railroader, I am very glad Ancora did not get its way and install subpar management to pad profits. PSR is slash and burn management. People should remember Mr. Jamie oversaw one of the largest operational failures in Canada with a catastrophic train derailment.

NS is the poster child of failure and for strong re-regulation of the industry. PSR has been nothing but slash-and-burn of the physical plant and workforce, so executives and their Wall Street masters can stuff their pockets. “Pricing above inflation”, now standard practice is price gouging by monopolists.