Amtrak carried more passengers in its 2024 fiscal year (October 2023-September 2024) than at any time in the company’s 53-year history. The milestone was achieved primarily by adding Northeast Corridor frequencies and deploying enough passenger cars on its main East Coast artery to meet expanding travel demand.

Nationwide, however, it was a different story. While state-supported services also registered growth as a result of additional trips, patrons traveling on long-distance trains faced capacity shortages leading to frequent sellouts and higher prices.

How it happened

More round trips were added in March between New York and Washington by converting trains to push-pull operation, eliminating a time-consuming move at the Sunnyside or Ivy City maintenance facilities. This was accomplished, passengers were advised in February, by flipping half the seats in every Amfleet coach to face in opposite directions.

When more capacity is made available, by increasing departures or train length, fares can be lowered to attract riders at different price points. The company has not only implemented this strategy in utilizing ultra-low, off-peak “Night Owl” fares (perhaps a nod to the name of a former Amtrak Boston-Washington, D.C., overnighter), but also by offering numerous travel options throughout the day.

Historically, customers on Amtrak’s long-distance network also benefitted when management took advantage of extra capacity to generate more mobility and revenue. As the 284-car Superliner fleet arrived between 1979 and 1981, single-level hand-me-downs updated to head-end power became available to launch Auto Train in 1983. The 195-car Superliner II order delivered from 1993 to 1996 under president W. Graham Claytor Jr. allowed Auto Train, the City of New Orleans, and the Capitol Limited to be converted to Superliners, along with extending the Sunset Limited to Miami.

But a mid-1990s federal budget cutback prompted Amtrak to sell off its expensive-to-maintain heritage cars, and the long-distance equipment pool began shrinking with the demise of the Broadway Limited, Montrealer, Gulf Breeze, and Hoosier State (the first time) in 1995. Viewliners started ousting heritage sleepers and Slumbercoaches that year, and Acela’s arrival beginning in 2000 freed up Metroliner Amfleet I coaches.

The company has ordered new Acelas that are to begin operating in 2025, as well as Aero trainsets set to replace 50-year-old Amfleet cars and 35-year-old Horizon coaches and cafes by 2025. Long-distance passenger car deployment, however, has remained static. Until about 2016, Superliners were routinely repaired except after the most destructive accidents. Expansion seemed possible with a 130-car order of single-level Viewliner II equipment in 2012, adding sleepers and replacing the last heritage baggage and dining cars. But damaged bilevels began being sidelined rather than overhauled, and long-delayed Viewliner II deliveries resulted only in a one-for-one replacement of original Viewliner sleeping cars.

Contraction occurred with the initial economic uncertainty during 2020’s Covid-19 pandemic. All long-distance trains except Auto Train were reduced to less-than-daily frequencies; a corresponding reduction of maintenance and overhaul capabilities followed. Passenger cars were sidelined, allowing four-year brake inspections to lapse.

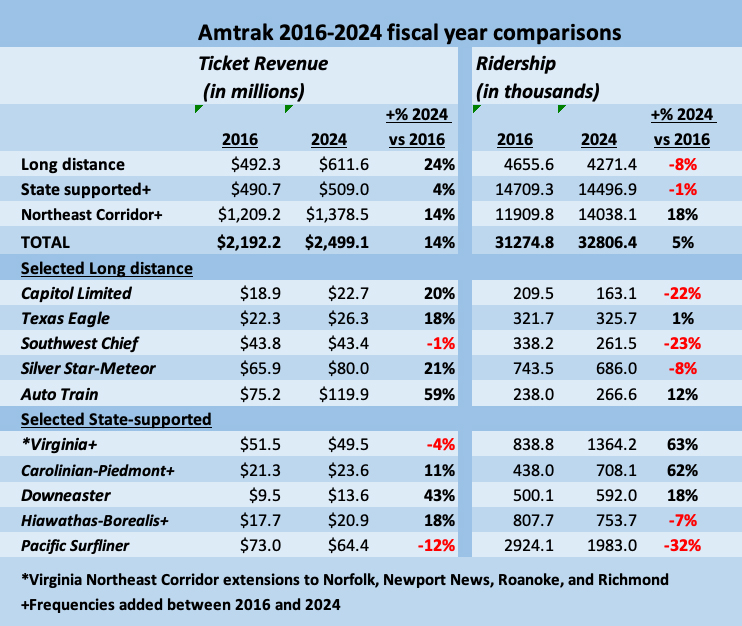

How did these cumulative actions affected ridership and revenue in 2024? The table below compares recent information with data from 2016, the last full year before a reduction in consists and onboard amenities began.

Examine the percentage differences between patronage and ticket income. Overall long-distance ridership contracted 8% while fares rose a whopping 24%. The trains that suffered the most ridership losses, the Chicago-Washington, D.C. Capitol Limited and Chicago-Los Angeles Southwest Chief, generally operated with up to four coaches and two Superliner sleepers plus a transition sleeping car in 2016, but about half that capacity this year.

From a business standpoint, management can rationally argue it is being fiscally responsible to charge higher prices, but too-high fares or outright sellouts drives away customers and thereby reduces Amtrak’s transportation relevance to communities on its routes. In contrast, Auto Train benefitted from expanded sleeping car capacity, more fare deals, and its status as the only long-distance train with targeted, route-specific marketing.

Patronage in the other two categories generally aligned with pricing, though both Wisconsin’s Hiawathas and California’s Pacific Surfliners were impacted by a post-pandemic reduction of five-day-per-week commuting. Significantly more round trips drove Virginia and North Carolina gains, while Maine’s Downeaster revenue surge could only outpace patronage increases if customers perceive greater value for the service.

What’s next

Changes are finally on the way. Amtrak announced expansion of coach and sleeping car capacity on Texas Eagle connections to and from the Sunset Limited, an extra Southwest Chief coach (though it was reassigned from the Seattle section of the Empire Builder), and more coach seats with conversion of the Capitol Limited to the Chicago-Miami Floridian. The 2024-2029 fleet plan, released earlier this year, acknowledged that 14 of 49 Viewliner I sleeping cars and 108 of 130 Viewliner II sleeping, dining, baggage-dorm, and baggage cars that had been idled “will re-enter service following overhauls delayed by COVID-19 pandemic-related storage as Mechanical resources permit.” It is unclear how soon and how many stored cars will return, because staffing shortfalls still exist.

A longer-term solution to alleviate the capacity crunch remains elusive. While regional trains will benefit from arriving Acela and Aero trainsets over the next three years, the procurement of long-distance equipment to replace Superliners is moving slowly. The process began at the end of 2023, but has been mired in revised design proposals, based on differences between what Amtrak wants and what two prospective manufacturers say they are capable of building. The missing pieces of that puzzle: how much the new equipment will cost and if the government will be able to guarantee sufficient funding over the life of the project.

Previous News Wire coverage:

A closer look at how capacity impacts growth on Amtrak’s network: Analysis, Feb 7, 2024

Fixed forward and backward seating to speed Northeast Regional equipment turns, allow more frequencies, Feb. 28, 2024

Amtrak adds eight weekday, four weekend Northeast Corridor trains, March 4, 2024

Amtrak adds Texas Eagle capacity with dedicated Sunset through cars: Special report, July 29, 2024

Amtrak still falling short in capturing U.S. travel demand: Analysis, Sept. 1, 2024

How Amtrak’s long-distance capacity affects pricing: Analysis, Oct. 7, 2024

Floridian debuts with delays, offers major coach travel discounts, Nov. 11, 2024

Amtrak notches ridership and revenue record for fiscal 2024: Analysis, Nov. 25, 2024

Love this about equipment constraints. Ordered and delivered at the end of the Clinton administration, Amtrak got the Acela for the northeast corridor. That was basically the last NEW equipment for passenger trains except for the 100 or so cars that the Obama ordered and got 2-3 years late in delivery. Under the present administration the Acela II train sets are 2 years late,we don’t know when they will come on line, and they are over budget. Also the Charger locomotives being delivered to replace the 30-35 year old GE’s are CRAP. In most cases the well worn GE’s perform equal or better than the new locomotives. Who know when we will be getting any long distance cars. Bet if we somehow ordered them today, they wouldn’t come on line for another 6 or 8 years. In the mean time repairing /rebuilding the present fleet get’s more expensive by the day.

Just look at the USPS LLV delivery fleet. The youngest vehicle is 31 years old with most being 35-40 years old. Friend of mine who works vehicle maintenance for the USPS said that if the whole fleet was replaced that the new vehicles would reduce cost and would pay for itself in 5 1/2 years

Inflation from 10/2016 to 10/2024 is 31%. So only the LD trains are even coming close to keeping up with a 24% increase in revenue, yet due to consist reductions revenue is still falling behind the 31% inflation value. Today’s ($2024) total revenue of $2499.1 M from reduced train capacity and higher priced tickets would be worth $1,913.8 M in ($2016), $278.4 M less than the $2192.2 M reported for 2016. Only every serious study of passenger train financials have pointed out that trains have a declining Long-run Average Cost per passenger with respect to volume carried.

Perhaps we should claw back all the bonuses?

Bob thanks for the very deep insight as we anxiously await full consists to return to long distance lines. I will take this opportunity to outline some consist expansions that have taken place beginning Thanksgiving:

1. Silver Meteor: Gained a fourth Amfleet coach.

2. Cardinal: A third Amfleet coach has finally been added after running only two coaches and one sleeper all year long.

3. Texas Eagle: A transition sleeper and a second full coach have been added.

4. City of New Orleans: Picked up a dining car in the form of a Cross Country Cafe car, which were previously assigned to the Capitol Limited. Equipment shortages resulted in the City running without a dining car and as a result no dining service for sleeping car passengers. Passengers were given free items from the cafe in the Sightseer Lounge.

5. Coast Starlight: The Starlight’s transition sleeper has been shifted to the Sunset Limited. To compensate Amtrak has added a third full sleeper to the Starlight.

Thanks again Bob for keeping us in the loop with your in depth analysis!

“…a time-consuming wye move at the Sunnyside…”

At Sunnyside there’s a loop for turning trains.